Could Your Company Issue Credit Cards? 3 Industries That Could Benefit from Cards-as-a-Service

If you’re looking to expand your profit margins, and your customer base, by adding financial services to your portfolio, a credit card issued and branded by your company is certainly a goal to aspire to. However, without any experience of offering financial services, you might be wondering about the best way to issue credit cards and bolster your revenue streams. Fortunately, Cards-as-a-Service (CaaS) is the simple, effective option that brings your own card program within reach. Let’s look at the industries best suited to issue credit cards and whether your company could benefit too.

Cards-as-a-Service is a concept that redefines who can issue credit cards – and how they can do it. In this article, we'll look at the sectors that can benefit from issuing credit cards, integrating success stories from Pliant customers in those industries. From travel management companies, to expense and invoice management platforms, companies in different industries can leverage credit cards to their advantage.

Whether your goal is to enhance customer experiences, unlock new revenue streams, or both; this post will provide valuable insights into the potential benefits of issuing credit cards in your sector. We'll cover:

Companies that can issue credit cards with Cards-as-a-Service

Why companies want to issue credit cards

What characteristics should a company that issues credit cards have?

Industries that are well-suited to issue credit cards:

Travel management companies

Expense management

Invoice management

Pliant: Your Cards-as-a-Service Partner

Taking the leap and issuing credit cards is a big step for any company: whichever industry you operate in. Especially at the beginning of your journey through the often-confusing landscape of embedded finance, expert guidance from a trusted partner is extremely important.

At Pliant, our Cards-as-a-Service team collaborates with partners across many different industries, offering comprehensive support to create white-labeled credit card programs, or to seamlessly integrate card programs into digital products. From expert business insights to navigating regulatory landscapes and providing technical assistance, we're committed to ensuring your success. In our blog series focusing on embedded finance and Cards-as-a-Service, we’ll explore the common challenges encountered by businesses like yours. Take the first step towards transforming your business by connecting with a Pliant expert for a demo today.

Who Can Issue Credit Cards?

Credit cards are everywhere – in business and in private life. Studies from Experian suggest that the average American consumer has 3.84 credit cards with an average credit limit of $30,365, and Statista shows that 28.44 billion payment cards will exist in the world by the year 2027.

Likewise, a quick glance at your wallet – digital or physical – shows the variety of companies that are issuing credit cards to their customers. On top of the credit card provided by your bank, you could be swiping the plastic from any number of your favorite brands: airlines, supermarkets, department stores and more. If you’re looking to launch your own card program, there’s only one question: how do I get involved?

Traditionally, getting into a position to issue credit cards to customers was a difficult process: involving intricate financial processes and regulatory considerations. From obtaining a Bank Identification Number (BIN) from payment networks such as Visa or Mastercard, to navigating stringent regulations that ensure consumer protection and financial stability, to finally receiving an issuing license, the result was a jungle of red tape.

Cards-as-a-Service: A New Beginning

However, the landscape of credit card issuance has evolved significantly in recent years. The emergence of Cards-as-a-Service (CaaS) models means that companies can launch card programs without building an entire infrastructure from scratch. Through strategic partnerships with specialized financial technology firms or card issuing platforms, businesses from a variety of industries can leverage existing frameworks for card issuance, transaction processing, and compliance management.

Why Do Companies Want to Issue Credit Cards?

