Deutsche Telekom

“All of Deutsche Telekom’s requirements are met 100%.”

Ricky Singh-Grewal, Project Lead Smart Payments, Deutsche Telekom

Nikolai Skatchkov founded Circula in Berlin in 2017 to simplify expense management for modern businesses, focusing on travel expenses, reimbursements, allowances, and meal allowances. By embedding Cards-as-a-Service directly into its platform, Circula has strengthened its value proposition, driving revenue and is ready to scale.

Circula offers a solution for paperless and automated accounting of travel costs and expenses. The intuitive software is designed to support employees, accountants, and supervisors by simplifying workflows. It helps modern companies digitalize receipts and integrate seamlessly with accounting systems, improving efficiency and accuracy across the board. “Circula built an expense management solution targeting large SMBs and mid-market companies in Germany and Central Europe. Our ICP consists of companies with around 200 employees in non-digital sectors”, says Skatchkov.

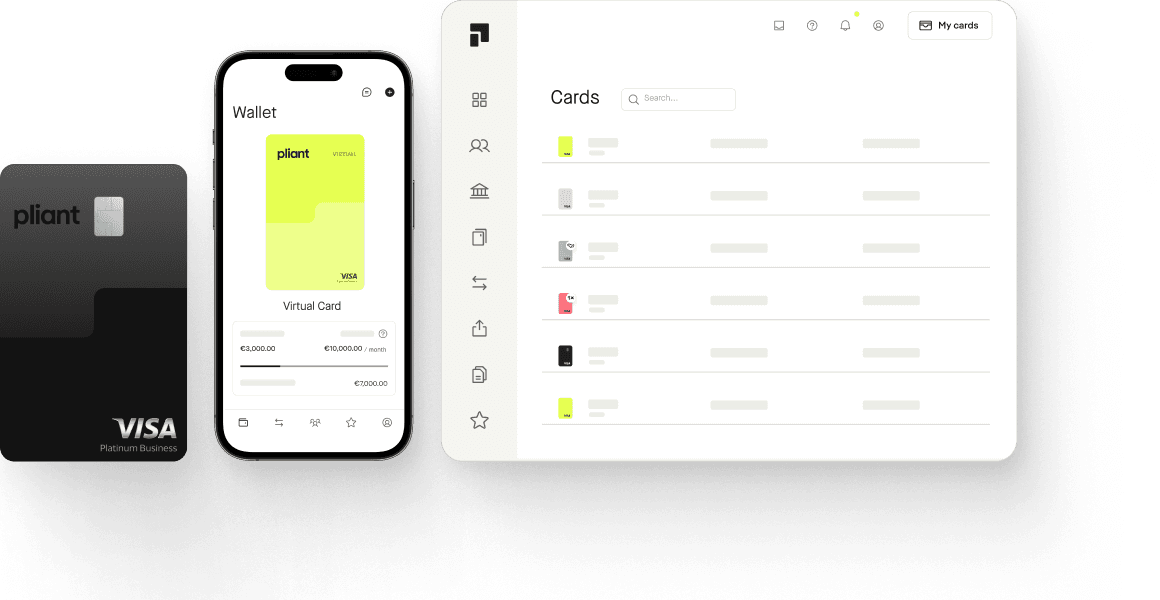

Fast Time-to-Market: Circula launched corporate cards within weeks by leveraging Pliant’s modular platform infrastructure.

Customer-Centric Rollout: Building gradually allowed Circula to validate demand and scale features based on real user needs.

Revenue Growth: Embedded cards unlocked new income streams and helped drive Circula toward €100M in annualized card spend.

As an expense management solution, Circula focused on digital receipt processing and accounting integration. To enhance financial workflows, Circula saw an opportunity to offer corporate credit cards. This would help businesses improve cash flow, reduce reliance on legacy banking, and increase efficiency.

“Many customers hesitated to issue or use multiple cards due to the hassle of collecting receipts at the end of the month”, says Skatchkov. Instead, they relied on reimbursement models to avoid administrative burdens. However, this approach created inefficiencies, delayed reporting, and increased manual work for finance teams.

Legacy banking systems also lacked seamless expense management integration. Without automated transaction syncing, companies struggled with poor visibility into spending. This made it difficult to manage accruals and maintain accurate financial reporting.

"Over time, we started considering broadening the product offering because we saw that European finance leaders were increasingly looking for integrated solutions. They wanted to replace traditional credit cards tied to their primary bank while also driving more convenience for employees who travel."

Instead of building its own card proposition, Circula partnered with Pliant to embed a ready-to-go corporate credit card solution into its expense management platform.

Circula’s journey toward offering a fully embedded corporate credit card solution followed a structured, phased approach. Rather than rushing into full integration, Circula carefully tested, refined, and expanded its solution to ensure the best possible customer experience.

Firstly, Circula kicked off with an API integration involving only a few endpoints to ensure seamless real-time transaction syncing. Automated data synchronization with Pliant from the start reduced the manual effort required for employees and finance teams to reconcile receipts at the end of each month.

To validate market demand, Circula combined this technical integration with a co-marketing initiative. This approach allowed the company to test whether businesses would adopt the solution while simultaneously demonstrating its core value proposition.

To increase card adoption, Circula introduced a dedicated card wallet within its platform. With 150,000 users who frequently travel or make business purchases, ensuring seamless card usage was key. The card wallet made it easier for employees to track and manage expenses while giving finance teams better visibility and control over transactions.

"Finance leads were willing to wait for certain features as long as employees could primarily use a Circula credit card,” explains Nikolai.

The development of a fully embedded Circula credit card ensured that the card experience was seamlessly integrated into Circula’s platform, aligning with both customer expectations and the company’s long-term strategic vision. As part of this phase, Circula introduced an embedded admin card app, providing full control over transactions, spend limits, and reporting.

By following this step-by-step approach, Circula successfully made use of Pliant’s modular solution to test product-market fit, and ultimately delivered a best-in-class, embedded corporate card solution tailored to the needs of its customers.

Adding Circula’s corporate credit card significantly expanded its market position. Originally focused on travel expenses, the solution now covers a broader range of spending categories like software and marketing, enabling Circula to secure new deals and grow its customer base to over 2,200 companies. The card also deepened customer relationships, increasing spending within the platform.

With 20% of spend currently processed via cards, this new revenue stream from card subscriptions and interchange fees presents substantial growth potential. Circula plans to reach €100 million in annualized transaction spend, making the card program a key driver of its continued growth and market success.

"Because of the Pliant credit cards, we are winning deals that we wouldn’t have been able to secure otherwise. Last year, 20% of our total spend was already processed via credit cards, and with a 5x growth potential within our existing customer base, we are on track to reach €100 million in card transaction spend this year. Finance teams are now using us not just for travel expenses, but also for software and marketing spend."

“All of Deutsche Telekom’s requirements are met 100%.”

Ricky Singh-Grewal, Project Lead Smart Payments, Deutsche Telekom

"At product launch, 1,000 caregivers at Caritas Vienna started using our Pliant cards."

Patrick Reinfeld, CEO and Co-Founder of Pflegenavi

"Our fleet card was only possible thanks to Pliant’s flexible solution."

Adriano Rissbacher, Managing Director, RMC Service GmbH

“Several thousand euros in cashback are a significant advantage for BLINKED.”

Jean-Gabriel Baron, CFO of the Jaws Group

"Pliant delivers a more efficient solution than building our own."

John Lindström, COO of Bezala

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.