How to Launch a Credit Card: 5 Steps to Starting Your Card Program

They call it “the future of finance” – the ability of non-financial companies to offer financial products and maximize their profits – and a popular way to make the most of the embedded finance boom is to launch a credit card. It’s a big step, but starting the journey to a credit card program is simpler than you think. So, how do you launch a credit card? And is it a worthwhile step for your company?

According to research by Statista, 55% of nonfinancial firms plan to offer integrated financial services in the next two years. In this blog post, we'll guide you through five essential steps to starting your credit card program successfully: from planning, to execution, to ensuring a smooth and trouble-free launch. We’ll cover:

The reasons to launch a credit card

Why Cards-as-a-Service may be the best way to launch your credit card

5 Steps to starting your card program

Defining your goals

Finding your partner

Navigating regulatory frameworks

Design and implementation

Rollout and management

Conclusions and FAQs

Think you’re ready? Then head over to our Cards-as-a-Service space and take the first step to launching your credit card program today.

Pliant: Your Cards-as-a-Service Partner

Getting started with embedded finance is a big step for any company, and you’ll need plenty of expert advice, from a partner you can trust, along the way. The Pliant Cards-as-a-Service team works with partner companies every day, helping them integrate card programs into their products with expert business, legal, and technical support.

In our blog series on embedded finance and Cards-as-a-Service, we address the challenges faced by companies just like yours: navigating regulatory frameworks and leveraging technology to maximize benefits such as increased revenue and customer loyalty. Let's empower your business together. Connect with a Pliant expert for a demo today.

