Circula

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

Sabrina Kast has been with the company from the very beginning and is now Operations Manager at BitterPower GmbH, better known under the brand BitterLiebe. She is responsible for administration and accounting. In this interview she talks about her experiences with the partner integration of Pliant and Agicap.

Based in Mannheim, Germany, BitterLiebe is confident that they belong on your dining table just as much as salt and pepper. We typically link a bitter taste with medicine, but founders Jan Stratmann and Andre Sierek want to change that perception with their healthy products made from natural herbs that improve people's well-being using bitter compounds. In October 2018, the two presented their bitter drops to a wide audience on the well-known show "Die Höhle der Löwen," which included Judith Williams on the judging panel. By 2021, the company's turnover had reached 10 million Euros. BitterPower sells bitter powders, teas, drops, and capsules in its own online shop. Drugstores such as dm, Rossmann and Budnikowsky carry the products nationwide. The company is also pursuing an entry into the food retail market.

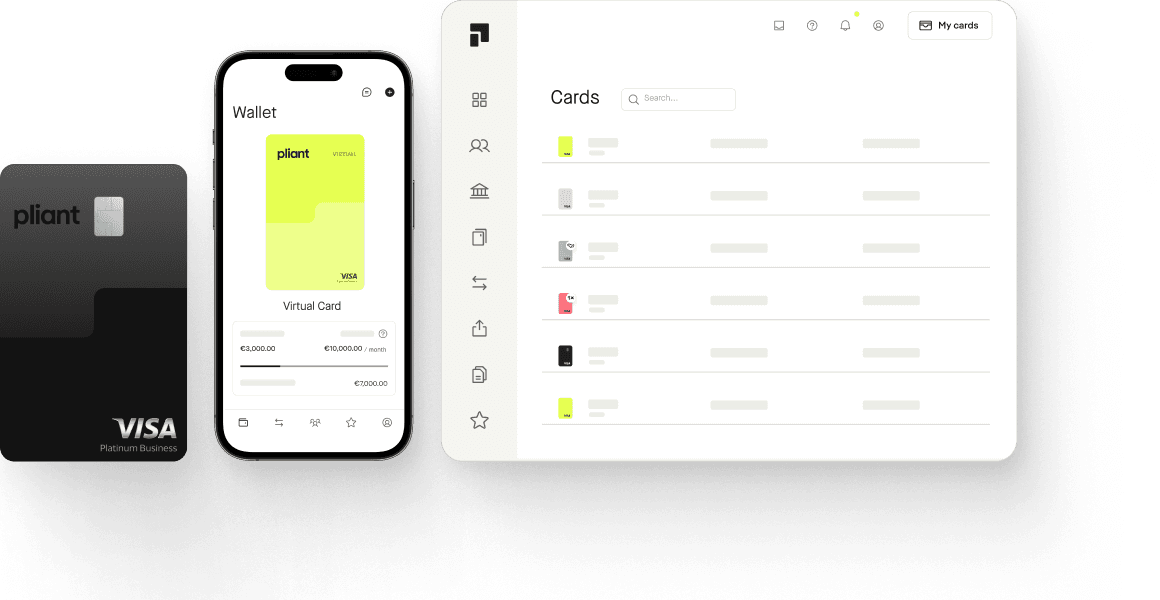

Independent management of all cards in the Pliant app, including digital receipt management.

Instantly available virtual credit cards for individual expenses and providers.

Accurate cash planning that also saves time.

Improved data quality and increased transparency.

Right from the start, Kast makes it clear: "We are in e-commerce. Almost everything we do is digital. It's important to us that things become more and more independent of manual input."

In the beginning, employees paid for their own business trips and settled them with travel expense reports. They had to manually transfer other expenses from their own accounts.

The BitterLiebe team was using Excel for cash planning. Manually compiling data and the lack of overview caused increasing problems for the growing startup.

Information sharing: All stakeholders can access the same data.

