What Is Embedded Finance? And How Could It Benefit Your Business?

As TechCrunch so aptly put it, embedded finance is having a moment: banking, payments, and more are being continually integrated into the apps and platforms you already use. You’d be forgiven for thinking that controlling the means of payment would be a goldmine because, well… it is. In fact, more companies than ever are aiming to blur the lines between product and payment, and if you’ve found this post, yours might be among them.

So, where to begin? For businesses eyeing the leap to fintech, understanding the basics of embedded finance is crucial. That’s why we’ve put together this beginner's guide – a sort of Embedded Finance 101 – to help you grasp what the topic is all about and explore how your company can tap into its potential. We’ll cover:

What is embedded finance?

Embedded finance: statistics and facts

What types of embedded finance are there?

Embedded finance examples

Where next for embedded finance?

Pliant: Your Embedded Finance Partner

Making your first moves in the world of embedded finance is a big step for any company, and you’ll need plenty of expert advice, from a partner you can trust, along the way. The Pliant Cards-as-a-Service team partners in different industries, helping them integrate card programs into their products with expert business, regulatory, and technical support. We’re embedded finance experts, and we’re here to share our knowledge with you.

In our blog series on embedded finance and Cards-as-a-Service, we address the challenges faced by companies just like yours: navigating regulatory frameworks and leveraging technology to maximize benefits such as increased revenue and customer loyalty. Let's empower your business together. Connect with a Pliant expert for a demo today.

What is Embedded Finance?

However, today we understand embedded finance in a slightly more specific context – and that’s because of technology. The "embedded" part – i.e. the platform that will provide the “face” of the financial product – is often a tech product like your rideshare app, travel app, or invoice management platform. The “finance” aspect simply defines what type of financial service will be offered, which we’ll cover below.