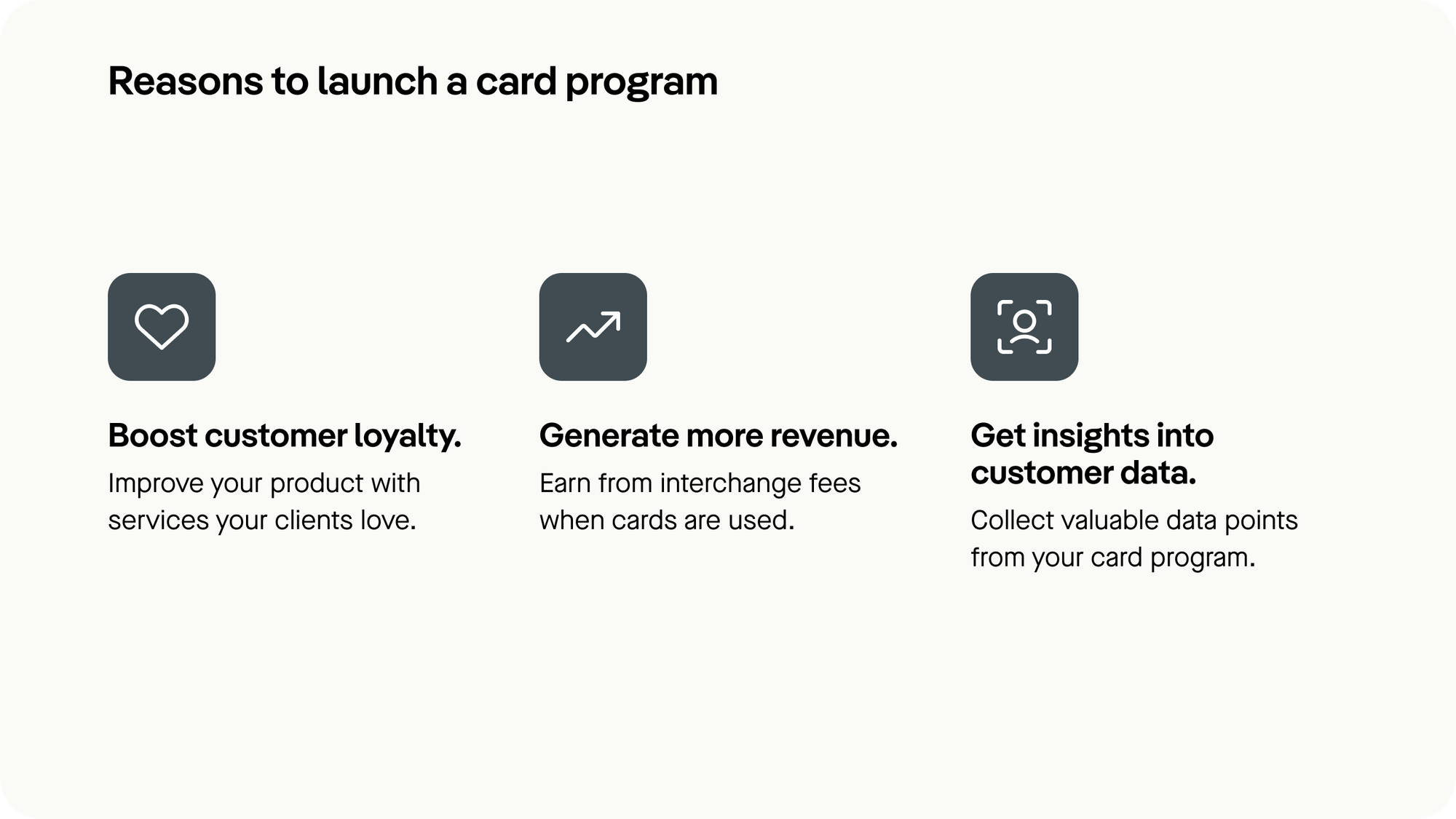

What are the reasons to launch a card program?

Boost customer loyalty

One of the main reasons that companies launch credit cards is to make their existing products better: reducing friction and creating “stickier” brands. Creating cards for your customers can also enhance your existing loyalty programs and make them more flexible for users.

Essentially, financial services are a part of the customer lifecycle that can be vertically integrated: if you already have a customer base that trusts you with one part of their business, offering easy-to-access financial tools can expand your reach into other parts. For example, Pliant helps invoice management providers like Candis leverage their customer relationships in a profitable way. According to Christian Ritosek, CEO and Co-Founder of Candis:

"By offering an all-in-one solution for invoice management and credit card services, we're deepening our relationships with customers and increasing overall customer satisfaction.”

Generate more revenue

A more complete product, especially one that utilizes embedded finance, is also much easier to monetize. Launching your own card will help you to acquire new customers, diversify your revenue sources, and generate more income through interchange charges.

Once your customers start spending using your credit cards, you’ll receive a steady stream of income with minimal operational expenses. Candis’ Christian Ritosek explains how launching a credit card can have an almost immediate, highly transformative effect on income.

“The transaction volume spent on our corporate cards has been doubling quarter over quarter for four quarters in a row. We now see the payoff, and it's been a game-changer."

Get insights into customer data

In today’s number-driven business environment, data is the new gold – and you can collect a lot of valuable customer data points from your card program. Applied correctly, these will help you understand your customers' spending habits, demand for new products, and how to optimize your own pricing structure.

This report by Deloitte pinpoints data collection as one of the key benefits of embedded finance: “Acceding to new types of customer data and being able to capture that information to improve the services offered by both the financial and non-financial partners.”

What is Card-as-a-Service (CaaS) & how can it help you?

Now you’ve seen the benefits that launching your own credit card could bring, you probably can’t wait to get started. You’re not alone, as non-financial companies everywhere are launching their own payment services: Apple, Lyft, and Nike all let their customers make payments directly through their products. However, embedded finance isn’t only for the major players, and you can follow their examples to launch your card program too.

