White Label Credit Cards: Is it Time to Think About an Embedded Payment Solution Instead?

If you’re looking to capitalize on the ongoing embedded finance boom, a white label credit card is likely near the top of your wishlist. However, there's more than one way to expand your horizons – and grow your profit margins – by adding a payment solution to your products and services. In fact, the big question is probably one you haven’t thought of yet: do you need a white label credit card or an embedded payment solution?

In this article, we'll break down the reasons that companies choose white label credit cards; examine the options for implementation in detail and look closer at embedded solutions. We'll keep it simple and straightforward: whether you're new to the world of embedded finance or looking to level up your product by offering financial services, you'll come away with a clear understanding of the options for your white label credit card program or embedded payment solution. We’ll cover:

What is a white label credit card?

What are the benefits of choosing a white label card program?

Choosing between a white label credit card and an embedded solution

The Pliant layered approach. The best of both worlds?

Considerations for you white label credit card or embedded solution

Speed vs. complexity

Customization options

Integration with your product.

Pliant: Your Cards-as-a-Service Partner

Launching a card program is a big step for any company, and you’ll need plenty of expert advice, from a partner you can trust, along the way. The Pliant Cards-as-a-Service team works with a range of partners in different industries, helping them integrate card programs into their products with expert business, regulatory, and technical support.

In our blog series on embedded finance and Cards-as-a-Service, we address the challenges faced by companies just like yours: navigating regulatory frameworks and leveraging technology to maximize benefits such as increased revenue and customer loyalty. Let's empower your business together. Connect with a Pliant expert for a demo today.

