Circula

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

Auxmoney was founded in 2007 with the goal of building the leading digital platform for personal loans in Europe. With this platform, they want to help more people get the loan they want. In this article, Raffael Johnen, CEO and co-founder of auxmoney, shares his experience with Pliant's digital credit card solution compared to a traditional offer from a house bank.

Regardless of a company's size or market focus, financial processes require an enormous amount of time and organization. At the end of the day, the larger the company, the higher the financial costs and the higher the expectations for internal processes. Due to the complexity of its processes, Germany's largest loan broker, auxmoney, was increasingly confronted with this issue. This is how the cooperation with Pliant, the Berlin-based fintech for digital credit cards, came about in 2021.

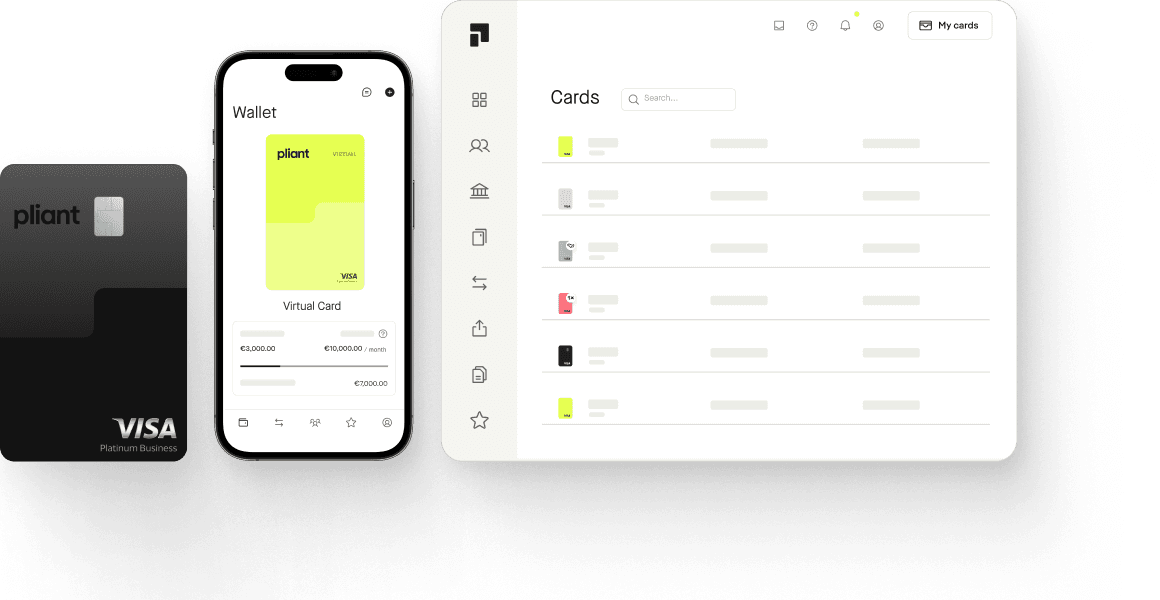

Independent management of all cards within the Pliant app, plus digital receipt management

Live transaction data available in the Pliant dashboard

Seamless integration with existing financial and accounting software

In the past, CEO Raffael Johnen was in charge of everything. He was the only one in the company with a credit card, which he had to give to other departments whenever a transaction was needed. With the growing number of users and transactions, the biggest challenge was the time it took to acquire and manage credit cards. This drama always began and ended in accounting. From obtaining a corporate credit card for individual employees to carefully collecting receipts, it would have been a Sisyphean task for the back office to provide cards to employees quickly. For the people in charge, the issue was very stressful.

Until now, auxmoney had to fill out a form with their bank for each new credit card. According to Malte Rau, CEO and co-founder of Pliant, "Banking processes are still time-consuming and difficult." This makes it difficult for the accounting department to act quickly. The result is a waste of valuable time, which can be several weeks in some cases. In addition, traditional quotes usually have standard limits. They can only be adjusted after further contact with the bank.

The Pliant app has helped the company to simplify the documentation of employee expenses. It not only optimized the storing and sorting of receipts, but fully digitized the entire management of individual credit cards. With a click, those responsible can create a card themselves and flexibly set limits and change them again. Everything s in real time.

Previously, access to live transaction data was unavailable to authorized parties. The Pliant dashboard changed this process forever. Receipts can now be easily uploaded to the mobile app or forwarded to an email inbox without the need for any further action. Collecting receipts used to be burdensome for the financial institution. With the help of Pliant, auxmoney is now able to do card management on its own. It's no longer necessary to create an account for each card. The app allows admins to issue cards and manage limits in real time.

In addition, Pliant is integrated easily into existing financial and accounting software. The loan lender was convinced by the fact that all relevant data can be exported from the app. Many companies would be afraid of changing something within the existing financial structure but with Pliant, auxmoney didn’t have to.

Currently auxmoney processes around 1000 card transactions a month and has generated more than 300 credit cards. According to internal information, these numbers would’ve been impossible to achieve with the previous process. Employees now pay for books, special office supplies, travel bookings, and many other purchases themselves, greatly reducing the operational management load of overseeing small orders and bank transfers. This extends to receipt management as well – 40% of invoices had to be manually searched for and collated, and Pliant has improved this with convenient receipt collection and forwarding.

“With Pliant, you become your own digital bank, bypassing processes that would otherwise take weeks.”

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

“Several thousand euros in cashback are a significant advantage for BLINKED.”

Jean-Gabriel Baron, CFO of the Jaws Group

"Pliant delivers a more efficient solution than building our own."

John Lindström, COO of Bezala

“With Pliant Pro API, we automate 1000s of daily transactions.”

Fiorino Cellucci, CFO at Easy Market

“Only with CaaS was a complete integration quickly achievable.”

Alexander Kintzi, CRO Scopevisio AG

“Pliant Pro API is a key asset to our travel booking platforms.”

Diego Furlani, Founding Partner at Salabam SolutionsOur team is available every Monday to Friday from 9am to 5pm to answer your questions personally.