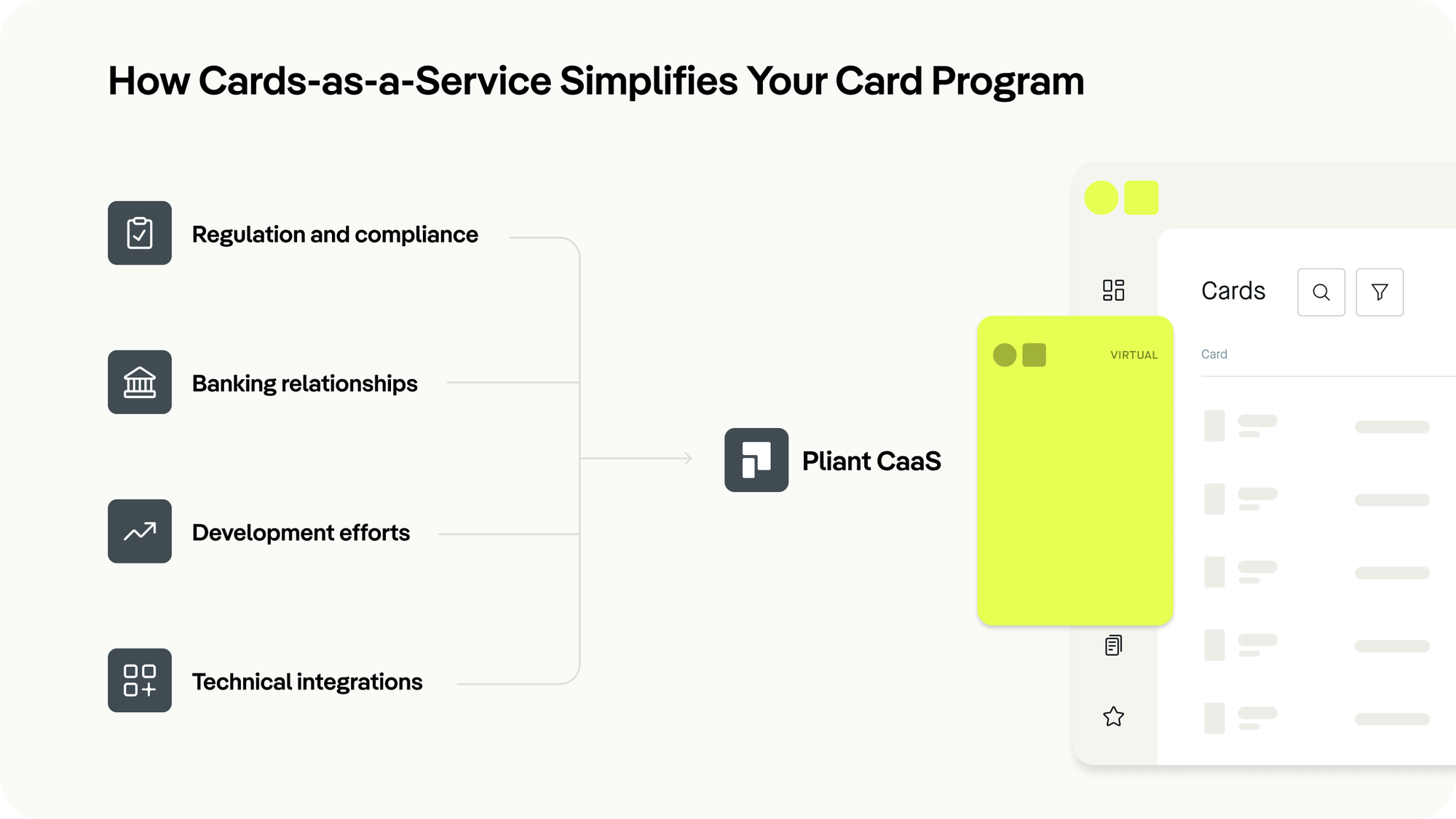

That’s where the Cards-as-a-Service (CaaS) framework comes into play. CaaS is a model that helps companies easily launch credit cards and manage their own card programs without facing the issues associated with traditional methods. These challenges include:

Regulated framework navigation

Building relationships in banking

Meeting compliance requirements

Managing technical integrations

If you choose the right provider, a step we’ll cover further in this article, Cards-as-a-Service can help companies that are interested in launching credit cards address common challenges and take care of their program’s technicalities, regulatory requirements, and banking infrastructure.

This represents a massive opportunity for non-financial companies to launch creative and innovative payment cards and expand into untapped markets, allowing them to capture a greater market share.