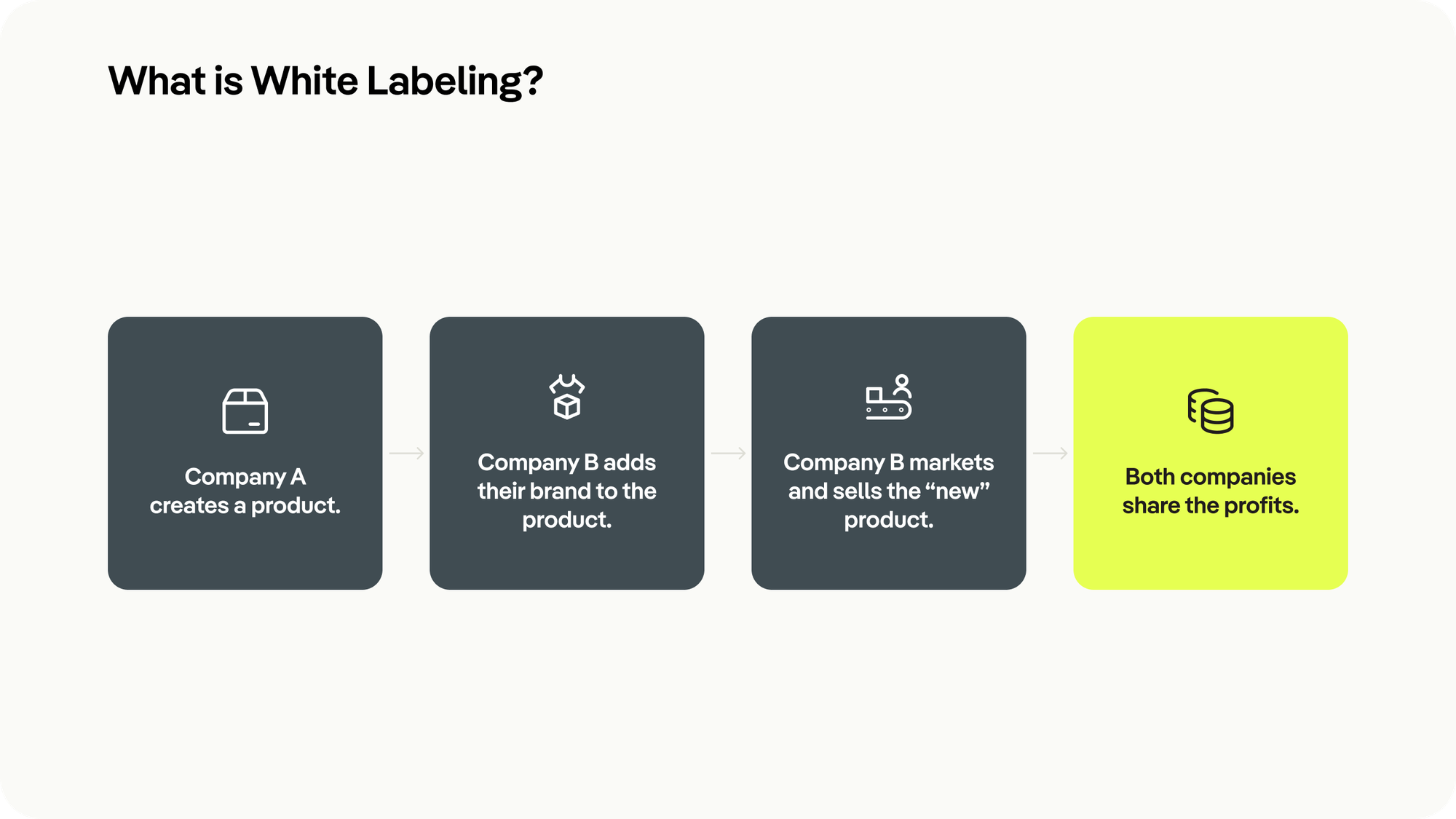

What is a White Label Credit Card?

In the most simple terms, a white label credit card is a type of credit card issued by one company but branded for and marketed by another. Unlike traditional credit cards that bear the branding of the issuing bank or financial institution, white label credit cards look like the products of the company offering them, such as retailers, airlines, or other businesses.

Amazon has one, so does Uber – and thanks to cards-as-a-service, your company may be able to launch one too. White label credit cards often come with customized features tailored to the specific needs and preferences of the target audience (for example Amazon gives you more cashback for Amazon purchases, in turn increasing brand loyalty). The general idea is that you can convince customers to keep buying your product by offering better payment terms, but still make money on transaction interchange fees if they shop elsewhere.

Head over to our Cards-as-a-Service space and find out more about how your company can launch its own card program.

What are the Benefits of a White Label Card Program?

That’s because the issuing bank or financial institution handles the backend processes like underwriting, transaction processing, and customer service, which require dedicated staff with years of experience. In turn, the partner company focuses on branding, marketing, and customer acquisition – activities within their normal business remit.

However, there are several other key benefits to offering a white label credit card – including customer engagement, revenue growth, and brand expansion – which is why so many brands are choosing to jump on the bandwagon.

Stronger customer relationships. By offering a convenient financial solution tailored to their needs, you can ensure that your customer base continues to use your products and services. Likewise, branding the credit card with your company logo and identity increases brand visibility and recognition every time customers use the card.

Diversified revenue streams. When purchases are made using the credit cards, the card provider and the brand share the profits from transaction fees and other incidental charges associated with the card.

Marketing opportunities. A white label credit card is a powerful marketing tool with the potential to attract new customers through promotional offers, reward programs, and exclusive discounts.

Choosing Between Embedded and White Label Solutions

There are disadvantages too. While white label card programs offer unique opportunities, acquiring customers while staying aligned with your brand’s core offering may dilute the overall customer experience. For this reason, more companies are turning to embedded credit card programs in order to offer financial services to their customers.