Data collection automation: Relevant data is clearly presented in one place without manual updates.

Missing receipt tracking: With corporate credit cards for multiple employees, you can accurately track spending patterns.

Smooth payments: Sufficiently high limits and cards that do not get blocked even with high frequency payments.

Timely and accurate liquidity planning: Quickly evaluate and react to changes.

In the past month, BitterLiebe has processed more than 300 transactions using Pliant cards. "Of those, ⅔ were spent on advertising. The rest is a lot of software, add-ons for the store, the store itself, and travel expenses," Kast says.

The company also uses virtual credit cards that can be quickly and easily issued to each employee. Kast creates cards for specific expenses like advertising. She also sets up virtual cards for individual service providers to keep track of their expenses and to limit the amount they can charge with a pre-set limit.

In the Pliant app, each employee can upload their receipts directly and is reminded of any missing receipts. "I can see immediately in the Pliant app which payments still need a receipt. And because everyone has their own card, I can contact the person responsible directly. Kast notes: "This was not possible before.”

Agicap is BitterLiebe's tool of choice for liquidity management. It provides real-time reporting on all accounts and projects. It is a good indicator of cash flows within the company. The dashboard provides a quick overview of potential savings and investment opportunities. This is made even easier by the automatic synchronization with all bank accounts and card providers like Pliant.

“Agicap gives us certainty in planning and optimizing cash flow. At the end of the day, it allows us to reconcile planned and actual values. Pliant saves us lots of time when it comes to handling receipts. Plus, the cashback was an added bonus, which made the decision easy.”

The setup of the integration between Pliant and Agicap was very easy with the help of finAPI. "We also connected other tools to it. It was really just a matter of minutes," Sabrina recalls.

Credit card transactions are now transferred without loss. The categorization of payments is also automated, just like for all other bank accounts. Without the integration, Sabrina would have had to perform a manual CSV export between the tools every week.

The integration between Pliant and Agicap allows for the automatic transfer of each credit card transaction and meets the following requirements that are important to Sabrina:

They are two financial tools without overlapping functionality, preventing duplicate work.

Each individual financial software must have all the relevant functions for the task so that the tool doesn’t need to be switched for a single task.

Flawless and seamless data exchange to "maintain an overview with little manual effort and invest the time and manpower in making decisions and responding, rather than processing data," Sabrina explains.

Thanks to the integration, the data quality has significantly improved. Each card transaction can now be assigned to a category. As a result, liquidity planning has become more precise. In a shorter amount of time, more conclusions can be drawn for the company.

"Look for ways to make your life easier through automation and integration, so you have time for other things," Sabrina advises other entrepreneurs.

In BitterLiebe's finance stack, there are additional tools that are interconnected through integrations. Agicap is also connected to Xentral's ERP system for processing outgoing invoices.

Xentral, in turn, is linked to Google Analytics and the e-commerce software from minubo, which is used to analyze sales figures.

For retrieving and processing receipts, Sabrina uses the interface between Pliant and GetMyInvoices. BitterLiebe also exports all receipts and card transactions to DATEV Unternehmen online. "The integration with DATEV Unternehmen online is very helpful because we can already process the receipts in the Pliant app and don't have to do it again in DATEV. This is one of the mentioned duplications that we would like to avoid," Sabrina explains.

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

“Several thousand euros in cashback are a significant advantage for BLINKED.”

Jean-Gabriel Baron, CFO of the Jaws Group

"Pliant delivers a more efficient solution than building our own."

John Lindström, COO of Bezala

“With Pliant Pro API, we automate 1000s of daily transactions.”

Fiorino Cellucci, CFO at Easy Market

“Only with CaaS was a complete integration quickly achievable.”

Alexander Kintzi, CRO Scopevisio AG

“Pliant Pro API is a key asset to our travel booking platforms.”

Diego Furlani, Founding Partner at Salabam SolutionsOur team is available every Monday to Friday from 9am to 5pm to answer your questions personally.