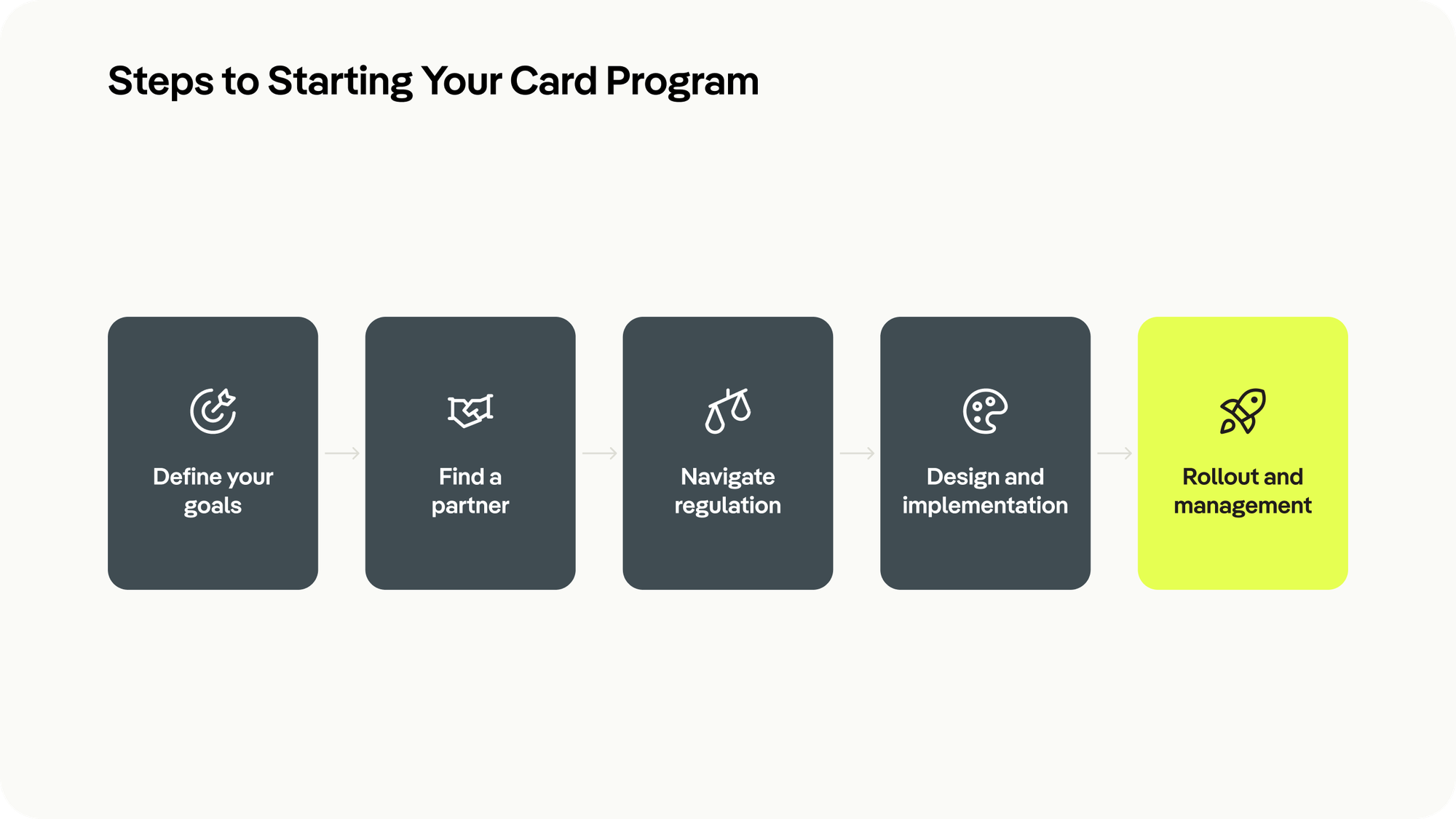

Ready to Launch Your Credit Card? Follow These 5 Steps to Starting Your Card Program