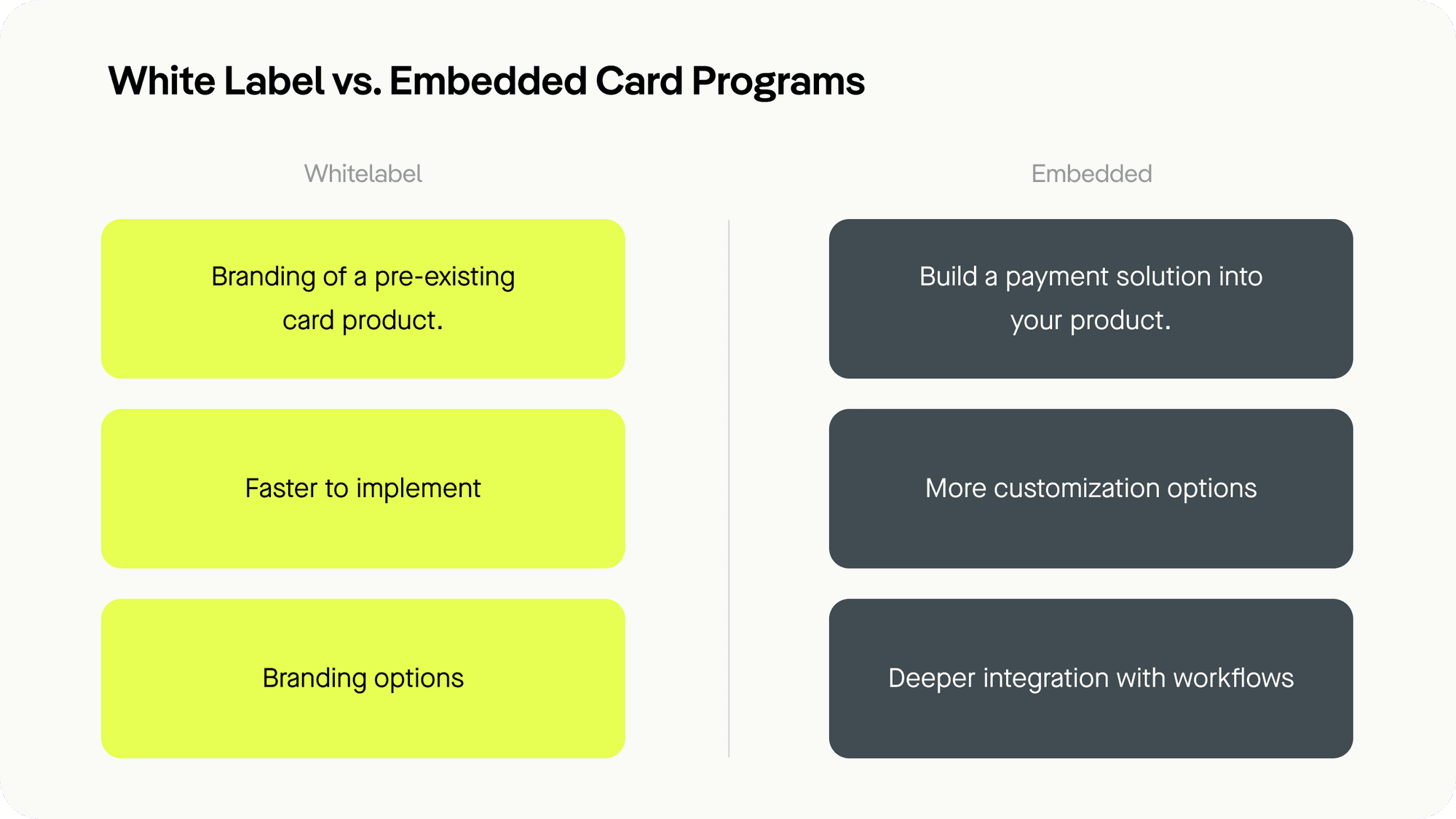

While a white labeled credit card program involves branding a pre-existing card product offered by a third-party provider, an embedded credit card program is designed to integrate more completely into your platform.

The logic behind this is that rather than offering a credit card as a separate product, companies can actually improve their core offering by including financial services – and in turn boost their revenue on two fronts.

Depending on your product, as well as size and nature of your company, you’ll need to decide exactly how deeply your card program should be integrated into your system – and as such whether a white label card program or embedded payment solution is right for you. This will define the technical effort that’s required to develop your card program, as well as the eventual look and feel of the financial services you provide to your customers.

