Insurance Claim Cards

Streamline claims payouts with Pliant’s Insurance Claim Cards

Managing insurance payments can be complex, with the need for quick claims payouts and a seamless customer experience. Pliant’s insurance claim cards simplify payment processes, reduce costs, and improve customer satisfaction—while ensuring compliance with the highest regulatory standards.

Transform your insurance payment processes

Traditional insurance payments can be complex, slow, and prone to errors. Pliant optimizes these processes with a fully digital, user-friendly platform tailored for the insurance sector.

Accelerate claims processing

Improve the customer experience

Tailor card settings to your use cases

Seamlessly integrate customer onboarding

Safeguard sensitive data with certified systems

The payment solution for your insurance cases

Pliant's digital credit card solution supports a variety of insurance scenarios, helping your customers get the best service possible:

Travel insurance

Issue virtual emergency cards for immediate support during flight delays, lost luggage, or emergencies abroad.

Private health insurance

Simplify payments for health expenses with seamless reconciliation.

Car insurance

Provide restricted cards for transportation or repair expenses following accidents.

Pet insurance

Cover veterinary bills instantly, ensuring pets receive prompt care.

Household contents insurance

Enable insured customers to replace essential items like TVs and furniture.

Enhance efficiency with Pliant’s digital features

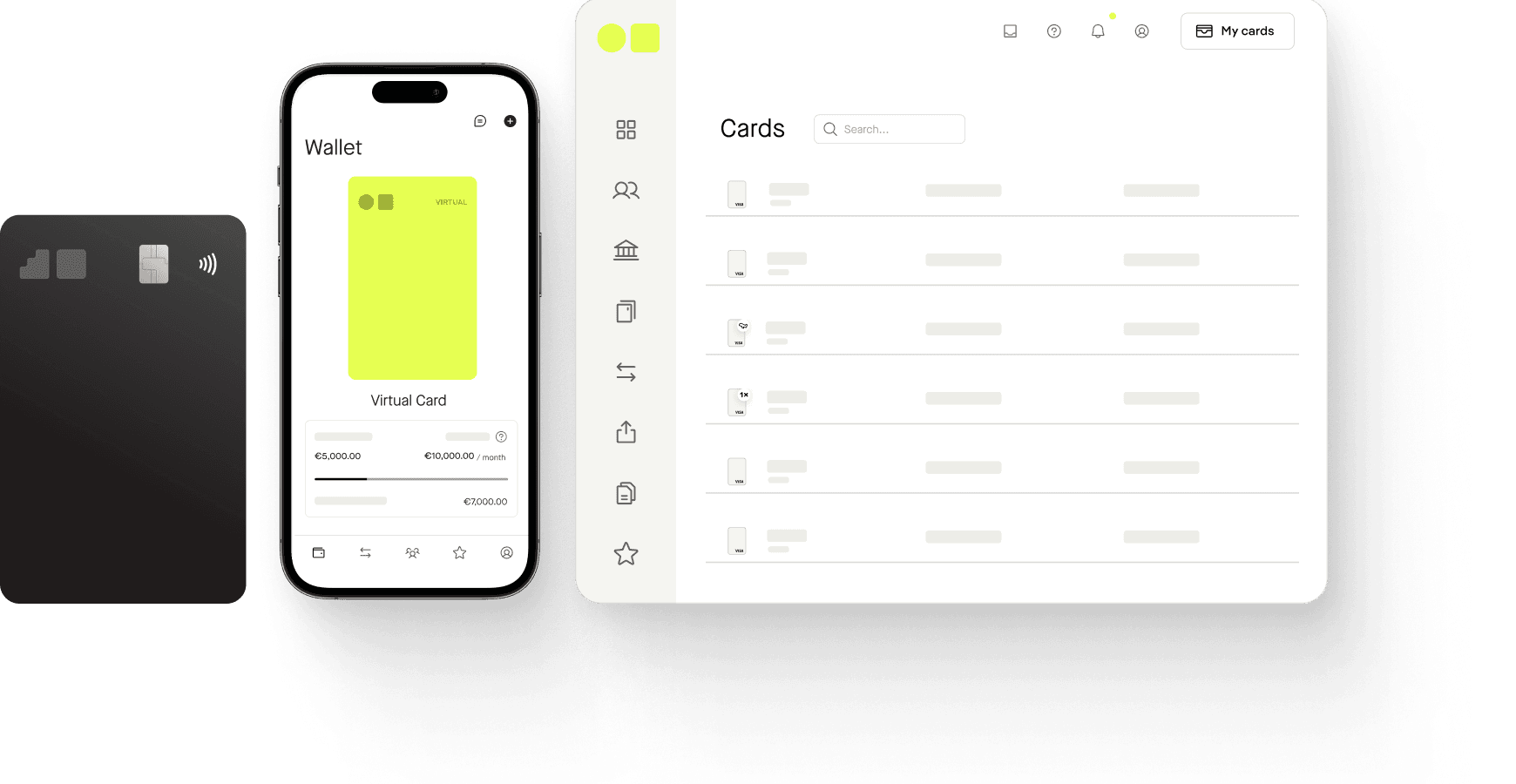

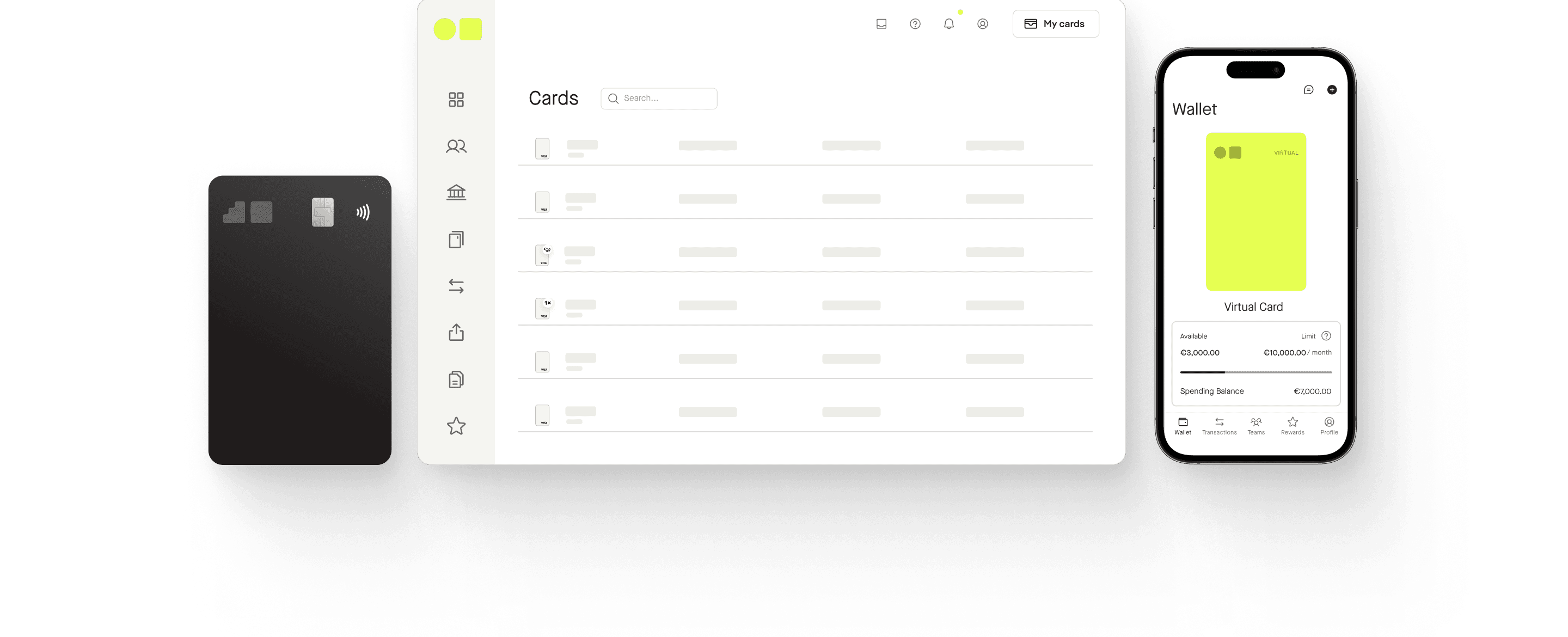

Instant virtual card issuance

Allow customers to start using cards immediately for online payments or link them to mobile wallets like Apple Pay and Google Pay.

Customizable card controls