Step 1: Define Your Goals

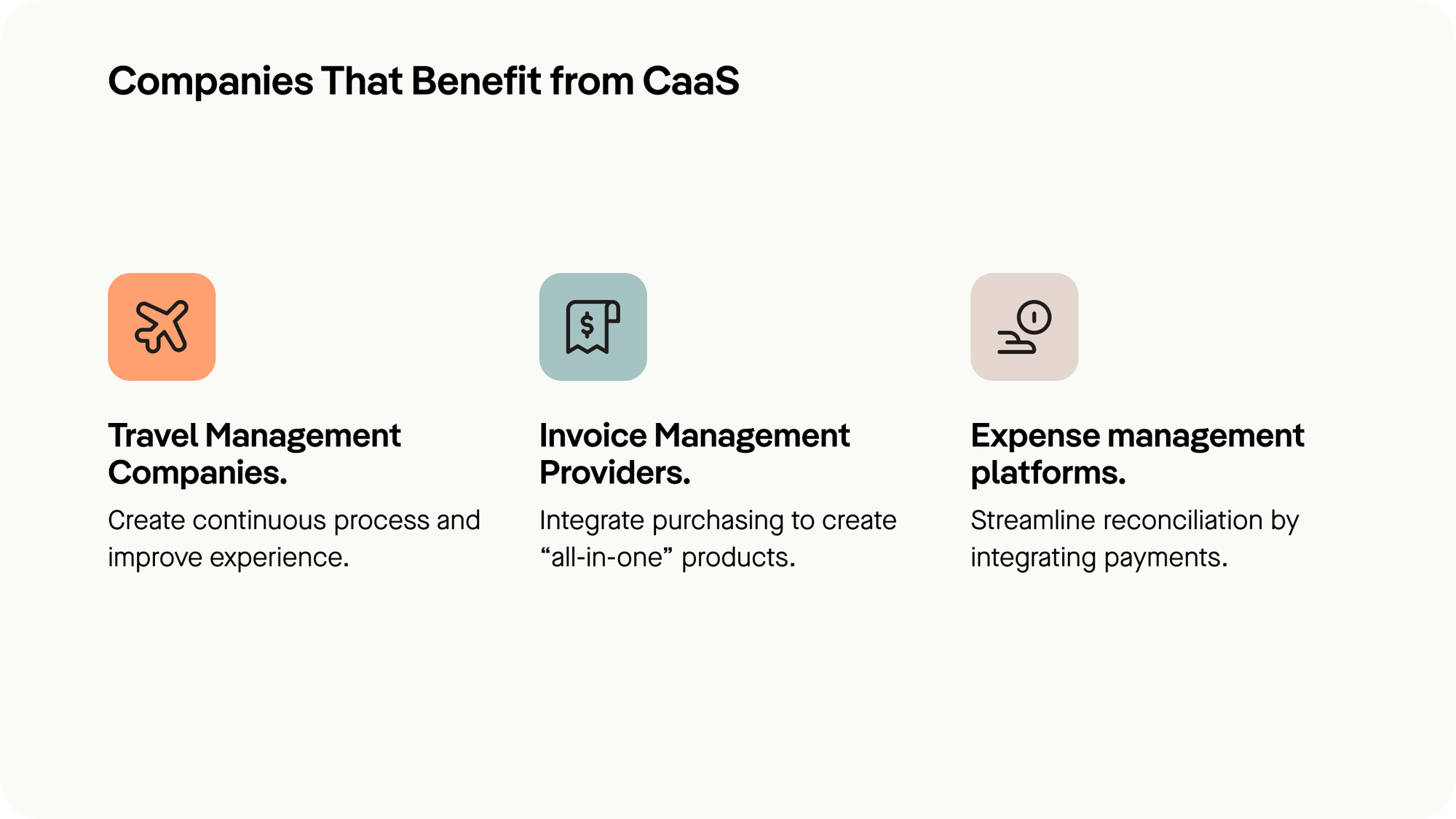

Use the benefits above – increasing brand loyalty, growing revenue, and generating customer data – to assess profitability relative to your audience size and the market you want to enter. Here are some business models that have proven particularly successful for Pliant CaaS – and may prove to be worthy inspiration for your company’s card program too:

Travel management companies, like InterTours, who offer credit cards in order to create a continuous purchasing process and save business travelers from advancing expenses with private cards.

Invoice management providers, like Candis, who can integrate purchasing services into their feature sets to create “all-in-one” products.

Expense management platforms, like Mobilexpense, who streamline reconciliation processes by integrating a payment system directly into their products.

If your business falls into any of these categories, or if you think you can see a clear use case for cards-as-a-service in your industry, get in touch with a Pliant expert today.

