Circula

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

Bart-Jan Maatman is the CFO of Klippa and responsible for the SpendControl business line, an expense management and pre-accounting software solution. He shares with us, how they added credit cards to their products suite driven by customer demand and how Pliant’s Cards-as-a-Service solution enabled them to do so within a few months.

Founded in 2015, Klippa recognized the challenges that organizations faced with cumbersome paperwork and sought to provide a digital and automated solution. Today, Klippa delivers SaaS products using machine learning and OCR, to save time and money for organizations and to improve compliance. Klippa offers an Intelligent Document Processing (IDP) platform, DocHorizon, and a pre-accounting and expense management software solution, SpendControl. Klippa partnered with Pliant to add business credit cards to SpendControl to maximize cost control and improve spend processes for their customers.

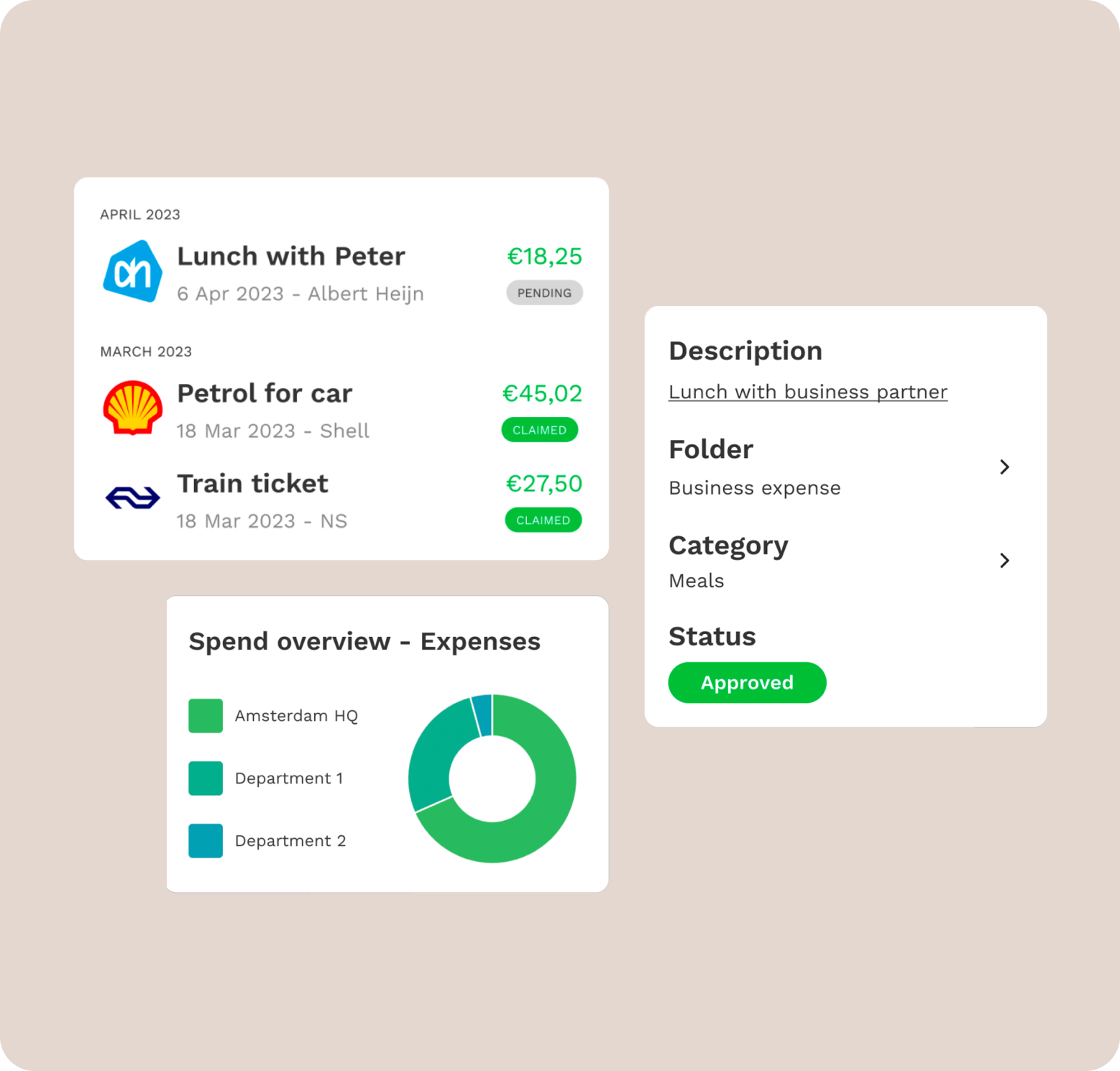

With the Klippa app, you can easily operate SpendControl wherever you are. You can scan receipts and invoices and to approve them when you are on the road. In your own to-do list you can see the overview of receipts and invoices to be approved.

While doing product demos with SMEs and corporates quite often they would ask for a credit card offering. “Adding business cards to the SpendControl platform is therefore really driven by the market demand”, explains Maatman.

He reports that customers often face a variety of challenges in their financial and administrative lives: “When processing credit card transactions, they struggle with an inefficient and expensive administrative process. This inefficiency is compounded by incomplete and non-compliant credit card administration, often due to a lack of essential proof of payment. Issuing cards is a time-consuming process with traditional banks. Another problem is the lack of real-time control over spending and missing insights of spending patterns.”

