Overcoming payment and receipt management hurdles for SaaS companies

Software-as-a-Service (SaaS) companies have revolutionized the way businesses operate by providing cost-effective and scalable software solutions. But as these companies continue to grow, it's critical for them to streamline financial processes such as receipt management and transaction tracking to ensure efficiency without compromising their data security.

In this article, we'll look at how SaaS companies can benefit from using virtual credit cards as a payment method.

SaaS in a nutshell

SaaS (software-as-a-service) companies deliver software applications and services to customers over the Internet.

Rather than selling traditional software products that must be installed and maintained on individual computers or servers, they offer their software as a subscription-based service.

This way, customers access and use the software applications through a web browser and typically pay a recurring fee for the duration of their subscription.

Common payment challenges faced by SaaS companies

Just like any other business, SaaS organizations face specific pain points when it comes to payment processing and receipt management.

Here are some examples:

Payment friction: Managing a high volume of payments from clients, partners, and suppliers can be extremely daunting for SaaS companies. On top of that, they often face complexities related to late payments, billing discrepancies, and payment reconciliation. This can lead to payment friction and potential cash flow disruptions.

Subscription invoice management: As mentioned above, they typically operate on a subscription-based model. This certainly adds complexity to billing and payment processes. Managing recurring billing cycles, pro-rated fees, upgrades, downgrades, and cancellations can become complicated, especially when dealing with a large customer base.

Multiple payments with a single credit card: They also deal with multiple payments that can become cumbersome to manage with a single card.

Reconciliation of expenses: For SaaS companies, tracking and reconciling expenses across multiple departments and teams can be complex.

Without an efficient way to manage receipts, finance departments may find it difficult to match expenses to the appropriate projects, departments, or budget categories, making it difficult to gain accurate insight into spending patterns.

The traditional approach of manually processing receipts creates a significant administrative burden.

Pliant's payment and invoice reconciliation solution for SaaS businesses

Instant virtual credit cards (VCCs) at the touch of a button

Our solution allows companies to create a separate virtual card for each type of expense or member in their organization at lightning speed.