The Best of Both Worlds? Pliant's Layered Implementation Approach

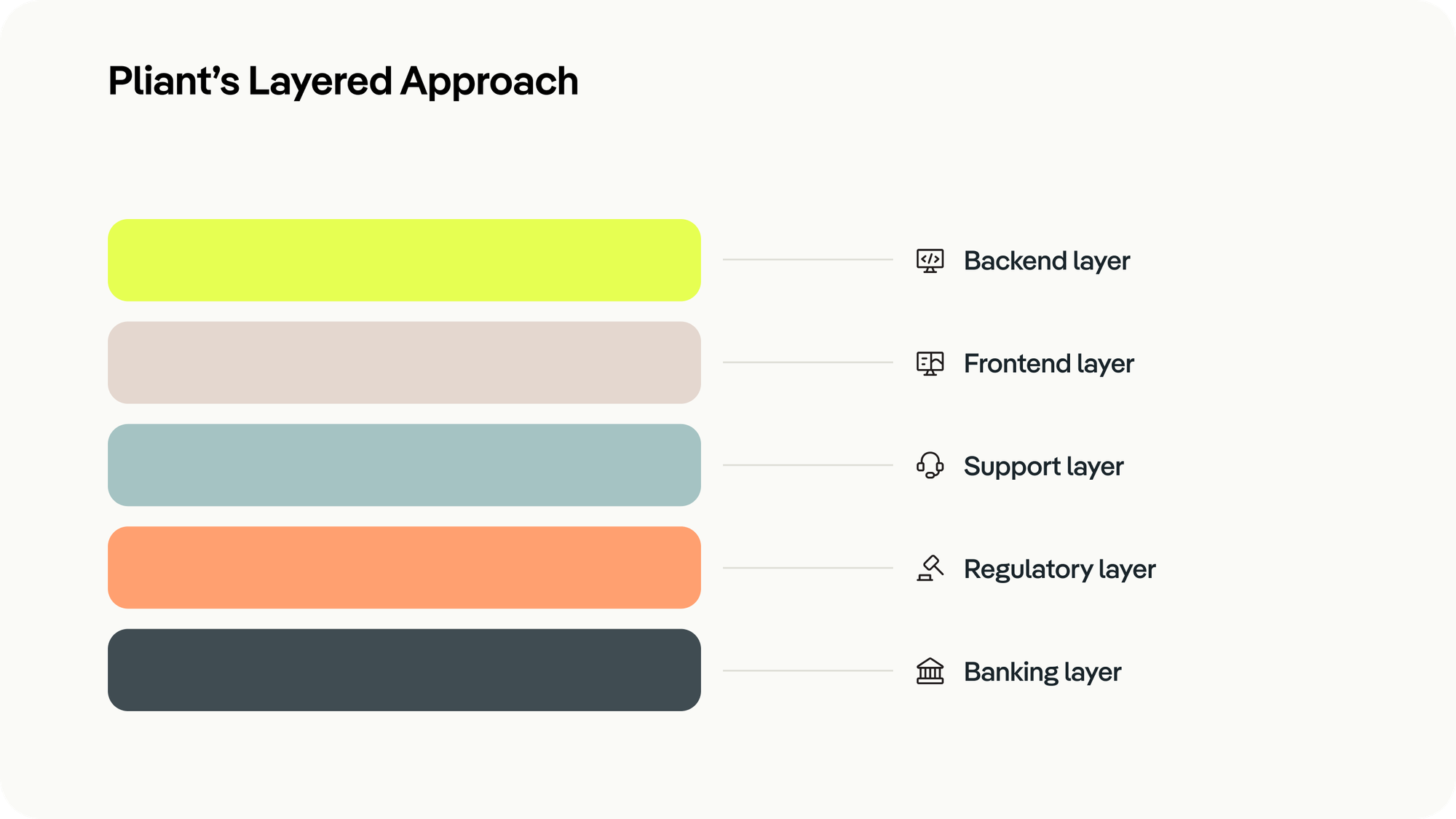

With the backend layer, you’ll gain API access to the operational processes that power your credit card program. This layer involves integrating Pliant's robust backend systems with your existing infrastructure, ensuring seamless communication and data exchange.

Our frontend layer is dedicated to the user-facing aspects of your credit card program. This includes designing and customizing the frontend interface to align with your brand identity and user experience goals.

At the support layer, you gain access to Pliant's dedicated team throughout the setup and operation of your card program. Likewise, because of the experience with our direct product, our team can act as a reliable resource for your clients, offering expertise and assistance every step of the way.

With the regulatory and banking layers, we’ll ensure that your card program complies with the relevant legal requirements in your region while ensuring that the financial processes behind your card program – such as authorization, authentication, and settlement – function flawlessly.

From strategic planning to technical execution, Pliant CaaS is a solution that can deliver exceptional results for both white label credit card and embedded solutions.