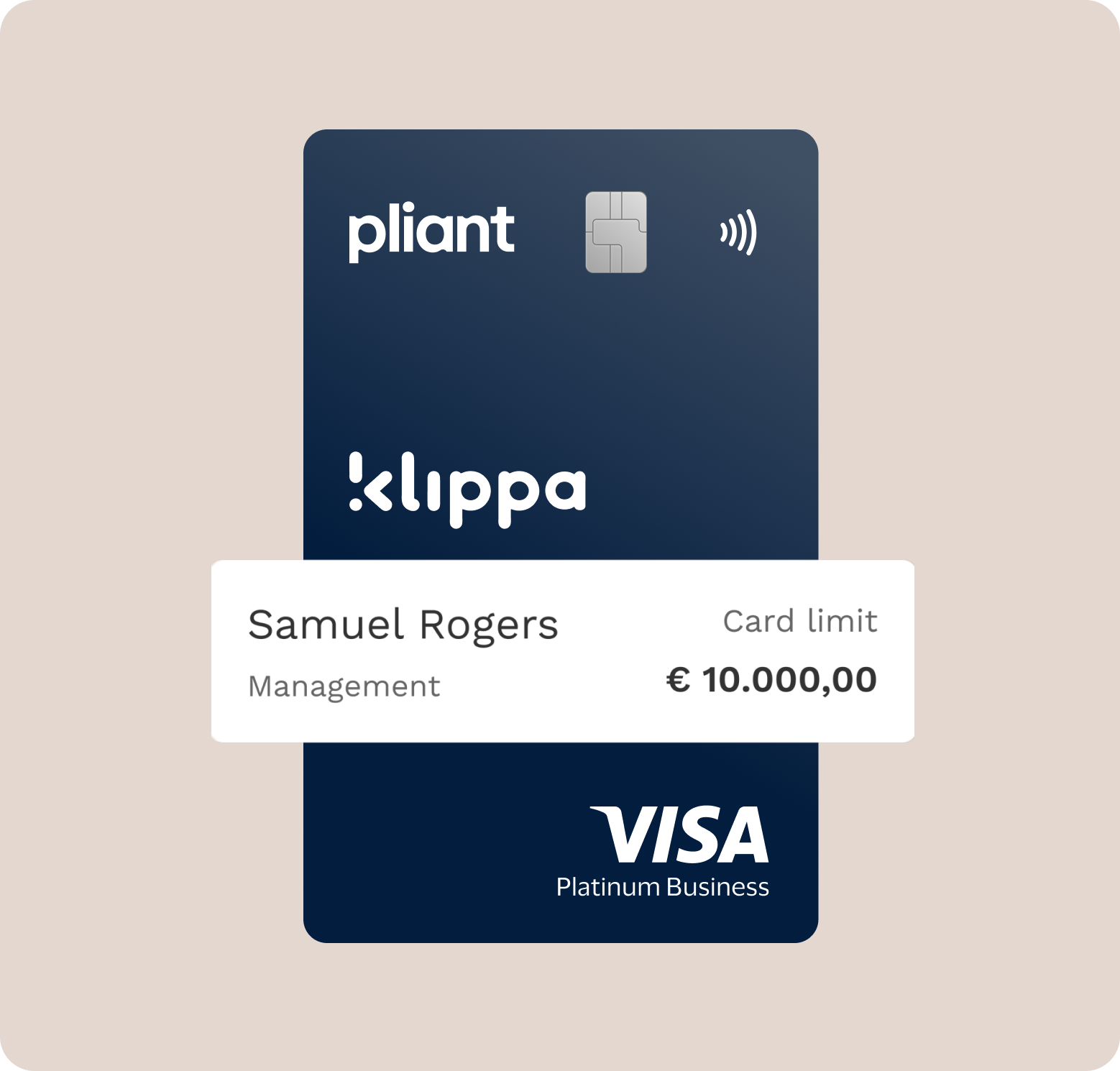

Klippa has partnered with Pliant to deliver more flexibility to its customers so they can make their own choices. They can now manage their expenses without a card, with their existing card, or with the Klippa expense card, which offers the highest level of control and the best customer experience.

According to Maatman, Klippa chose Pliant because the German company backed by VISA provides the perfect balance between reliability and innovativeness: “Pliant is a reliable partner, which was extremely important for us considering the fintech and payment space we move into. We match very well because both Pliant and Klippa have innovation spirit in their DNA."

With the help of CaaS, Klippa enhanced their product offering adding functions requested by their customers. Maatman highlights:

the single dashboard to manage all cards and transactions,

the push notifications in case of a denied transaction,

the limits per card and transaction which enhance the level of control and

the real-time insights into the spending behavior.

Before, Klippa provided a powerful and intuitive pre-accounting solution that effectively processed credit card transactions, invoices, and other business expenses. Now with Pliant’s CaaS, Klippa can issue their own cards to customers, seamlessly connecting the entire journey from purchase to reconciliation. Furthermore, the onboarding process remains completely digital, eliminating the need to visit a bank or open a separate bank account.

Reliability: Pliant is a German-based company backed by VISA.

Time to market: Pliant provides an out-of-the-box and easy to embed setup as a market ready product.

Usability: To provide customers with the highest level of spend control and the best UX design.

Capabilities: To combine best-in-class credit cards with a powerful pre-accounting tool