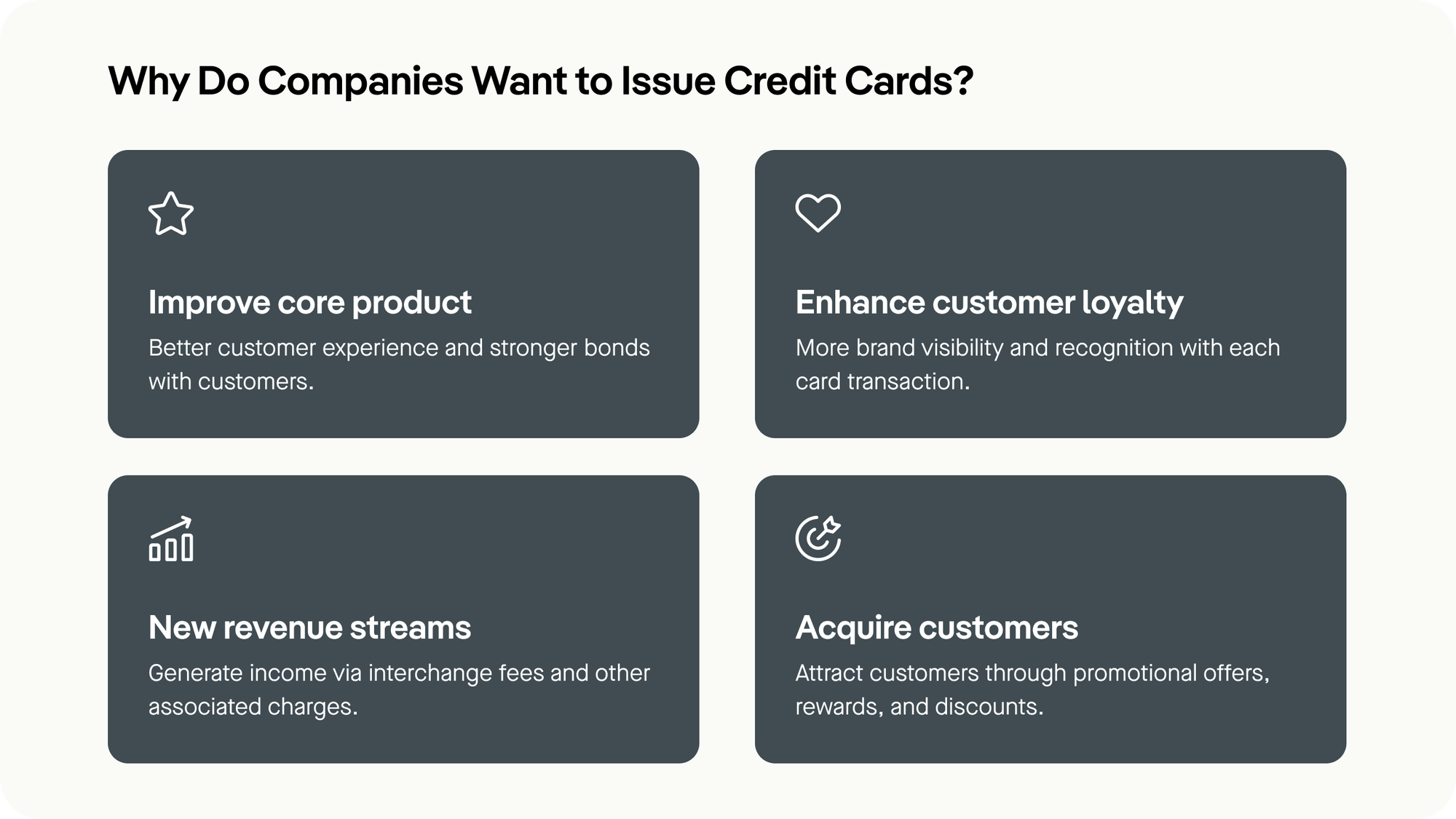

Improve core product offering. By integrating a convenient financial option into your product or platform, you can improve customer experience and strengthen bonds with your customer base. In many cases, this can ensure ongoing usage of your products and services.

Enhance customer loyalty. Additionally, branding the credit card with your company logo enhances brand visibility and recognition with each card transaction.

Boost revenue streams. With transactions made using the credit cards, your company could generate revenue through interchange fees and other associated charges, contributing to increased revenue.

Acquire new customers. A well-designed credit card is a potent marketing tool, capable of attracting new customers through promotional offers, reward programs, and exclusive discounts: valuable marketing opportunities for your brand.