Embedded vs. White Label: Which is Right for Me?

Businesses are all unique, and the right choice between a white labeled or fully embedded credit card program will depend on the specifics of your company as well as your personal preferences. However, there are key factors to consider when deciding between embedded and white label credit card programs.

To help you with your choice, we’ve gone into more detail on the questions you should be asking when you consider the specifics of your new credit card program.

1. Speed or Complexity?

Whichever model you choose, you should be aware that creating a card program takes time and isn’t a decision you should take lightly. However, while you may sacrifice some degree of customization and control, white label credit card programs can be a faster and more straightforward solution for businesses looking to enter the market quickly, as far less development effort is required.

If you want to embed a credit card program, you’ll typically require more time and resources to develop and integrate card management technology into your existing systems, even with API recipes that greatly simplify the process. You will either need to use your existing development resources, or hire contract developers for the duration of your project, as well as keeping an eye on maintenance as time goes on.

As such, you should consider whether you prioritize speed to market or the ability to tailor the credit card experience to your exact specifications when making your decision between an embedded or white label program.

Or… Try Both?

With Pliant’s layered CaaS approach, you can start thinking about launching your card program without needing to make a permanent choice between white label and embedded. From a white label MVP, we can extend our partnership with deeper integration into your product. Talk to a Pliant CaaS expert to learn more about your options.

