Circula

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

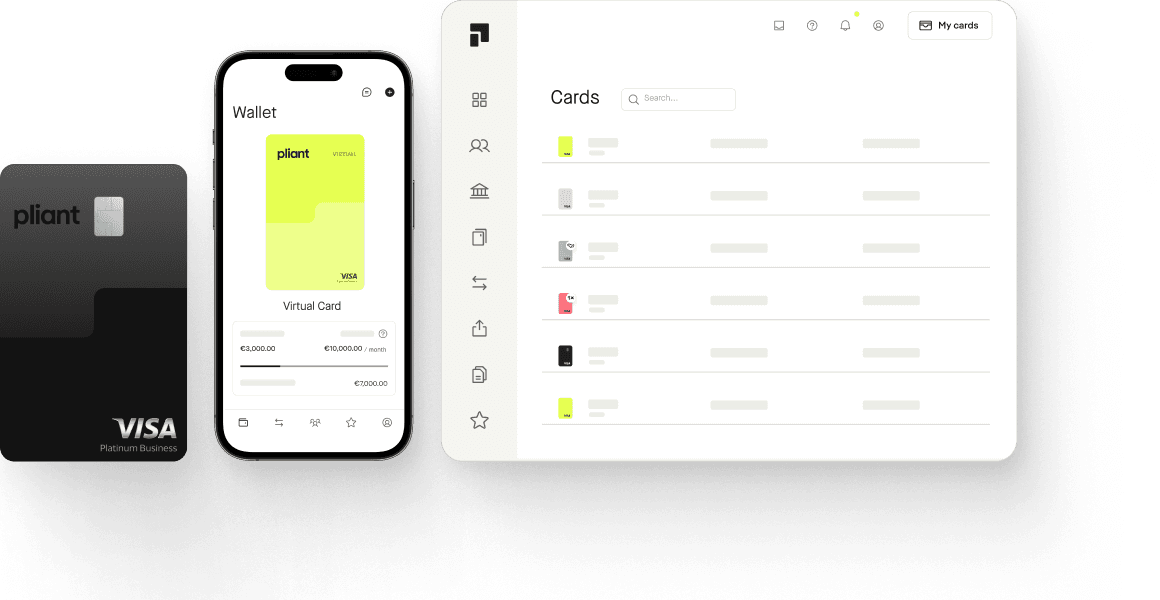

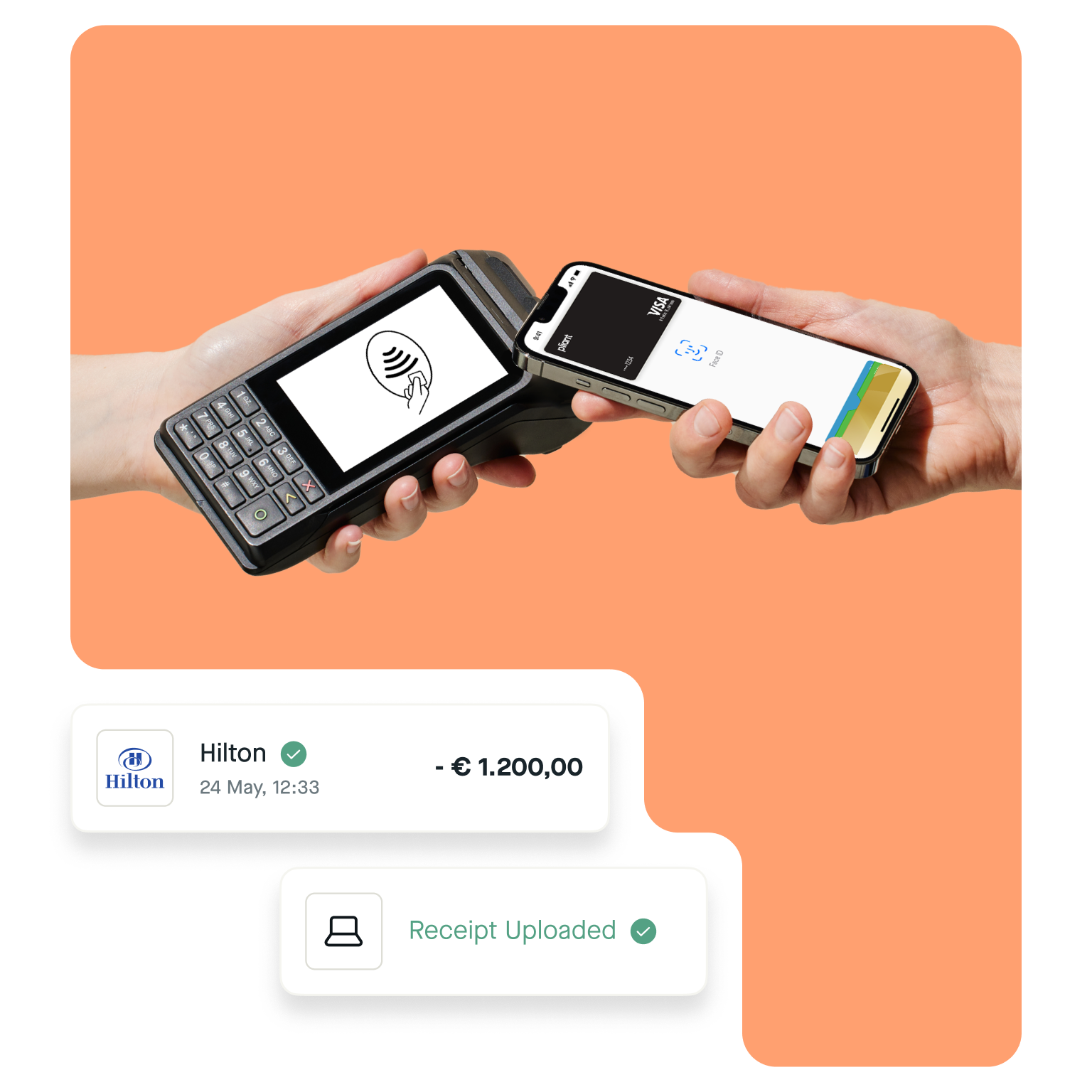

Optimize your finance stack with physical and virtual credit cards that adapt to your needs and maximize savings.

Save time when you manage all your cards and card settings from a single convenient app.