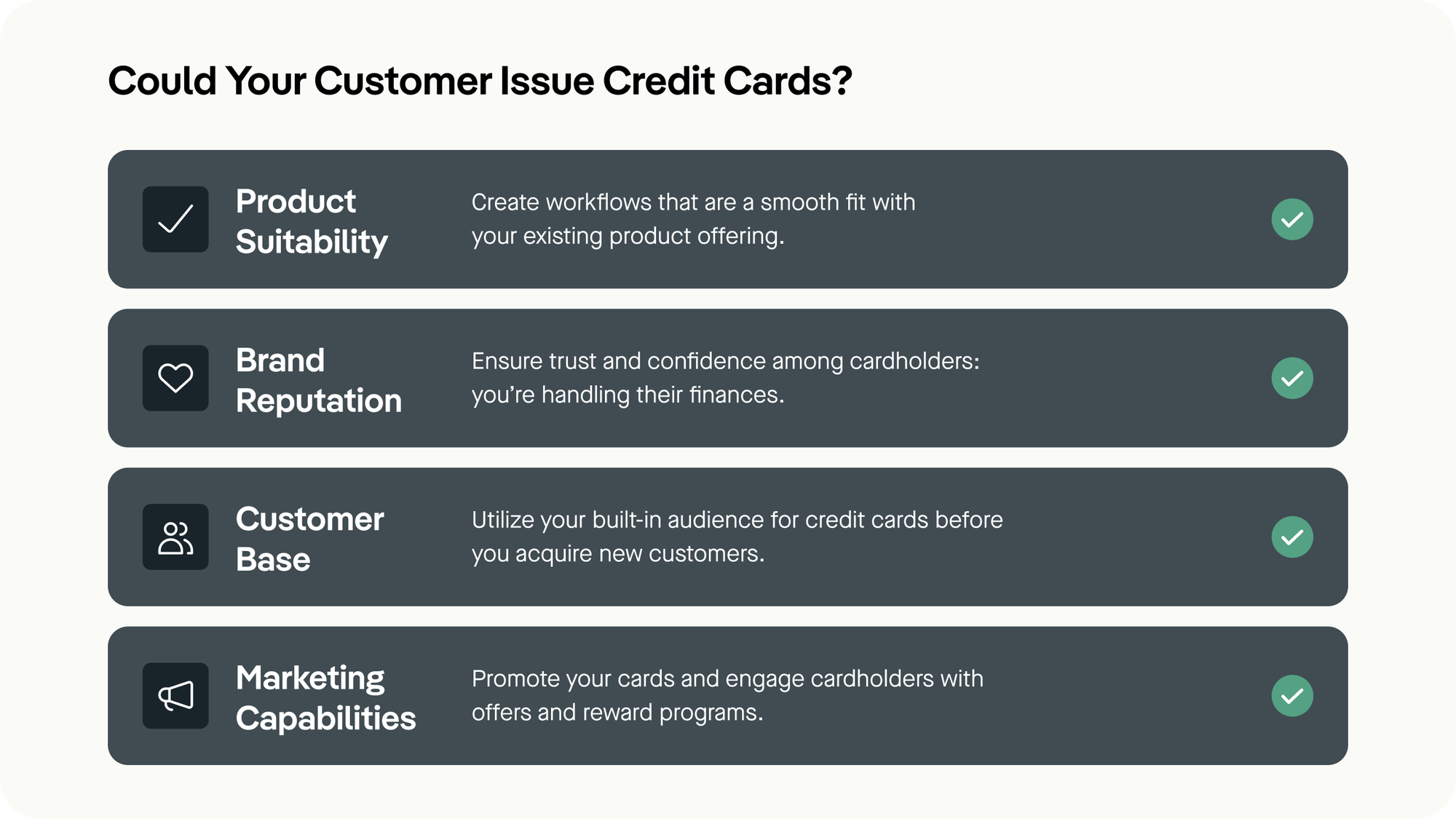

What Characteristics Should a Company That Issues Credit Cards Have?

A Well-Suited Product. If you’re going to embed your credit card program into your product, you should ensure that it’s a smooth fit with your existing offering – see our list of industries below for inspiration.

Established Brand Reputation. A reputable brand image instills trust and confidence among cardholders, a non-negotiable if they’re to trust you with handling their finances. Companies with a solid reputation for reliability, transparency, and customer service are better positioned to attract and retain cardholders.

Existing Customer Base. Your existing customer base provides a built-in audience for credit card offerings – it’s often easier to “upsell” financial services than to offer them directly. In some cases, customers even actively request payment cards from their software providers. Leveraging an established customer relationship facilitates marketing efforts, enhances customer acquisition, and fosters long-term loyalty.

Marketing Capabilities. While Cards-as-a-Service may spare you the effort of implementing extensive financial infrastructure or acquiring regulatory expertise, the sales effort will occur largely on your end. As such, your company should be prepared to market branded credit cards to your existing customer base. Customer support may also be something you want to explore, but your CaaS partner – including Pliant – can help you there.

Industries That are Well-Suited to Issue Credit Cards:

In our discussions with customers and potential customers, we find that companies from certain industries are inherently well-suited to issue credit cards. From this strong basis, we use our technology, expertise, and experience to help them succeed.

From established travel management companies to innovative software-as-a-service providers, there are a number of key sectors that have the potential to leverage credit card programs to their advantage. Let's explore a selection of core focus industries poised to benefit significantly from issuing credit cards.

Travel Management Companies

Travel management companies (TMCs) specialize in organizing and facilitating travel arrangements for businesses, including booking flights, hotels, and transportation. Likewise, they’ll often take care of invoice and receipt management processes on behalf of the client, simplifying their travel costs.