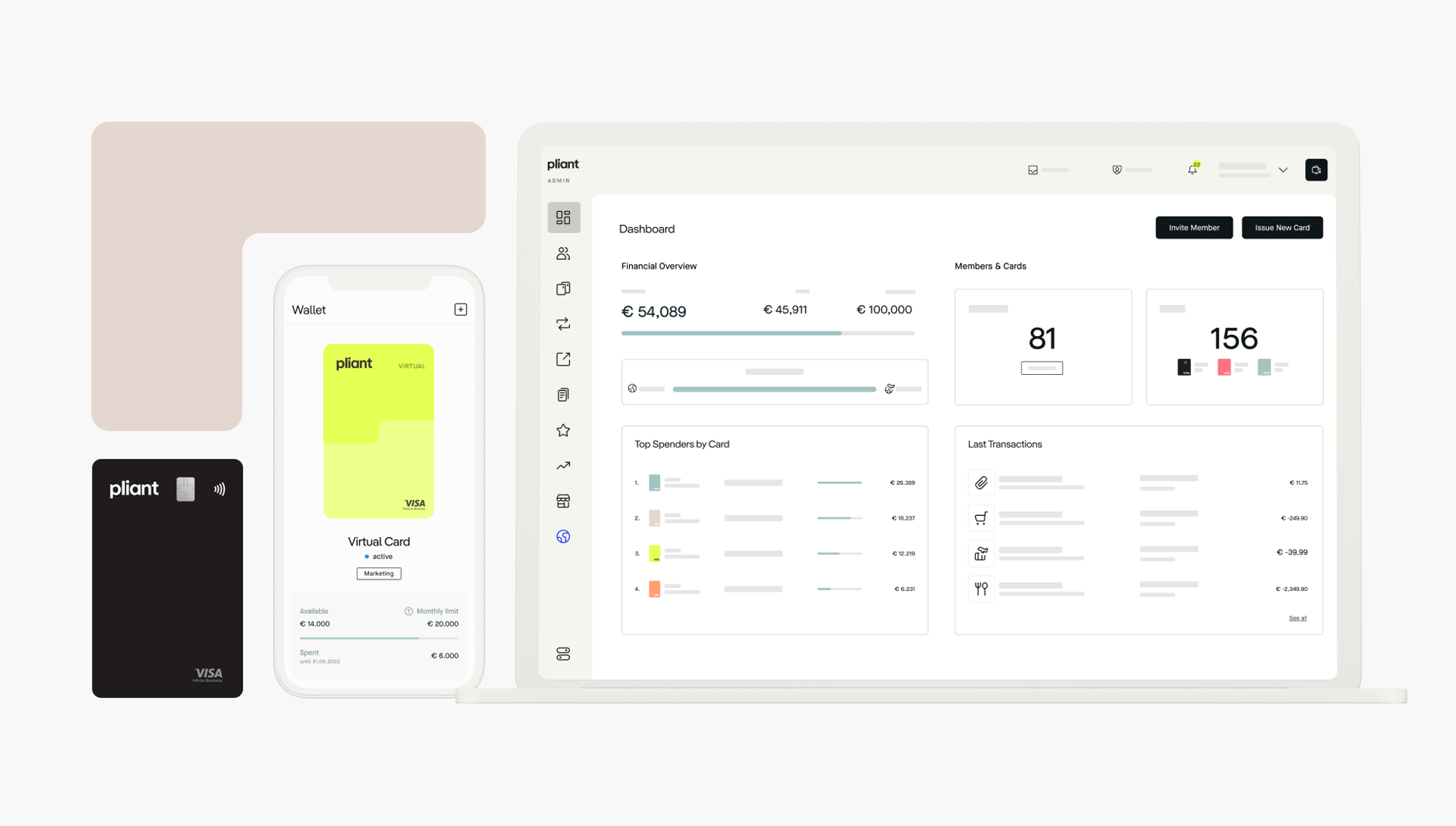

Cost centers: By linking virtual cards to different cost centers, SaaS companies can easily track and allocate expenses to the appropriate departments or projects.

This feature simplifies financial management and reporting for the finance department.

High velocity (high frequency) payments: SaaS companies often have high velocity or high frequency payments due to their subscription-based business models. Virtual cards provide a streamlined and efficient solution for these frequent payments, allowing them to automate the payment process for recurring subscriptions, software licenses or service fees.

Enhanced security: Security is paramount for SaaS companies, but restricting 2-factor authentication to the CEO can definitely create vulnerabilities.

Fortunately, Pliant's solution enables 2-factor authentication for each virtual card individually. Which means that, regardless of the user or employee initiating the payment, each transaction made with a virtual card requires additional authentication. Also, VCCs can be easily deactivated or modified, providing instant control in case of any unauthorized or suspicious activities.

Easy receipt reconciliation: Chasing receipts can be a time-consuming and frustrating task for the finance team! Luckily, Pliant's VCCs automate the receipt collection process by providing features that automatically capture and associate receipts with each transaction.

More information on this topic here.

Additionally, we offer integration options with finance and accounting software, allowing seamless transfer of transaction data.

How to get greater control over financial transactions?

Pliant’s virtual credit cards provide granular control by allowing companies to set spending limits and define the specific parameters for each card. This prevents overspending and ensures adherence to budgetary constraints.

Increased operational efficiency

Since SaaS companies often deal with a large volume of transactions, manual processing of transactions can be time-consuming and prone to errors.

Pliant's virtual credit cards streamline this process through payment automation and elimination of manual intervention.

Once the cards are set up, recurring payments can be scheduled, reducing administrative tasks and giving SaaS companies valuable time to focus on core business activities.

To sum up

In short, virtual credit cards offer enhanced security, improved expense tracking, increased operational efficiency and greater control over financial transactions, making them an invaluable tool for the SaaS industry.

Interested in learning more? Book a demo.