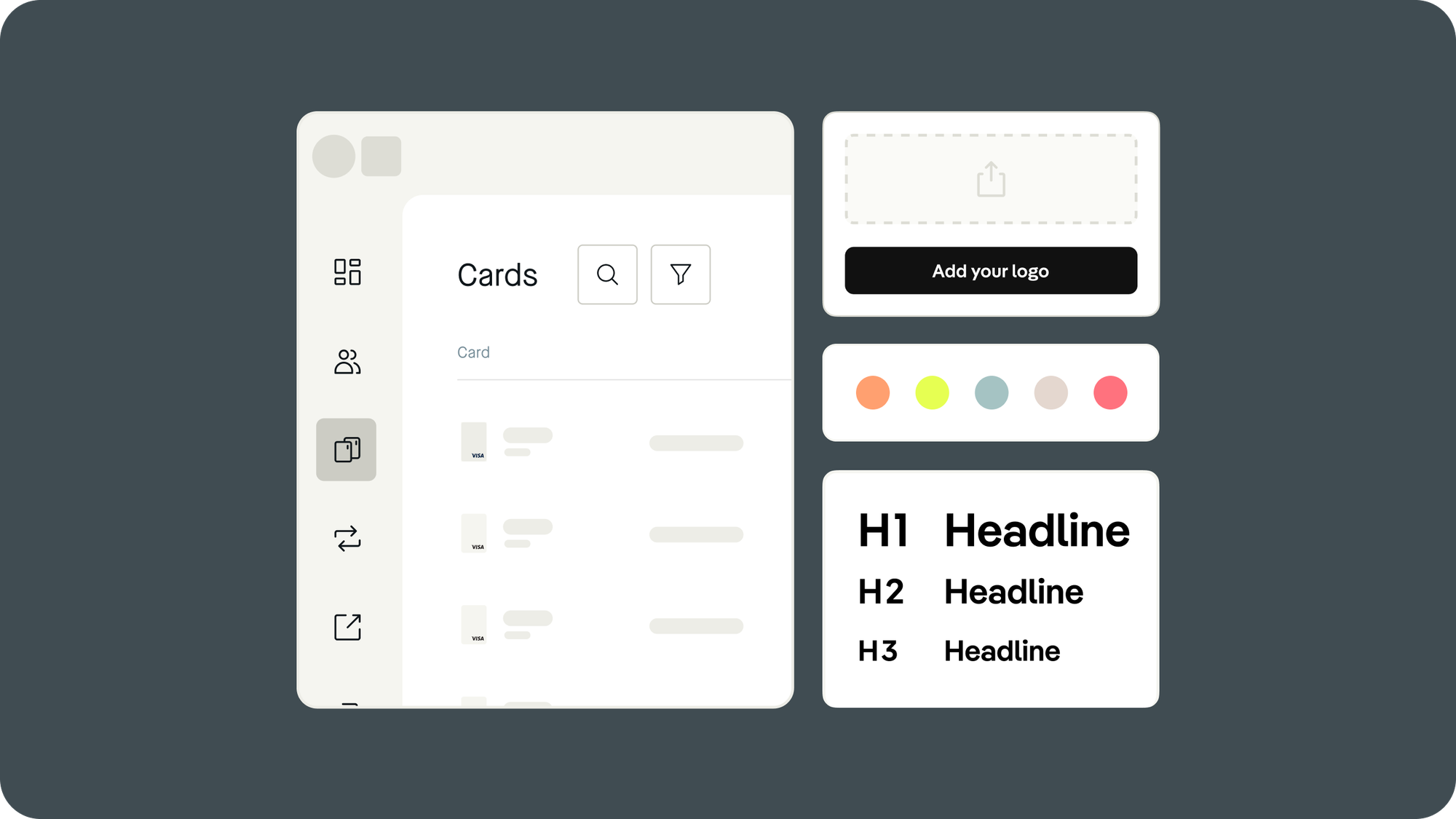

2. Customization

Embedded payment solutions offer a higher level of customization compared to white label credit card programs. With an embedded solution, you have the flexibility to tailor every aspect of the credit card experience to align with your brand identity and meet the specific needs of your customers. This includes designing the user interface, implementing unique features, and integrating seamlessly with your existing systems and processes.

On the other hand, white label credit card programs provide limited customization options, as they are built on the pre-existing infrastructure of a third-party financial institution. Potentially, you’ll also have some customization such as the branding of the user interface or the design of the cards themselves. If you choose Pliant as your cards-as-a-service partner, we’ll work with you to adapt our platform to your business as seamlessly as possible.

Consider the importance of customization in achieving your business objectives and meeting the expectations of your target audience. If offering a highly tailored credit card experience is crucial for your brand differentiation and customer satisfaction, an embedded program may be the preferred choice. However, if you prioritize speed and cost-efficiency over extensive customization, a white labeled program could be more suitable for your needs.

3. Integration with Your Product

When deciding between embedded and white labeled credit card programs, consider how seamlessly the chosen option needs to integrate with your existing products or services. Essentially, the question of whether you need an integrated solution or a white label credit card comes down to whether your financial services will become a product in their own right, or part of your core offering.

Embedded credit card programs allow for deeper integration with your product ecosystem. You can tightly integrate the credit card functionality into your existing platforms or applications, providing a cohesive user experience for your customers. For example, Pliant partner Circula issues its own credit cards as part of expense management processes. Payments are automatically integrated with approval flows or special features around company travel policies.

On the other hand, white label credit card programs will not integrate as seamlessly. While you can still incorporate the credit card offering into your product portfolio, the integration may involve redirecting users to a separate platform or application managed by the card provider.

Learn how Pliant partners Mobilexpense, Klippa and Candis have integrated Cards-as-a-Service into their various product offerings.

If integration is crucial for enhancing user engagement and simplifying the customer journey, an embedded credit card program may be the preferred choice. However, if you prioritize speed and simplicity in launching the credit card offering, a white labeled program could still provide value despite potentially less seamless integration.

Making the Leap? Talk to a Cards-as-a-Service Expert

Finding the right credit card partner is the first big step toward launching your card program – whichever model you choose. Look for a partner with expertise in credit card topics, including card design, issuance, and transaction processing – as well as solid expertise in both white label credit cards and embedded payment solutions.

With Pliant, you have a partner that is not only an industry expert in Cards-as-a-Service, credit cards, and embedded finance, you get a team with a track record of helping companies and their customers launch successful credit card programs.

Ready to explore? Read our CaaS case studies or get in contact with your Pliant CaaS expert to launch your card program today.

White Labeling vs. Embedded: FAQs

A white label credit card is a generic card product offered by a third-party provider that businesses can brand with their logo and design. It allows companies to offer financial services without developing their own infrastructure.

The difference lies in integration depth. White label solutions involve branding pre-existing products, while embedded solutions integrate financial services seamlessly into the company's platform, offering greater customization and control.

Embedded finance suits businesses seeking a tailored user experience and greater control over financial products. It's ideal for companies looking to enhance customer engagement and differentiate their offerings through integrated financial servicesric