Circula

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

Simon Kronseder is one of the three founders of everydays and ensures that his e-commerce startup is scalable. In an interview with us, he explains the reasons why they chose Pliant and how the credit cards optimize their liquidity.

"A healthy normal" is how everydays describes its goal. They want to support their customers in leading a happy and fulfilled life with the help of Smart Nutrition. The Berlin-based startup sells products against lack of drive or sleep problems in its own online store as a one-time delivery or on a subscription basis. Even though online retail has to deal with numerous problems, everydays is on a strong growth course.

Digital credit card solution with fast support and seamless processes

High credit limit and hassle-free limit increases for marketing spend

Interest-free payment terms to optimize cash flow

Everydays sells around 80 percent of its products directly to end customers via its own online store. This is working so well that the e-commerce company has at least doubled in size every year since it was founded in 2018. Simon Kronseder creates the conditions for that by optimizing internal processes and cash management.

He was looking for a digital credit card solution to continue to grow, because "it's still the Stone Age with a lot of credit card providers. To get a new card, you have to send in forms and call customer support. Instead, I want to have a self-service center and solve problems myself right away.”

“We have no investors and no bank loans. With everydays, we want to build a model that is self-financing and scalable. Therefore, payment terms with credit cards and with suppliers are important topics for us.”

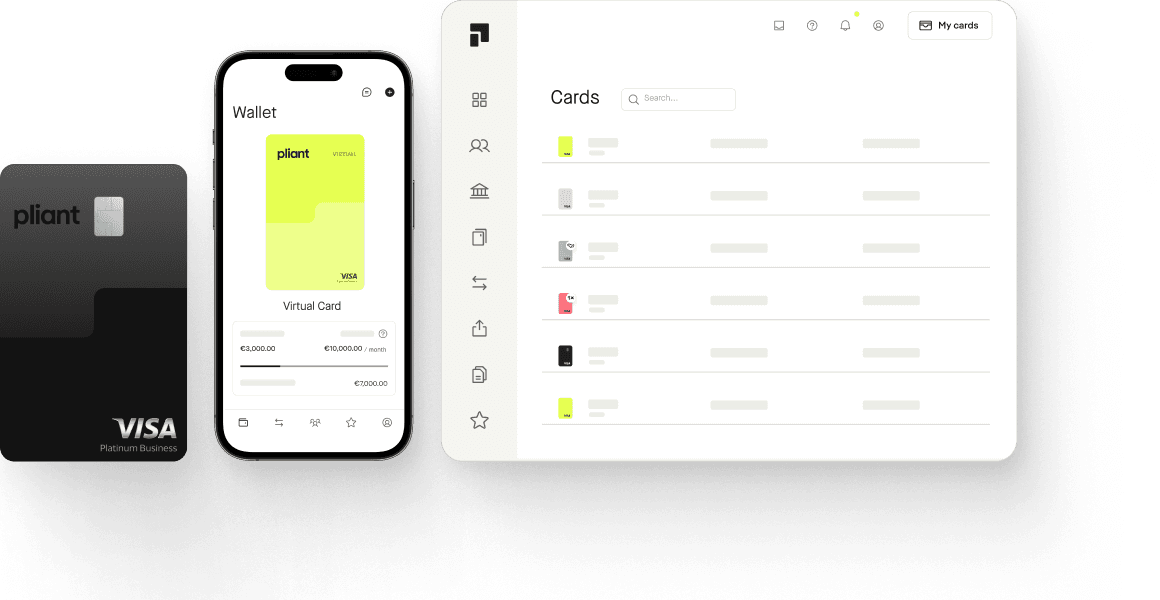

Today, everydays employees pay online and on the go with virtual Pliant credit cards. Thanks to Apple Pay and Google Pay, physical cards are no longer needed.

"We try to avoid dependencies on banks and other service providers. Thanks to Pliant, we can create, change or block cards ourselves in one minute," explains Simon Kronseder. "There are two worlds of providers. There are the ones that are okay and there are the ones that really have outstanding support. When I contact support there, I have a solution in a few hours. For me, Pliant belongs in that category." It was this ease of use that convinced the company's founder to choose Pliant.

Another important criteria for selection was the high credit limit, which Pliant has increased continuously as expenses have grown. "Pliant sends us a reminder when we use 80 percent of the limit. Then I enter our new preferred limit and the reasons for it into an online form and receive feedback after two to three days," explains Simon Kronseder.

The crucial factor for him was the additional liquidity provided by the interest-free payment term of the real credit cards.

“Liquidity and payment terms are central to online merchants. In e-commerce, when you're buying and reselling product, the cash cycle is essential. With Pliant, we've switched Facebook and Instagram ads payments to credit cards and can now scale our marketing budget faster than before.”

In order to finance growth, everydays has to keep a permanent eye on its liquidity.

For an optimized goods flow, payment targets are arranged with suppliers, which are ideally paid once sufficient goods have already been sold. In the same way, everydays can use a payment target with Pliant for customer acquisition costs.

“Marketing expenses are our biggest cost factor. Having Pliant's interest-free payment terms as a time buffer is a key driver for our growth. We can spend money that is not even in the account yet. Just as we have payment terms with suppliers on one side, Pliant credit cards offer us payment terms with Google and Facebook, so to speak.”

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

“Several thousand euros in cashback are a significant advantage for BLINKED.”

Jean-Gabriel Baron, CFO of the Jaws Group

"Pliant delivers a more efficient solution than building our own."

John Lindström, COO of Bezala

“With Pliant Pro API, we automate 1000s of daily transactions.”

Fiorino Cellucci, CFO at Easy Market

“Only with CaaS was a complete integration quickly achievable.”

Alexander Kintzi, CRO Scopevisio AG

“Pliant Pro API is a key asset to our travel booking platforms.”

Diego Furlani, Founding Partner at Salabam SolutionsOur team is available every Monday to Friday from 9am to 5pm to answer your questions personally.