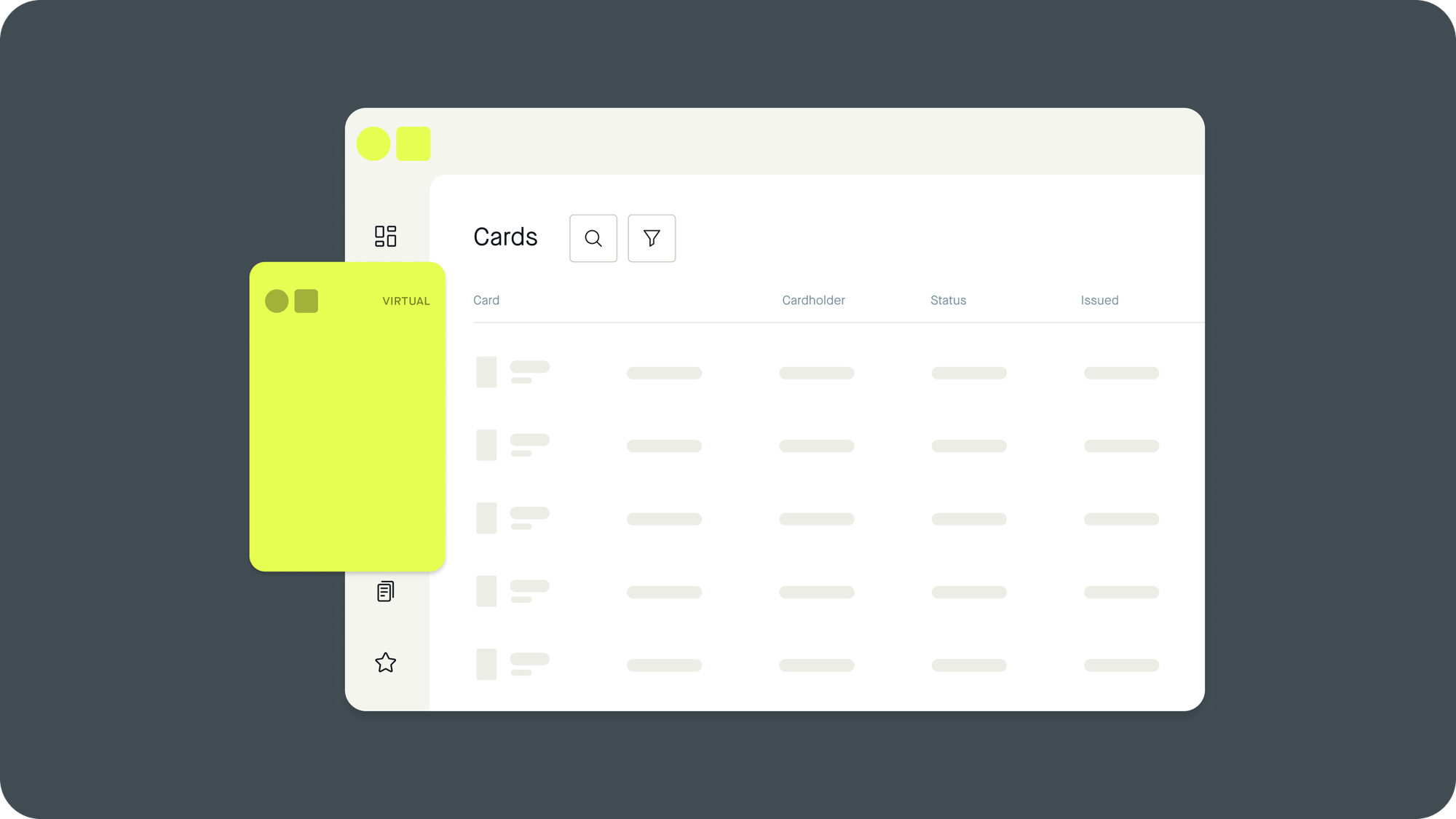

Step 2: Find Your Partner

Finding the right credit card partner is a pivotal step in launching your card program. If you choose the Cards-as-a-Service model, you’ll need a provider you can trust who will act as the card issuer. Look for a partner with expertise in card issuing topics, including card design, issuance, and transaction processing.

A knowledgeable partner can also navigate complex regulatory frameworks, mitigating risks and ensuring smooth operations. Especially if you aren’t a financial expert yourself, seek a partner that is capable of providing comprehensive support throughout the entire card lifecycle, from initial setup to ongoing maintenance.

