Turning insurance payments into a strategic differentiator

Across every insurance line, legacy reimbursement models are holding providers back. Manual claims slow down processes, increase fraud risk, and frustrate customers with out-of-pocket expenses. hi.health by Pliant replaces this with a cashless, real-time claims and payments platform that restores control and builds lasting trust with customers.

Across every insurance line, legacy reimbursement models are holding providers back. Manual claims slow down processes, increase fraud risk, and frustrate customers with out-of-pocket expenses. hi.health by Pliant replaces this with a cashless, real-time claims and payments platform that restores control and builds lasting trust with customers.

Why embedded payments are the future of claims

The current reimbursement model is outdated. It burdens customers and leaves insurers exposed to risk. hi.health by Pliant embeds payments directly into the claims process, transforming it into a seamless, digital-first experience.

Cashless claims with no upfront payments

Faster processing with real-time settlement

Fraud protection built into every payment

Real-time data for full transparency

Global reach with Visa credit cards

Lower costs with preferred providers

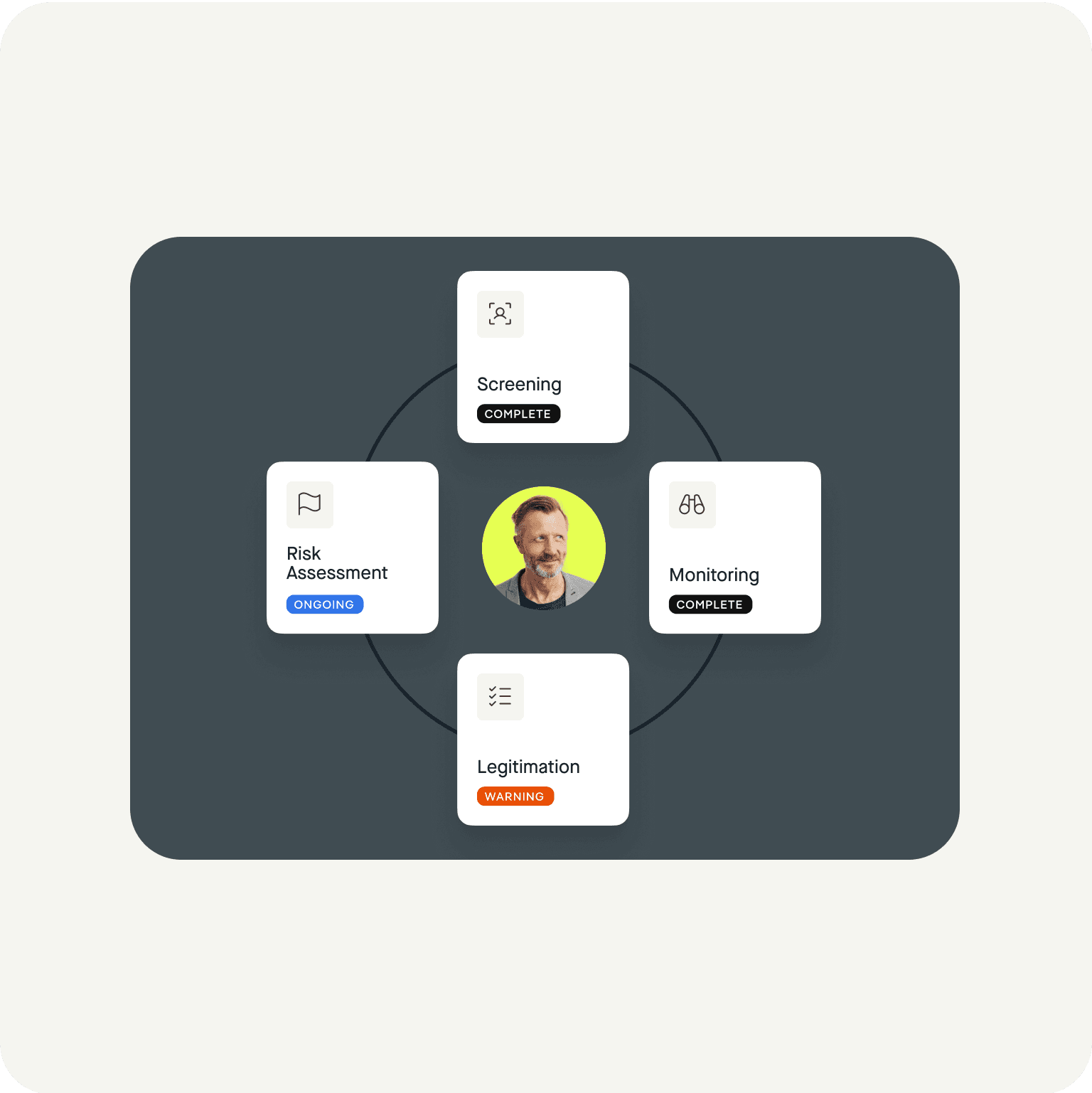

Embedding fraud prevention into every payment

Insurance fraud is evolving fast. AI-generated invoices, synthetic identities, and automated resubmissions make it easier than ever for bad actors to overwhelm outdated systems. Start embedding fraud prevention into the payment flow with hi.health by Pliant.

Data integrity

Every payment creates structured metadata, helping detect duplicates and anomalies early.`

AI-powered oversight

Automated checks flag unusual patterns early so fraud is stopped before money ever leaves your system.`