The position at the center of the business travel world means that many TMCs are well-placed to issue credit cards to their customers. With an integrated credit card solution, travel management companies can streamline payment processes for corporate travel expenses – offering companies a simple corporate credit card solution instead of complicated reimbursement processes with employees’ private cards.

This is exactly what Pliant offers the German TMC InterTours – marketed as “Travel. Pay. Expense.” By offering an integrated payment method for on-the-road expenses, with no pre-funding necessary, the InterTours product is greatly enhanced. Furthermore, low FX rates and perks like travel insurance, included with Pliant credit cards, are natural selling points for corporate travel too.

Learn how Pliant partner InterTours is improving its product – and growing its revenues – by offering its own card program.

Expense Management Platforms

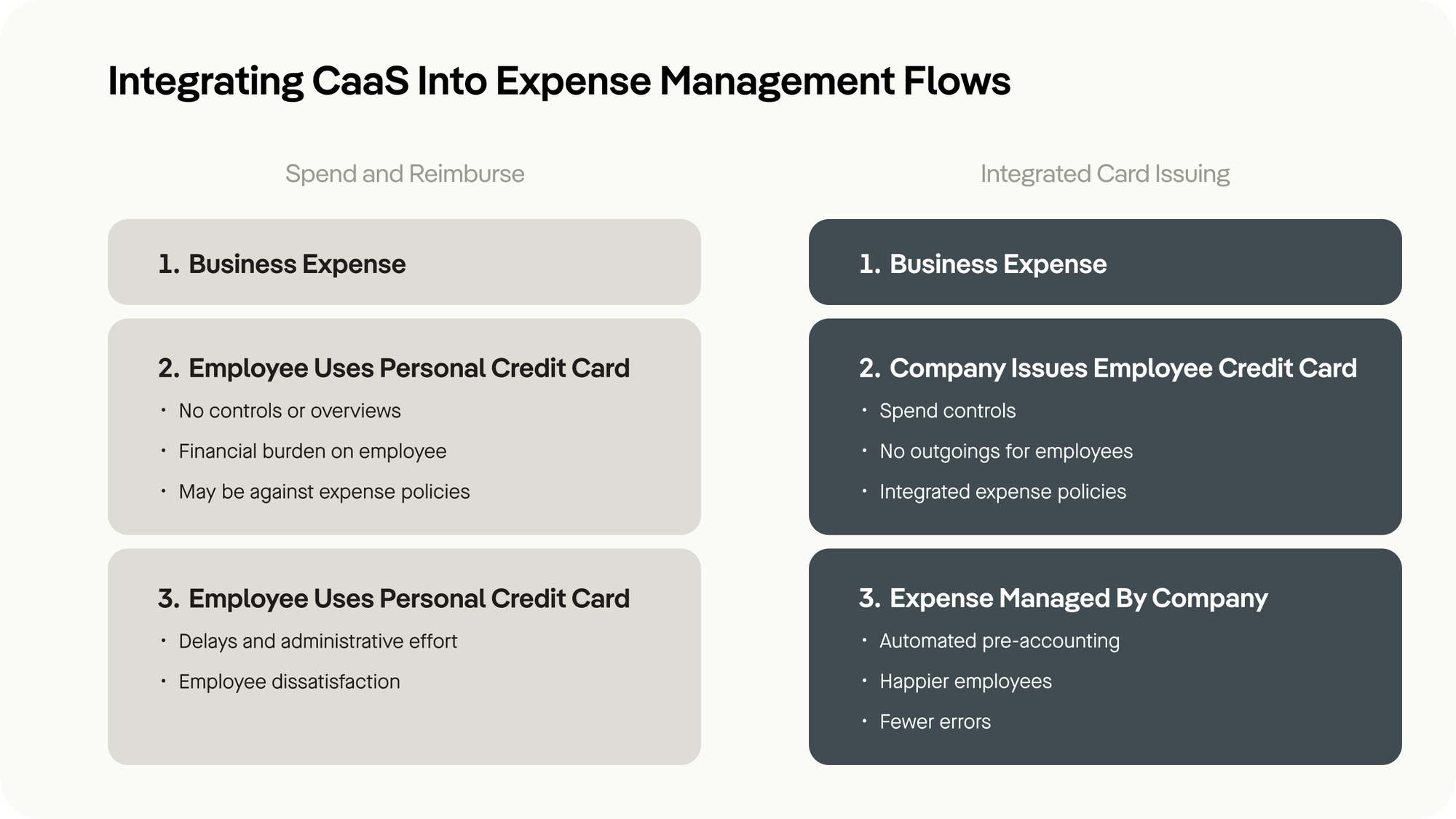

However, despite the time-saving nature of expense management platforms, companies are trying to move away from the “spend and reimburse” model, which gives little oversight or control of spend. So, how do expense platforms stay relevant?

