Circula

"Circula käsittelee tänä vuonna 100 miljoonan euron korttikulut"

Nikolai Skatchkov, CEO Circula

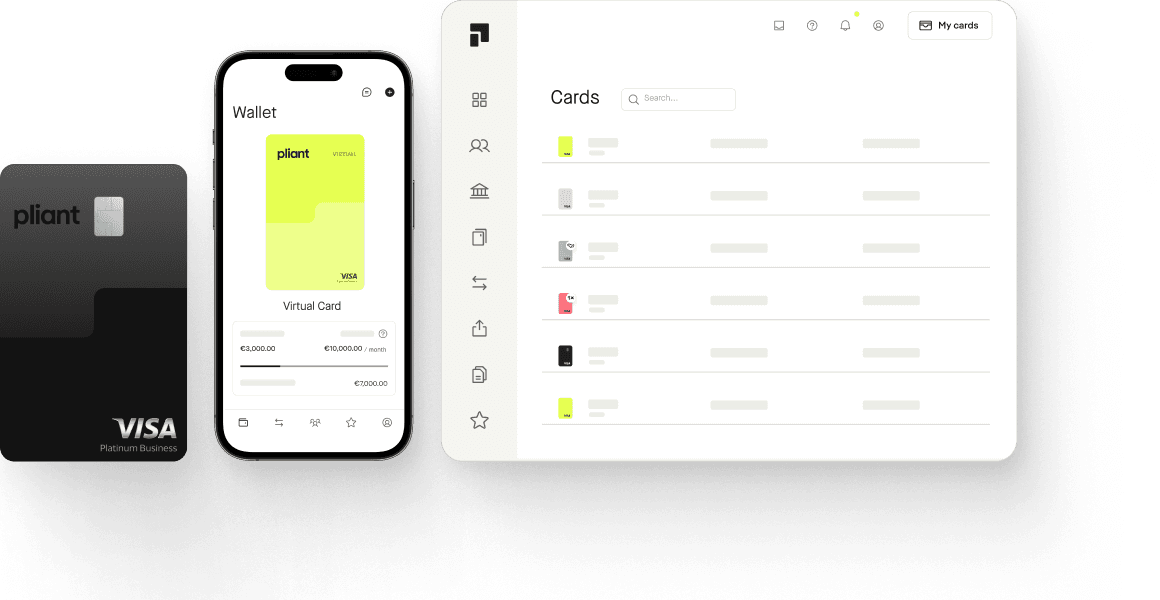

Salabam Solutions, an Italian travel tech firm, offers a range of travel services like hotel bookings, flights, and vacation packages. To streamline their supplier payments, they integrated Pliant Pro API. Diego Furlani, Founding Partner and COO at Salabam Solutions, shares how Pliant’s virtual credit card solution has enhanced reliability, ease of use, and integration into their operations.

Riippumatta yrityksen koosta tai alasta, taloushallinto vaatii aina aikaa ja toimivia prosesseja. Ja mitä suurempi yritys, sitä tarkempaa organisointia tarvitaan. Kustannukset ovat suurempia, kuten myös odotukset sen suhteen, miten yrityksen sisäiset prosessit on järjestetty. Saksan suurimman lainanvälittäjän, auxmoneyn, haasteena oli yhä useammin sisäisten prosessien monimutkaisuus. Tästä sai alkunsa yhteistyö digitaalisia yritysluottokortteja tarjoavan Pliantin kanssa vuonna 2021.

Pro API integration: The API integrates effortlessly with existing booking and financial systems.

Reliable transactions: Automated card issuance has reduced errors and payment failures, ensuring efficient processing.

Increased efficiency: Seamless integration has cut administrative overhead and streamlined workflows.

Improved customer experience: Fewer transaction issues have improved customer satisfaction and retention.

Automated card configuration: Single-use virtual cards to match each transaction request.

Before adopting Pliant's credit card solution, Salabam Solutions faced significant challenges with their non-integrated virtual debit cards:

Manual Fund Management: This led to errors in fund allocation and incorrect card balances, disrupting transactions and impacting the efficiency of the payment process.

Transaction Failures: Payment failures were common, especially when a card’s balance was insufficient for larger transactions. This resulted in delays and complications in processing bookings, requiring manual adjustments.

Operational Inefficiencies: Frequent manual adjustments and handling of payment issues increased administrative overhead, slowing down the booking process and adding to staff workload.

Customer Dissatisfaction: Delays and transaction failures adversely affected customer satisfaction, crucial for retaining clients in the competitive travel tech industry.

These issues jeopardized their business model by undermining the reliability and efficiency of their payment system, affecting both operational performance and customer experience.

Pliant Pro API is seamlessly integrated into Salabam Solutions’ travel booking platform, enabling the automatic generation of virtual credit cards at the moment of booking. When a user initiates a transaction, the system immediately calls the API to create a single-use credit card.

"Single-use credit cards ensure that every transaction is secure and well-managed by generating a unique card for each payment. They eliminate the risks of fraud and errors tied to shared card information, giving us tight control over our expenditures", says Furlani.

The credit limits for each card are automatically customized based on the specific transaction requirements, ensuring that each card is generated with the exact amount needed, including a buffer for foreign currency payments.

Integrating Pliant’s API into Salabam Solutions’ automated financial and accounting workflows went smoothly, with only minor adjustments required. This seamless fit has allowed the new system to enhance efficiency without disrupting existing operations.

”Pliant Pro API is our go-to solution for digital payments. It seamlessly became part of our automated accounting and financial workflow. Using Pliant's comprehensive documentation, we developed our own application, and the new system has integrated completely into our processes. Based on our experience, Pliant cards have an almost perfect acceptance rate, so we haven’t heard any complaints about failed transactions.”

Pliant Pro API streamlines financial processes, resulting in more efficient operations and lower costs for Salabam Solutions. Automated issuance of virtual credit cards removes the need for manual adjustments, saving time on administrative tasks and ensuring faster, more efficient transactions.

By reducing payment failures and eliminating rebookings, the API significantly cuts operational costs. The minimized risk of card rejection leads to fewer disruptions and reduced expenses related to handling failed transactions.

Additionally, the API’s reliability has enhanced customer satisfaction by decreasing transaction issues and improving client retention.

”Pliant Pro API has transformed our financial operations with exceptional performance and reliability. The automated issuance of virtual credit cards has streamlined our processes, eliminating the operational costs of manual bookings and rebookings. With superior technology, user-friendly interfaces, and outstanding card acceptance, Pliant has significantly enhanced our efficiency and reduced costs. The API has truly become a key asset to our travel booking platforms.”

"Circula käsittelee tänä vuonna 100 miljoonan euron korttikulut"

Nikolai Skatchkov, CEO Circula

"Pliant tarjoaa tehokkaamman ratkaisun kuin oman kortin rakentaminen."

John Lindström, Bezalan COO

“With Pliant Pro API, we automate 1000s of daily transactions.”

Fiorino Cellucci, CFO at Easy Market

"Luotamme Pliantiin digitalisoidessamme luottokorttijärjestelmämme."

Merelle Ahlman, taloushallinnon vastuuhenkilö Vincit

"Ennen Pliantia jokainen luottokorttilasku sai kylmän hien otsalle."

Lasse Iskanius, Julkee x Lempeen toinen perustaja

Tiimimme on tavoitettavissa maanantaista perjantaihin kello 10-18 ja vastaamme kysymyksiisi henkilökohtaisesti.