Innovativeness: Pliant and Klippa feature a high degree of digitalization and automation, which is essential for a company’s finance stack.

With the help of Pliant CaaS, Klippa has launched a market ready credit card solution within a couple of months from specifying the requirements to onboarding the first clients and is in the process of onboarding their first clients.

Klippa is now able to issue their own business credit cards directly to their customers enabling them to manage the entire payment process from purchase to reconciliation in one convenient platform. This leads to dramatic time savings for the finance departments.

“CaaS is an integrated offering with our expense and invoice management platform SpendControl. With only one platform, the finance suite manages the entire accounts payable process. For Klippa this leads to more qualified sales leads, happier customers and less churn because of the more complete offering. One advantage of CaaS worth highlighting is the speed to market. We realized a market-ready product within a few months. The collaboration between our development teams was really amazing. Big compliments!”

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

“Several thousand euros in cashback are a significant advantage for BLINKED.”

Jean-Gabriel Baron, CFO of the Jaws Group

"Pliant delivers a more efficient solution than building our own."

John Lindström, COO of Bezala

“With Pliant Pro API, we automate 1000s of daily transactions.”

Fiorino Cellucci, CFO at Easy Market

“Only with CaaS was a complete integration quickly achievable.”

Alexander Kintzi, CRO Scopevisio AG

“Pliant Pro API is a key asset to our travel booking platforms.”

Diego Furlani, Founding Partner at Salabam SolutionsOur team is available every Monday to Friday from 9am to 5pm to answer your questions personally.