By issuing credit cards, travel expense management companies can streamline the reimbursement process, integrate approval processes defined by internal travel policies, and forward transactions directly to accounting software. This significantly enhances efficiency and reduces administrative burdens: an excellent USP for business users who may otherwise expend considerable effort on manual reconciliation.

Pliant partner Mobilexpense is a notable example of how a card program can be effectively marketed to an existing target audience. They offer credit cards to their customers with the promise to say goodbye to employees advancing money out-of-pocket for their expenses. By issuing credit cards, Mobilexpense generates income whenever the card is used to make payments both (online and in-store) – increasing profits as well as customer satisfaction.

Explore how Pliant's Cards-as-a-Service (CaaS) can benefit your expense management company on our website.

Invoice Management

Invoice management software is used by companies to centralize invoice processing, track money owed to merchants, manage accounts receivable and payable, and ensure timely payment. By integrating credit card issuance, invoice management companies can simplify accounting processes, facilitate receipt reconciliation, and streamline pre-accounting processes.

As there is a logical link between payments and invoices, issuing credit cards to existing users is a logical step forward for many invoice management platforms – giving them the means to actually pay their invoices as well as process them for accounting purposes. The result: a seamless, “all-in-one” solution.

According to Candis, an invoice management platform and Pliant partner, using a credit card that’s integrated into the receipt management system can help companies keep track of expenses in real time and never search for missing receipts, because Candis automatically connects it with the transaction. This is a significant USP for the company, which is increasing its revenues from issuing credit cards month-on-month.

Learn how your invoice management tool could integrate card issuing functionality on our website.

Is Your Company Ready to Issue Credit Cards?

We've discussed the characteristics that make a company well-suited to issue credit cards, emphasizing the importance of a strong partner ecosystem, marketing prowess, scalability, and a commitment to data security. By asking who can issue credit cards, we hope that you can begin to determine whether your company is ready to embark on its Cards-as-a-Service journey.

Furthermore, we've highlighted key industries, including Invoice Management, Expense Management, and Travel Management, which stand to benefit significantly from implementing credit card programs. If your company operates within one of these industries and you're intrigued by the potential benefits of issuing credit cards, now is the time to take action.

Reach out to the Pliant team today to learn more about how we can help you unleash the power of credit cards for your business.

What types of companies can issue credit cards?

Credit cards can be issued by a wide range of companies across various industries. Traditional financial institutions such as banks and credit unions commonly issue credit cards as part of their financial services offerings. Using Cards-as-a-Service, non-financial companies, including retail chains, airlines, and technology firms, may also issue branded credit cards to enhance customer loyalty and generate additional revenue streams. Ultimately, any company that can access the necessary infrastructure, regulatory compliance, and strategic vision – either in house or via a Cards-as-a-Service partner like Pliant – can explore credit card issuance as a potential business opportunity.

Can I issue a credit card without a partner?

While it is technically possible for a company to issue credit cards independently, it often requires a considerable investment in infrastructure, expertise, and regulatory compliance. Many companies opt to partner with specialized financial technology firms or card issuing platforms to streamline the process and mitigate risks. Partnerships with Cards-as-a-Service providers like Pliant enable companies to leverage existing infrastructure and expertise, ensuring a smoother and more cost-effective credit card issuance process. However, the feasibility of issuing credit cards without a partner ultimately depends on the company's resources, capabilities, and strategic objectives.

How can Cards-as-a-Service help me issue credit cards?

Cards-as-a-Service (CaaS) is a comprehensive solution for companies looking to issue credit cards without building their entire infrastructure from scratch. CaaS platforms offer a range of services, including card program management, transaction processing, regulatory compliance, and customer support. By partnering with a CaaS provider like Pliant, companies can benefit from access to a ready-made infrastructure and expertise, allowing them to launch and manage credit card programs more efficiently and cost-effectively. Additionally, CaaS platforms often offer customizable features and flexible pricing models, catering to the unique needs and requirements of each company. Overall, Cards-as-a-Service represents a convenient and scalable solution for companies seeking to issue credit cards.