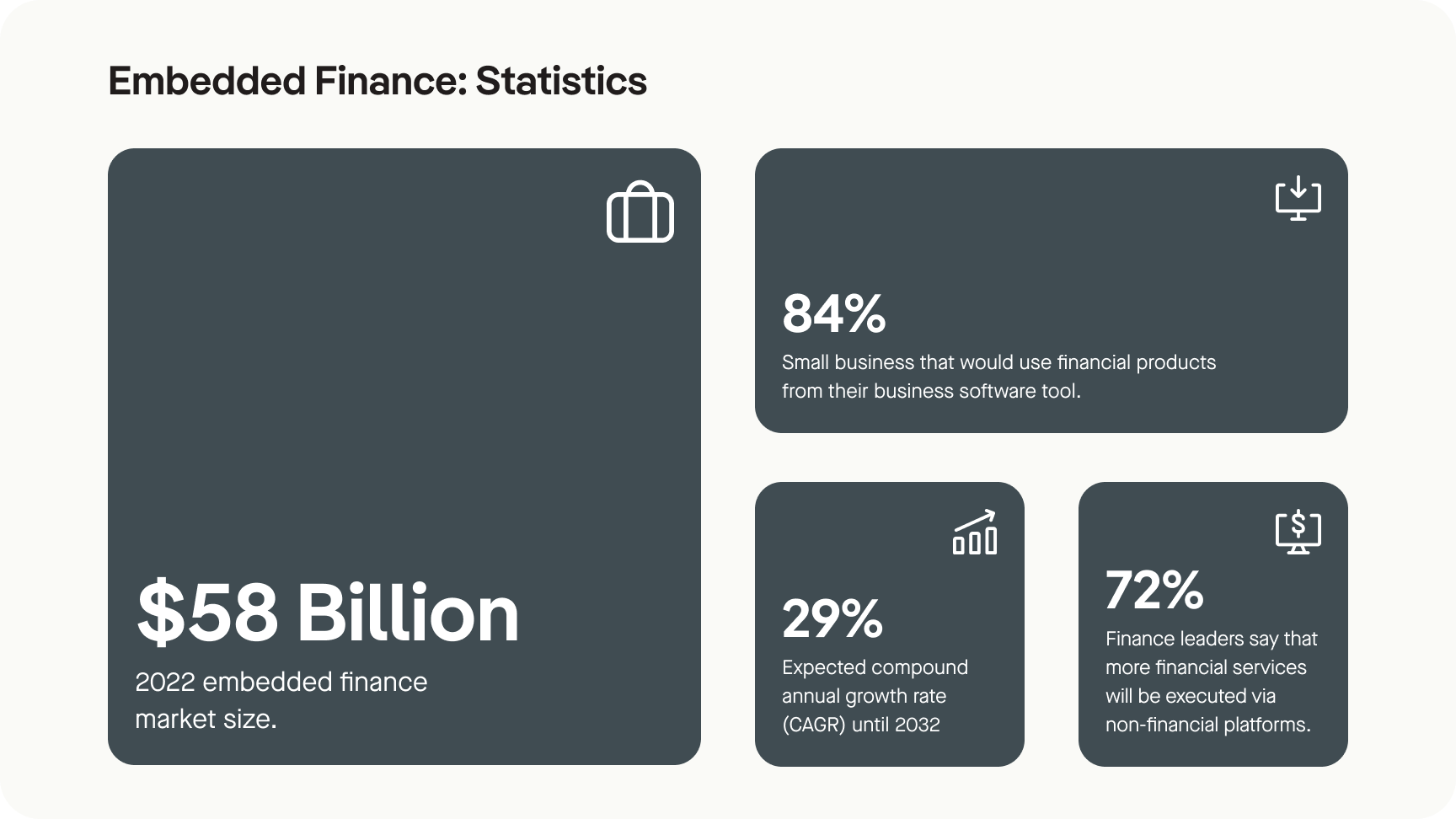

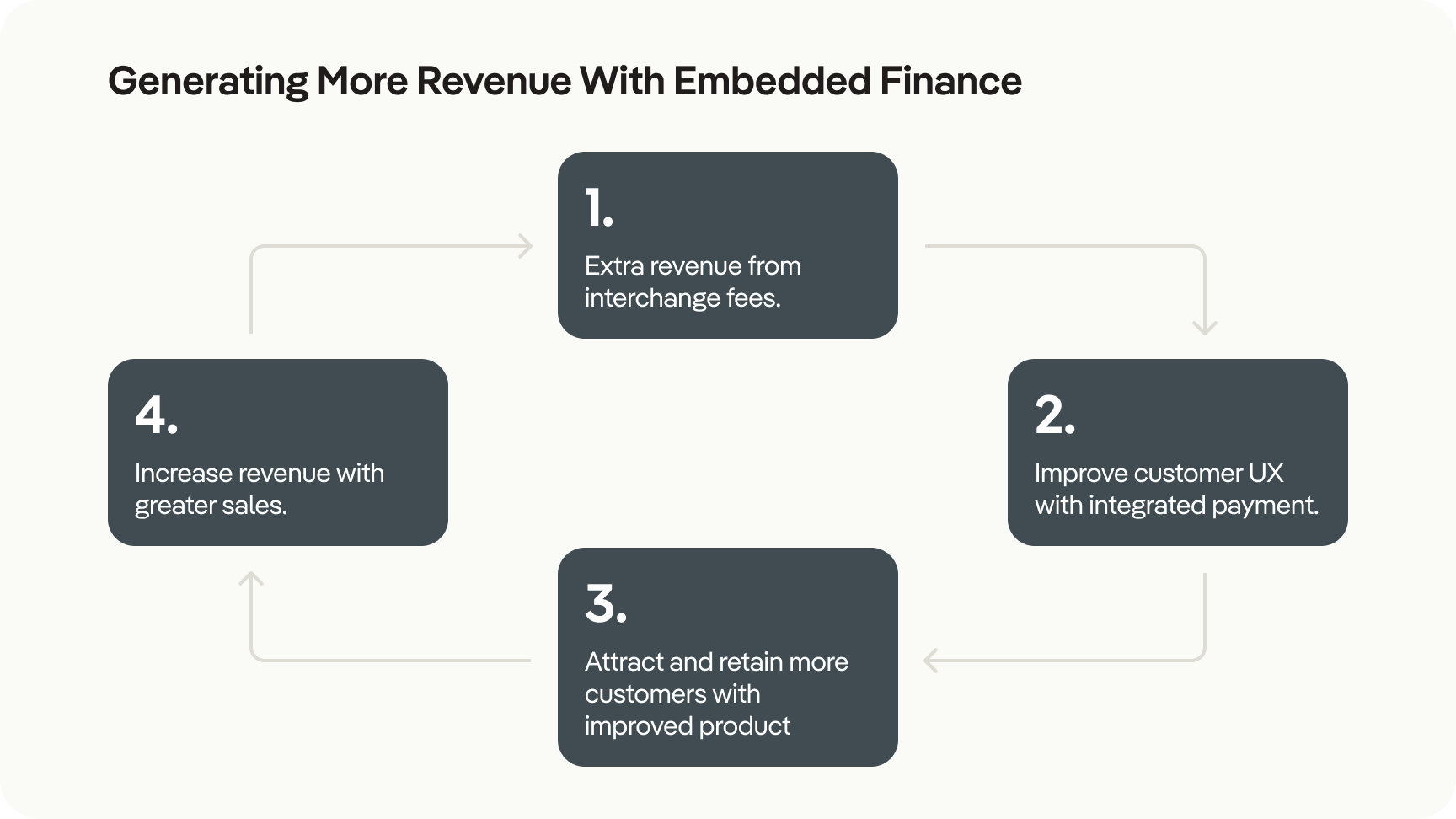

Ultimately, embedded finance aims to provide access to financial services by making them more accessible, convenient, and tailored to the specific needs of consumers. In providing this access, companies can increase revenue, build loyalty, and improve user experience. Here are just a few statistics that illustrate the power of embedded finance and its increasingly central role in B2B and B2C business models:

According to Global Market Insights, the embedded finance market was valued at $58 billion in 2022 and is estimated to register a compound annual growth rate (CAGR) of over 29% until 2032

In an EY study, 72% of global finance leaders thought that a majority of financial services would soon be executed via non-financial platforms.

In a study conducted by Unit, 84% of small businesses said they would explore financial products from their business software tool, if they were offered.

Read our step-by-step guide to starting your own credit card program on our blog.