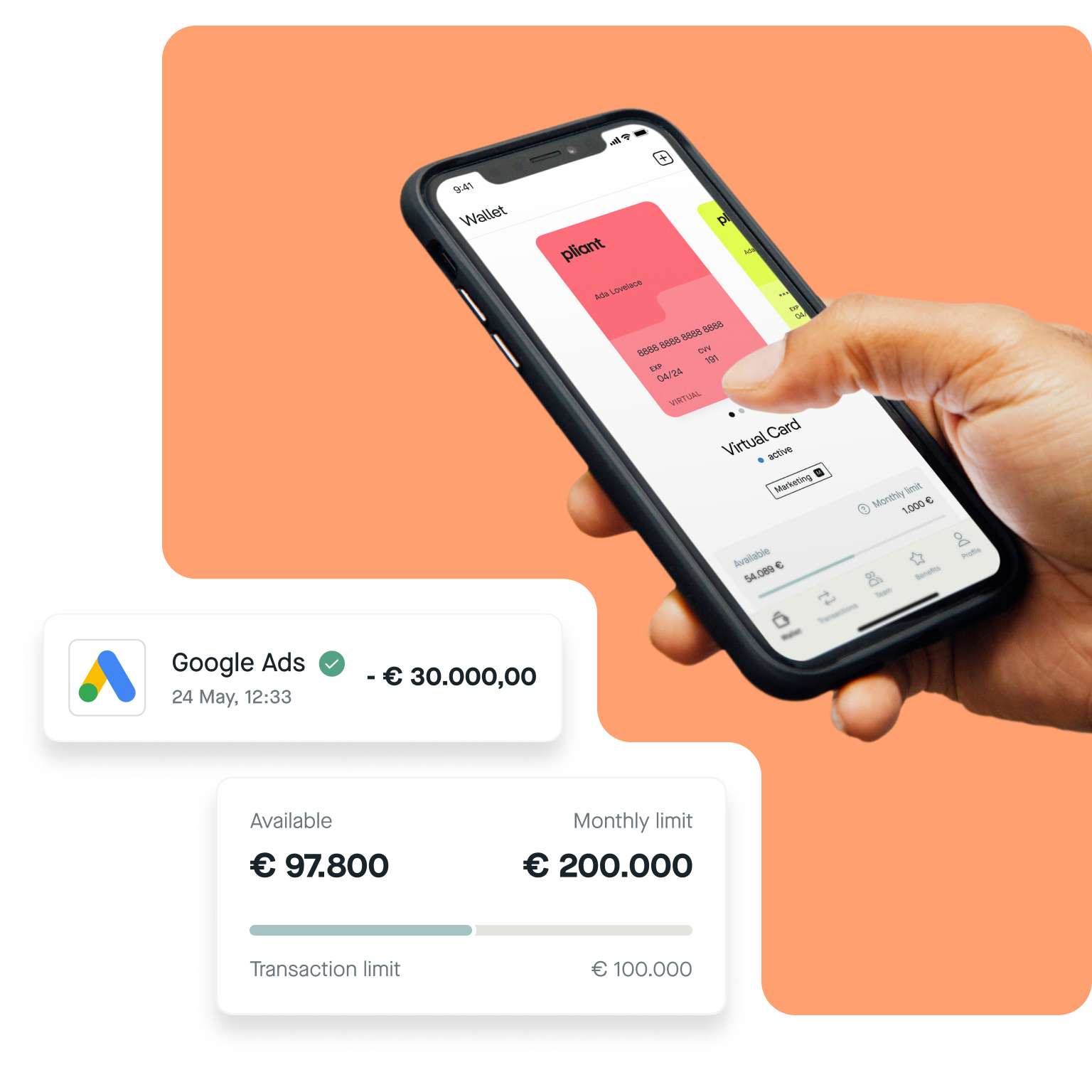

Get high credit limits to facilitate high transaction volumes with custom billing cycles to maximize