Turning insurance payments into a strategic differentiator

Across every insurance line, legacy reimbursement models are holding providers back. Manual claims slow down processes, increase fraud risk, and frustrate customers with out-of-pocket expenses. hi.health by Pliant replaces this with a cashless, real-time claims and payments platform that restores control and builds lasting trust with customers.

Across every insurance line, legacy reimbursement models are holding providers back. Manual claims slow down processes, increase fraud risk, and frustrate customers with out-of-pocket expenses. hi.health by Pliant replaces this with a cashless, real-time claims and payments platform that restores control and builds lasting trust with customers.

Why embedded payments are the future of claims

The current reimbursement model is outdated. It burdens customers and leaves insurers exposed to risk. hi.health by Pliant embeds payments directly into the claims process, transforming it into a seamless, digital-first experience.

Cashless claims with no upfront payments

Faster processing with real-time settlement

Fraud protection built into every payment

Real-time data for full transparency

Global reach with Visa credit cards

Lower costs with preferred providers

Real-world use cases across insurance lines

With hi.health by Pliant, insurers can offer members a smoother experience while keeping costs and risks under control. Here’s how it works in practice:

Health & care

Members can pay for a dental visit or collect medication with a card that’s already funded by their policy. For long-term needs like recurring prescriptions, insurers can issue ongoing cards.

Home & property

After a fire or flood, policyholders get instant access to funds with emergency cards restricted to trusted repair or housing providers. Support is immediate and costs stay under control.

Travel & international

Instantly issue cards for medical treatment abroad or lost luggage. Insurers report savings of over 25% in markets like the US where self-pay tariffs are lower than billed insurance rates.

Corporate & group

Employers can offer benefit cards for preventive care, wellness, or flexible healthcare budgets. For insurers this opens new ways to differentiate and strengthen relationships with corporate clients.

Auto & mobility

Settle repairs or roadside assistance directly with a card tied to the policy. Members receive quick support and insurers maintain full control over spending.

The next generation insurance claims and payments platform

Upstream fraud prevention

Card logic, MCC filtering, and jurisdictional controls block misuse before it happens.

Instant provider & merchant settlements credit lines

Clinics and hospitals are paid instantly, removing reliance on Guarantee of Payment letters and making reimbursements unnecessary.

Structured real-time data

Each transaction generates structured metadata, feeding live dashboards for reporting, forecasting and reserving.

Configurable spend control

Cards are tied to specific policies, service categories, or even individual merchants.

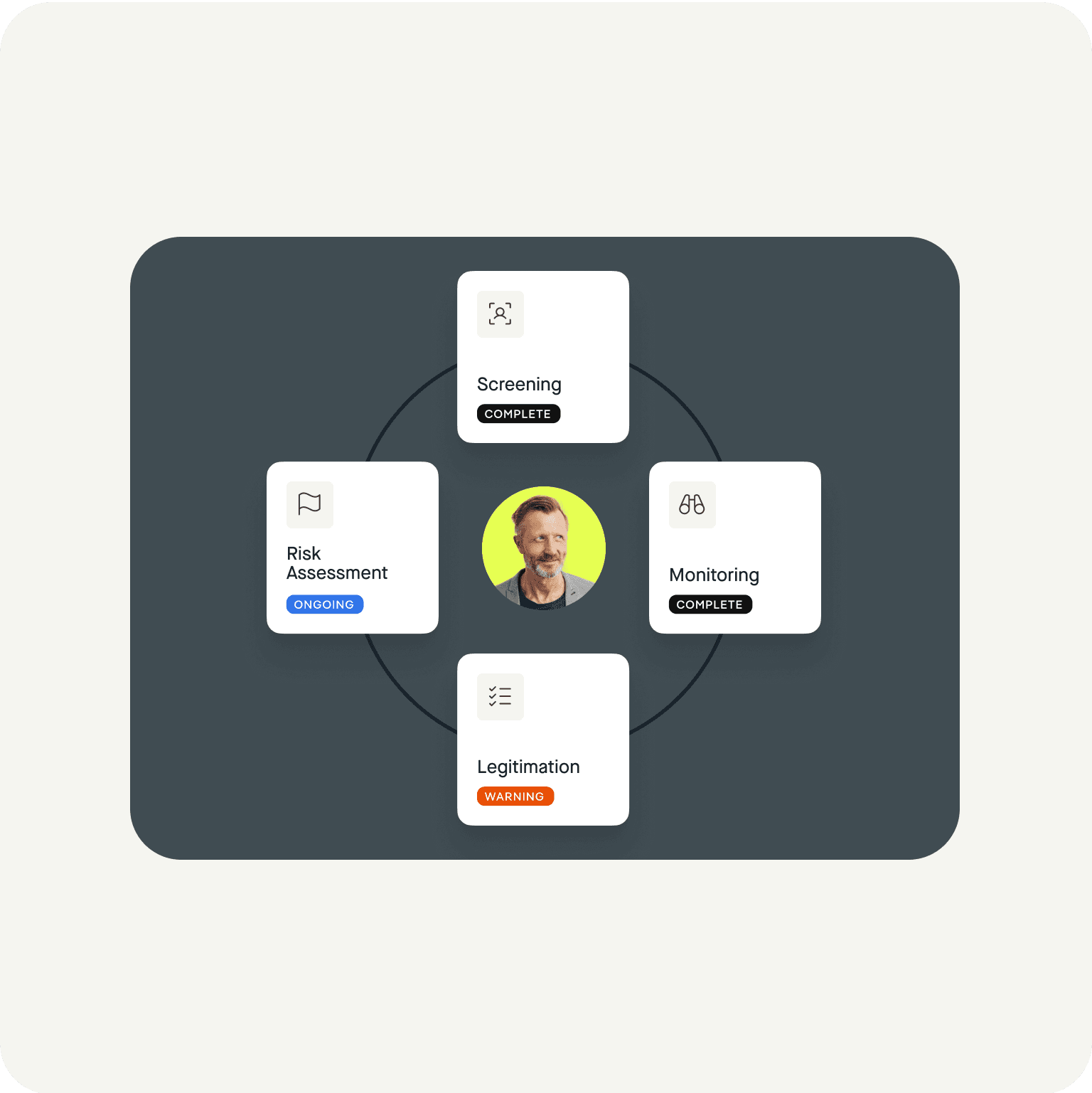

Embedding fraud prevention into every payment

Insurance fraud is evolving fast. AI-generated invoices, synthetic identities, and automated resubmissions make it easier than ever for bad actors to overwhelm outdated systems. Start embedding fraud prevention into the payment flow with hi.health by Pliant.

Data integrity

Every payment creates structured metadata, helping detect duplicates and anomalies early.`

AI-powered oversight

Automated checks flag unusual patterns early so fraud is stopped before money ever leaves your system.`

FAQ

Policyholders no longer need to pay upfront. Payments flow directly from insurer funds via the Pliant card, with co-pays or deductibles charged automatically. If a claim is denied, uncovered charges are settled through the customer’s payment card on file.

Cards can be physical or virtual, usable in-store, online, or via mobile wallets. They are restricted to authorized merchants and providers within the Visa network, configured per policy type.

Each card is connected to the policy. The insurer funds transactions, with limits and restrictions set at the policy level. Spending limits and restrictions are set according to the policy.

No. To ensure control and reduce fraud, cards are restricted to policy-relevant merchants (e.g. clinics, auto workshops, pharmacies, or emergency housing providers).

Say hello to smarter insurance payments

Our team is available every Monday to Friday from 9am to 5pm PST to answer your questions personally.