Lastly, you’ll need to consider factors such as scalability, flexibility, and technological capabilities to align with your program's objectives and growth trajectory. By selecting a trusted partner with the right expertise and resources, you’ll lay a solid foundation for a successful and sustainable card program, driving value for your business and customers alike.

Step 3: Know the Regulations… Or Make Sure Your Partner Does.

For a lot of very good reasons, credit cards are highly regulated: before you can issue them, national and international authorities will need evidence that there are safeguards in place to stop misuse and fraud. From PCI DSS compliance to banking regulations, the legal and regulatory frameworks surrounding card issuance can be intricate, particularly on an international scale where regulations vary significantly.

Partnering with a Cards-as-a-Service (CaaS) provider like Pliant can streamline this process significantly. Our CaaS experts possess decades of expertise in navigating diverse regulatory environments, and they will take care of KYB and KYC, AML and credit risk checks so you can focus on providing your clients with the best experience. As such, they ensure your compliance with relevant laws and standards, saving you considerable time and effort in researching and interpreting complex regulations.

A good CaaS provider will also handle the implementation of necessary safeguards, such as encryption protocols and fraud prevention measures, minimizing the burden on your business while ensuring adherence to legal requirements. This collaborative approach allows you to focus its core operations while confidently launching your credit card.

Step 4: Choose Between Embedded and White-Labeled

Depending on your product, you’ll need to decide exactly how deeply your card program should be integrated into your system. This will define the technical effort that’s required to develop your card program, as well as the eventual look and feel of the financial services you provide to your customers.

A white-labeled credit card program involves branding a pre-existing card product offered by a third-party provider, allowing for quicker deployment with less technical investment, as there is no development effort required on your side.

On the other hand, an embedded credit card program integrates seamlessly into your platform, offering a tailored user experience and greater control over features and functionalities, albeit requiring more development resources.

Need more advice? Read our full guide to embedding or white labeling your credit card program.

Step 5: Testing and Rollout

One of the most important points when thinking about how to launch a card program is a smooth card distribution process and an enjoyable onboarding process for your customers. To minimize your own internal support efforts, which may have long term effects on your efficiency and profitability, you should iron out as many technical issues as possible with a smaller sample size.

When you partner with Pliant, our CaaS experts utilize their extensive experience to facilitate a seamless rollout. We’ll help you oversee the testing phase, ensuring that any potential technical glitches are addressed proactively. This strategic approach not only enhances the efficiency of the rollout process but also mitigates the need for extensive customer assistance, ultimately contributing to a smoother and more successful launch.

Ready to Get Started?

Ready to start your journey to launch a credit card program? With the guidance of Pliant's Cards-as-a-Service (CaaS) experts, you can navigate the complexities with confidence. From strategic planning to seamless execution, we're here to support your vision every step of the way. Contact a Pliant CaaS expert today and unlock the potential of your card program.

How to Launch a Credit Card: FAQs

Launching a credit card program requires thorough planning and expertise. Start by identifying your objectives and target market, then find a reputable card issuing partner – ideally a Cards-as-a-Service provider like Pliant, that can assist you with their expertise in compliance and technology. Collaborate closely with your partner to navigate regulatory requirements, design card features, and implement necessary infrastructure for a successful launch.

Cards-as-a-Service (CaaS) is a type of embedded finance that enables non-financial companies to issue virtual or physical cards to their customers. This can be used to create “all-in-one” products that handle business expenses end-to-end, or alternatively to provide a trusted payment method from a reliable source. CaaS providers like Pliant handle the “nuts and bolts” of the card program, taking responsibility for card issuance, management, and associated services, catering to all kinds of business needs.

Cards-as-a-Service (CaaS) provides a range of benefits to companies who issue cards: creating new revenue streams, improving the product portfolio or service offering, and attracting new customers in the process.

Companies who implement a Cards-as-a-Service solution can offer their own customers a wide range of benefits too: simplified expense tracking, heightened control over spending, streamlined payment procedures, increased security via virtual cards, customizable spending limits, real-time monitoring capabilities, and scalability to adapt to changing business requirements.