Tailor card settings to fit specific needs, including spending limits, expiration dates, and usage categories for secure, case-specific transactions.

API integration for automation

Our API enables automated card creation, management, and usage, seamlessly integrating into your workflows.

Flexible Cards-as-a-Service

From white-label solutions to full integration, Pliant offers a customizable platform to fit your existing systems.

Real-time data and insights

Gain immediate visibility into card transactions with detailed reporting and tracking, improving security, compliance, and decision-making.

Global acceptance

Enable worldwide card usage with no hidden fees, offering your customers reliable payment options wherever they are.

Simplify reconciliation with virtual IBANs

Pliant’s Virtual IBAN solution streamlines reconciliation by assigning unique virtual IBANs to each customer or payment. This automation ensures a 1:1 connection between customer and account, reducing manual effort and errors. By eliminating costly manual processes, virtual IBANs save time, improve accuracy, and enhance overall efficiency in your payment workflows.

Meeting the highest regulatory standards for data protection

E-money licensed

In the EU, Pliant is an e-money (EMI) licensed company and a Visa Principal Member – both licenses allow Pliant to issue cards using its own regulatory setup and directly process payments from customers using Visa credit cards.

PCI DSS certified

Pliant is certified as a Payment Card Industry (PCI) Data Security Standard Service Provider – PCI DSS is the highest security standard in our industry.

ISO/IEC certified

Additionally, Pliant is certified to internationally recognized ISO/IEC 27001:2022 standards that define the requirements for information security management.

Ready to partner with us?

Click below to schedule a conversation with our Cards-as-a-Service team to discuss how Pliant’s CaaS can transform your product.