Payments optimized

Customize everything you need to make payments, control spend, and optimize finance operations using one credit card platform.

Pliant is the credit card platform that allows businesses to optimize their payment processes.

No matter if you use our Payment Apps, Pro API, or CaaS solutions, Pliant will adapt to your unique needs and help you succeed.

Our productsChoose the Pliant solution that works for you.

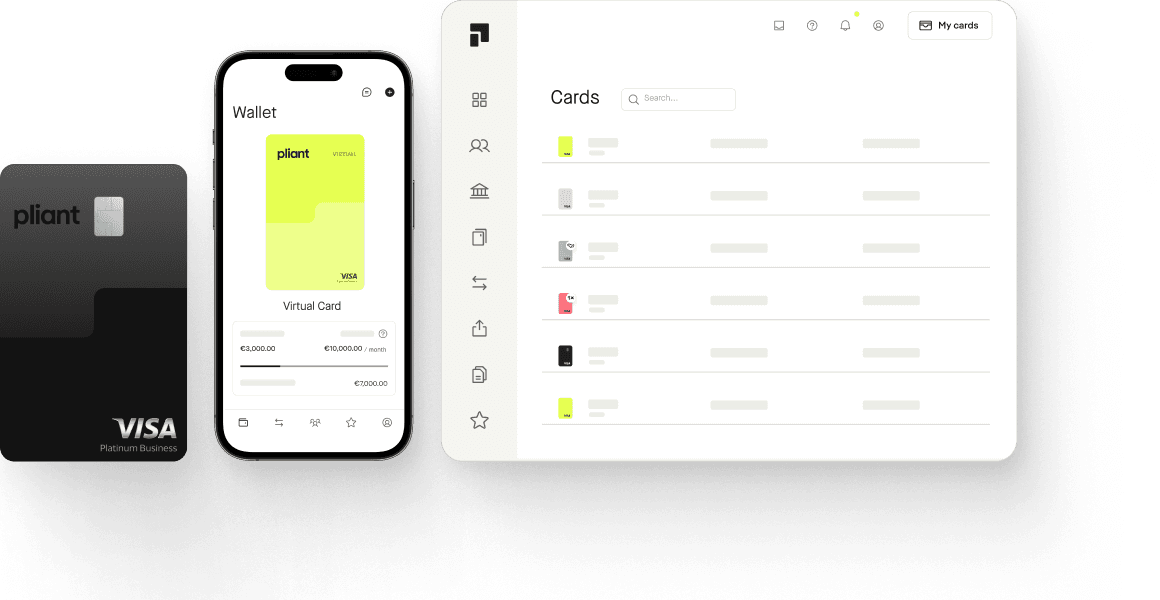

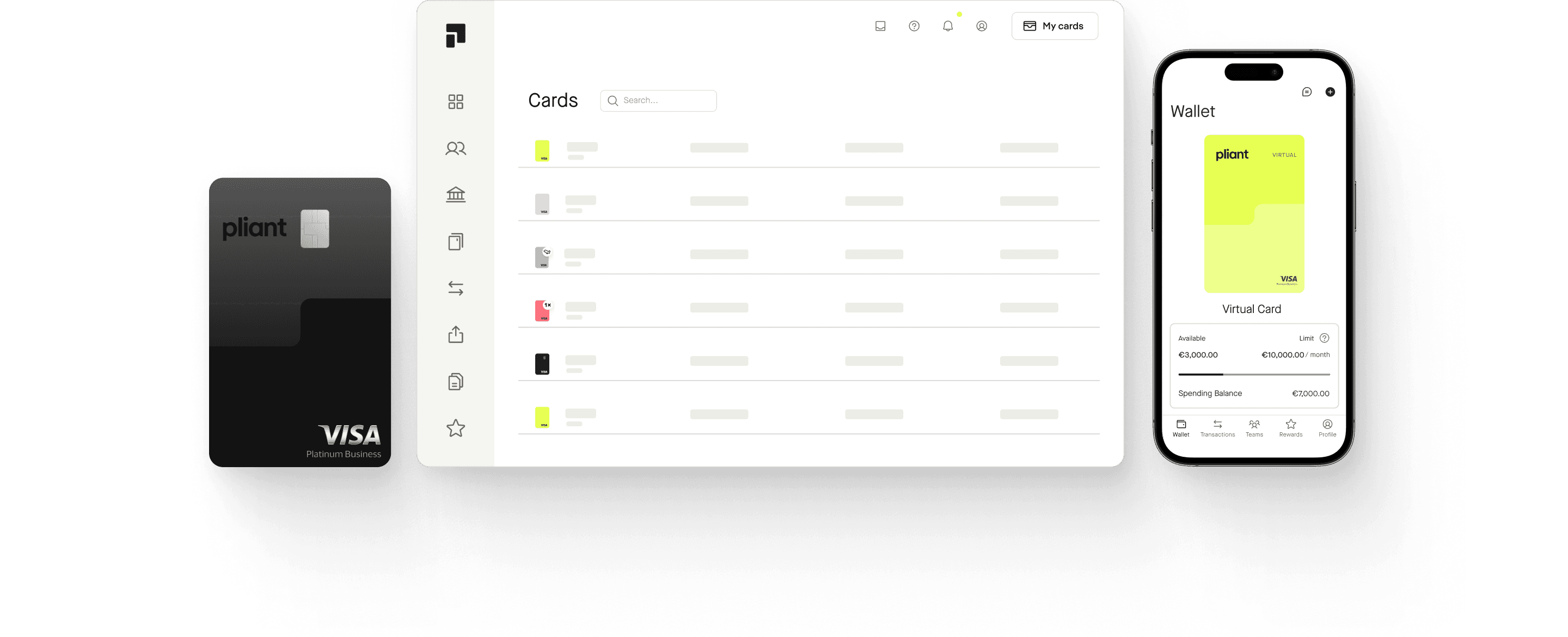

Payment Apps

Pro API

Cards-as-a-Service

Card OS

Streamline processes with Pliant’s best-in-class credit cards and card management apps.

Learn moreDo everything Payment Apps can do in a completely customizable way – at scale.

Learn moreIssue your own credit cards through our best-in-class B2B card platform.

Learn morePliant makes it easy to launch an innovative credit card program for banks.

Learn more

Our productsChoose the Pliant solution that works for you.

Payment Apps

Pro API

Cards-as-a-Service

Card OS

Features that maximize flexibility and savings

Real-time monitoring

Real-time monitoring

See every transaction as it happens and make timely decisions on spending limits, card usage, and accounting.

Spend control

Spend control

Define limits and rules for all cards on multiple levels for maximum control.

Receipt management

Receipt management

Every transaction requires a receipt, so make managing receipts as effortless as paying for things with your credit card.

Integrations

Integrations

Integrate Pliant seamlessly into your existing accounting, invoice management, travel expense, and other financial solutions.

Accounting automations

Accounting automations

Automation capabilities that bring your bookkeeping into the 21st century while maintaining trust and accuracy.

Choose Pliant with confidence

E-money licensed

In the EU, Pliant is an e-money (EMI) licensed company and a Visa Principal Member – both licenses allow Pliant to issue cards using its own regulatory setup and directly process payments from customers using Visa credit cards.

PCI DSS certified

Pliant is certified as a Payment Card Industry (PCI) Data Security Standard Service Provider – PCI DSS is the highest security standard in our industry.

ISO/IEC certified

Additionally, Pliant is certified to internationally recognized ISO/IEC 27001:2022 standards that define the requirements for information security management.

We’re here for you.

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.