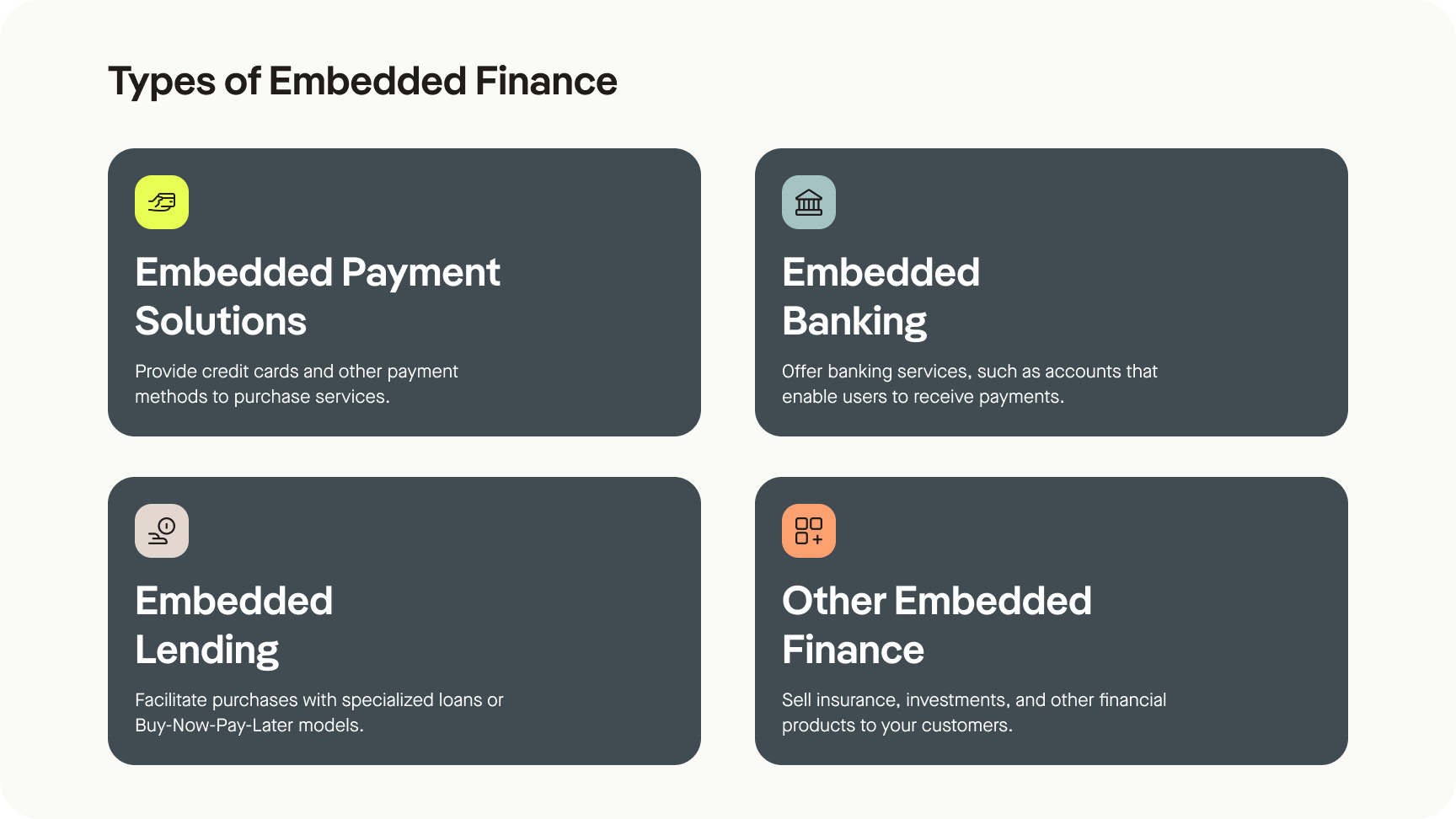

What Types of Embedded Finance Are There?

Embedded Payment Solutions

Companies generate revenue by selling goods and services – and they need to choose a way in which they receive payment for these. Traditionally, this costs a merchant money in the form of bank transaction fees or credit card (interchange) charges. Sometimes merchants pass this percentage onto their customers, sometimes they don’t.

However, embedded payment solutions, provided by financial service companies like Pliant, enable merchants to take on the role of the payment provider. In other words, the money (or part of it) that would otherwise be forwarded to the payment provider stays with them. Popular embedded payment solutions include co-branded (or white-labeled) credit card solutions, but “pre-funded” payment cards are often used too.

By “cutting out the middleman,” some of the biggest companies in the world are increasing their margins. For example, according to its IPO filings, Uber paid $749 million in credit card processing fees in 2017 roughly 2.2% of turnover. By transitioning to an embedded finance model, for example with its prepaid cards and Uber Visa Card, Uber can redirect that turnover back into the company instead.

What is Cards-as-a-Service?

Cards-as-a-Service (CaaS) is a type of embedded finance product that enables non-financial companies to issue virtual and physical credit cards to their customers. This can be used to create “all-in-one” products that handle business expenses end-to-end, or alternatively to provide a trusted payment method from a reliable source.

CaaS providers like Pliant handle the “nuts and bolts” of the card program, taking responsibility for card issuance, management, and associated services, catering to all kinds of business needs.

Embedded Banking

According to Unit, Embedded banking enables tech companies to make financial products (e.g., high-yield accounts, credit cards) available within their apps and websites. It’s a reasonably broad area of operations that enables many different use cases. Theoretically, embedded payments are a type of embedded banking, but it makes sense to consider the two separately.

That’s because, in its most common definition, embedded banking differs from embedded payments in that it enables end customers to get paid as well as to make payments. As such, it’s a particularly popular embedded finance product for services such as ride-share apps, freelancer platforms, and much more besides.

For example, Housecall Pro enables service professionals to receive payment via credit card for their services. This is extremely convenient for your plumber or builder – who can use further services to automate receipts and the like, but also enables Housecall Pro to monetize their services. From their terms and conditions, they’ll charge a builder, plumber, maid, or gardener:

2.59% for when the card is swiped, tapped, or chipped with our card reader

2.99% if the card is entered online by the customer via an invoice emailed to them

3.49% when the card details are manually entered or scanned with the app or entered by your staff in the web portal.

At first glance, it doesn’t seem a lot. However, multiplied by thousands of users, it can turn into quite a lucrative business model.

Embedded Lending

Lendflow describes embedded lending as when lending is offered through non-financial services or products. It eliminates the need to rely on high-cost third parties, like a financial institution, within the lending process. In other words, it enables companies to offer payment plans to their customers, which then enables them to buy products and services from the companies in question.

The practice of lending people money so that they can buy from you specifically is a practice that is as old as the hills. From Americans offering lend-lease services to allies during WWII to dodgy double-glazing salesmen tricking the elderly on housing estates in Britain in the 80s, “Buy Now, Pay Later” is a concept that keeps the business world moving.

Popular BNPL providers like Klarna and Afterpay are independent of regular credit frameworks and enable users to split their payments into installments with ease. However, BNPL solutions are often embedded into the apps and websites of online shops, then branded with the shop’s name. Providers like ratepay claim that a white-labeled BNPL solution can provide a 54% higher conversion and thus secure more high-value sales for merchants.

Embedded Finance Examples

Now that we know some of the basic types of embedded finance models, let’s take a look at some examples of famous companies leveraging it. While companies have different motivations for integrating financial services into their products, many general principles are the same.

Amazon Store Card and Business Credit Card

Amazon is the largest e-commerce platform in the world: a company that has fundamentally changed the way that people and organizations buy everything. Given the platform’s vertical integration into streaming services, physical stores and web services, it’s hardly surprising that embedded finance is an increasingly potent part of their offering.

