Circula

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

Till, CEO of We Love X, a global leader in comparison shopping for digital products, shares his experience with Pliant.

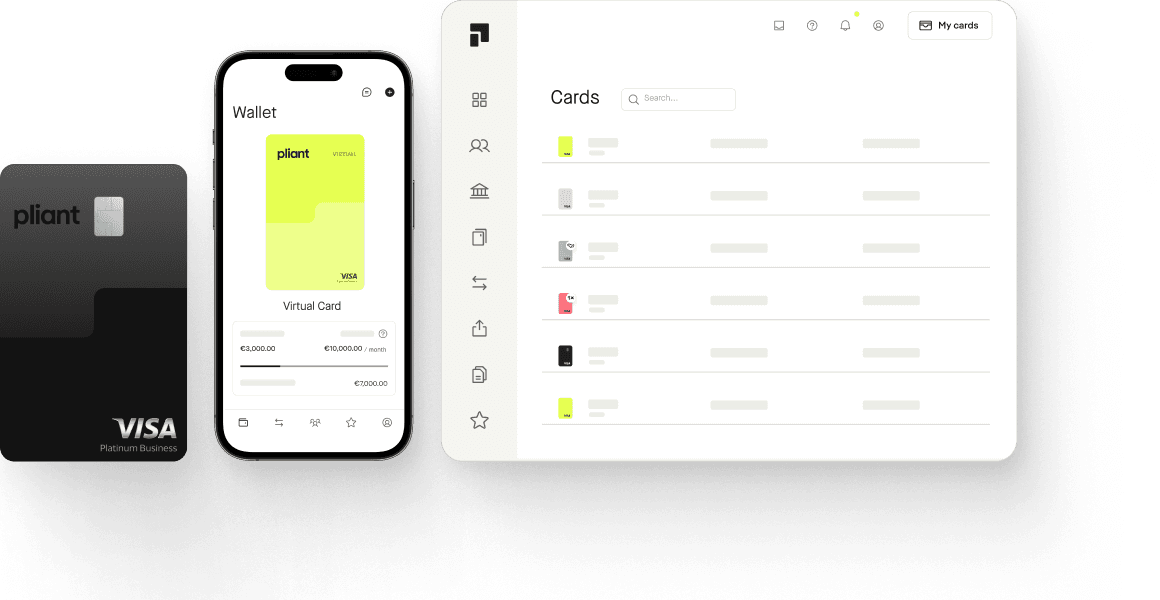

We Love X buys millions of dollars of traffic through media buying platforms like Google Ads as one of the world's leading digital product affiliates. They pay a majority of these transactions with Pliant's corporate credit cards. As a result, the company benefits from attractive cashback. This reduces advertising costs and increases return on advertising spend (ROAS). “By using Pliant's corporate credit card solution, we are able to permanently increase our ROAS without having to expend any significant effort," says CEO Till Haakshorst.

Generous cashback for high card spending.

Fully digital card and receipt management.

Till Haakshorst was in search of a way to reduce his marketing spend and increase ROAS. Cashback is a simple solution to this problem – with every transaction, a portion of the spend is automatically returned to the merchant. In the German market, there are a number of providers of corporate credit cards that offer cashback, but with many challenging conditions.

In his search for a suitable provider, Till Haakshorst came across Pliant's digital corporate credit card solution. Generous cashback is credited immediately when paying with Pliant cards. It's possible to make a payment to the company's bank account from a minimum of €100.

In the end, We Love X saw other benefits as well. The CEO and his staff liked Pliant's real-time reporting and virtual credit cards.

"Our accounting department spends much less time reconciling different credit card invoices because we have a single statement for all physical and virtual cards," said Till Haakshorst.

We Love X effectively reduces its advertising costs with Pliant's generous cashback. This has resulted in rewards in the five-to-six-figure range due to their high marketing spend.

“When it comes to buying media, we benefit from cashback. We also use the cards for purchasing. We no longer have to go to a central person to order what we need. Instead, a virtual card is issued to each employee who regularly places orders. This makes us more agile and we are able to avoid cumbersome processes.”

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

“Several thousand euros in cashback are a significant advantage for BLINKED.”

Jean-Gabriel Baron, CFO of the Jaws Group

"Pliant delivers a more efficient solution than building our own."

John Lindström, COO of Bezala

“With Pliant Pro API, we automate 1000s of daily transactions.”

Fiorino Cellucci, CFO at Easy Market

“Only with CaaS was a complete integration quickly achievable.”

Alexander Kintzi, CRO Scopevisio AG

“Pliant Pro API is a key asset to our travel booking platforms.”

Diego Furlani, Founding Partner at Salabam SolutionsOur team is available every Monday to Friday from 9am to 5pm to answer your questions personally.