For B2C customers, the Amazon Store Card – an embedded finance product provided by Synchrony – is designed to give end customers more benefits when they pay with this particular card compared to any other payment method. Even without ancillary fees like late charges and interest rates, simply maintaining the card issuer part of the interchange fee makes this a huge source of revenue for the platform.

Amazon actually has a separate card program that works in a similar way for B2B customers. Amex provides the Amazon Business Credit Card, which is an embedded finance solution that specifically targets companies with a high Amazon Web Services (AWS) spend – as well as to convince businesses that don’t already use AWS to do so with attractive rebates on Amazon’s own services.

My Starbucks Loyalty App

It’s undoubtedly the strangest, but by many measures the most successful, embedded finance solution of them all. “My Starbucks” is an in-app mobile payment system that is an economy in its own right. In basic terms, the program rewards customers with points – or stars – that they can use to get gifts like a free coffee, cookie, or merchandise. When a customer spends $2 through the app via a linked Bank of America credit card, they gain one star, or if they spend $1 via prepaid app credit, they get two stars.

It’s a perfect example of embedded finance because of the seamless payment system that users experience within the app. This, in turn, drives purchases in Starbucks stores around the world. The question is…why reward prepaid customers more?

Well, according to a 2022 Bluetree Savings article, there is around US$1.6 billion of credit loaded to Starbucks cards globally at any one time. Roughly 10% of this is simply forgotten about, giving Starbucks $160 million of “free” money that is never claimed. This is in addition to end customers essentially lending Starbucks money for free via the prepaid service, which can be invested into the business – and it culminates in a simply epic amount of money every year, for not selling coffee.

In short, embedded finance is the triple pump caramel whipped cream on top of Starbucks’ flat white of retail sales. Not to everyone’s taste, but undoubtedly impressive.

Debit Card for Drivers from Lyft Direct

One of the biggest ride-sharing service providers, Lyft, launched a debit card that gives their drivers immediate access to payments after each ride – rather than having to wait for days or weeks for payout via other financial platforms. Uber does a similar thing with its debit card for drivers, which they market as having no minimum balances, overdraft charges, or monthly fees.

Naturally, neither Lyft nor Uber bother with any of the tricky banking parts of these operations. The Lyft program is an embedded banking product from Stride Bank, whereas Uber uses GoBank for their version.

Yet they do profit from it. Having the payment option embedded in the app is firstly very convenient for drivers, because it offers other benefits such as ATM access, identity theft protection, and more. However, the key to the system is it earns valuable revenue for Lyft: by giving drivers a card with targeted benefits for things like fuel (10% cashback for Elite drivers), they can ensure almost continual, daily usage and the turnover associated with it.

Is Embedded Finance Only for Big Companies?

Absolutely not. The reason that companies like Amazon, Starbucks, and Uber are the poster-children for the embedded finance boom are that they are extremely well known companies that make colossal sums of money from their embedded finance programs, including Cards-as-a-Service.

However, there is a possibility for many different types of companies to profit substantially from offering embedded financial services to their customers, particularly in the form of card programs.

Ready to learn from Pliant CaaS partners who are increasing their revenue with individually tailored, Cards-as-a-Service solutions? Read their success stories on our website.

Paying the Future: What’s Next for Embedded Finance?

As finance becomes more interconnected and digital payments become more commonplace, embedded finance is here to stay: a transformative force that’s shaping the future of business.

With the market poised for exponential growth, we can expect to see more companies embracing embedded finance and integrating financial services into their offerings in the near future.

The question is: how can your organization profit? Talk to a Pliant embedded finance expert today about launching your credit card program and take full advantage of the Cards-as-a-Service boom.

Embedded Finance FAQs

Embedded finance refers to the integration of financial services directly into non-financial platforms or experiences. It allows users to access banking, payments, and other financial services seamlessly within the same ecosystem they are already engaged with, without the need for separate applications or websites. This approach streamlines processes and enhances convenience for consumers and businesses alike.

The key benefits of embedded finance include opening new revenue streams for businesses, enhancing the overall user experience, fostering stronger brand loyalty, and increasing customer engagement and retention. By integrating financial services seamlessly into existing platforms, companies can offer added value and convenience to their customers while driving growth and innovation in their respective industries.

While any company can explore offering embedded finance services, certain factors may influence their ability to do so effectively. Companies must have the technological infrastructure and resources to integrate financial services seamlessly into their existing platforms, while a larger customer base will naturally result in a more effective embedded finance program.