your working capital.

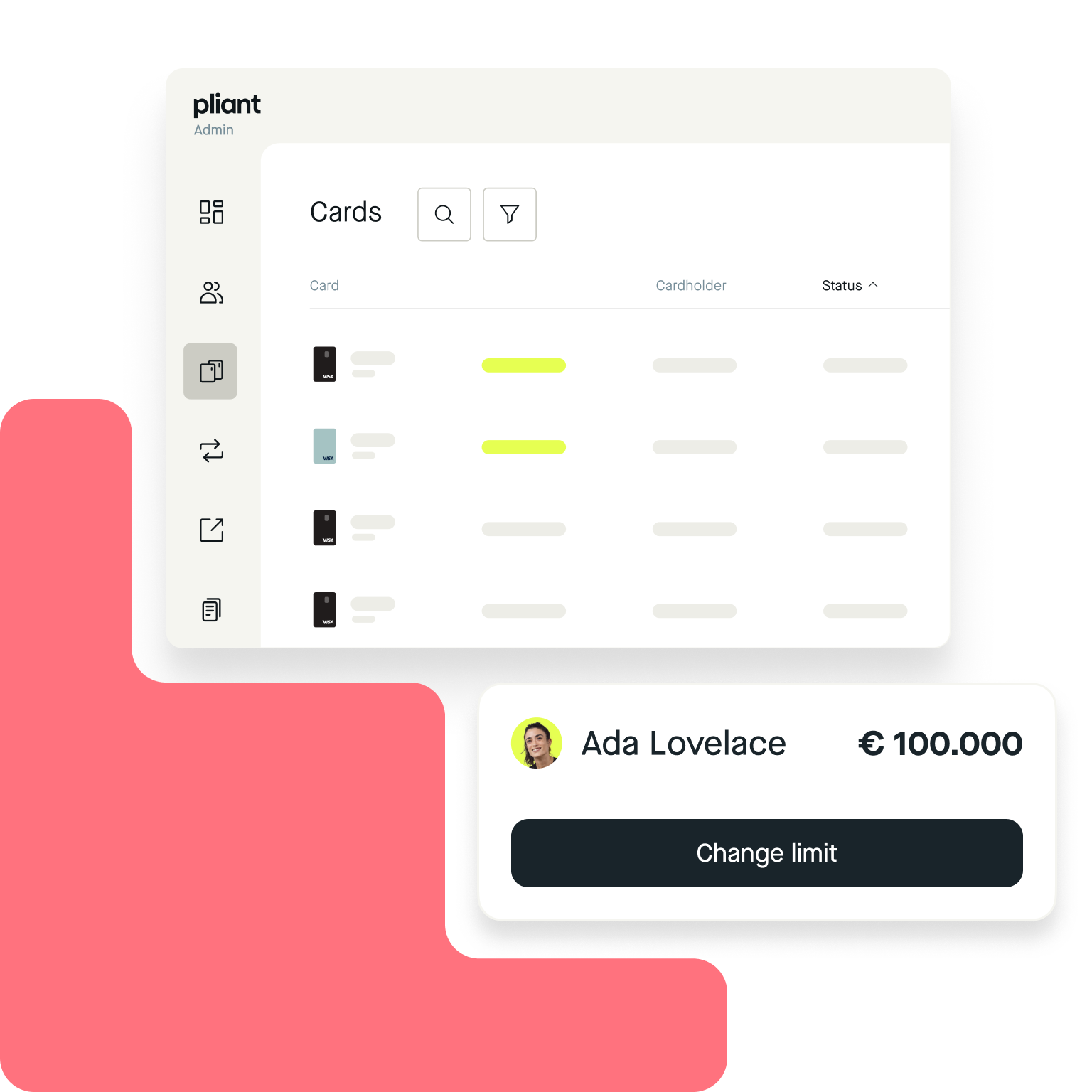

Issue virtual cards with custom card controls for complete spending control.

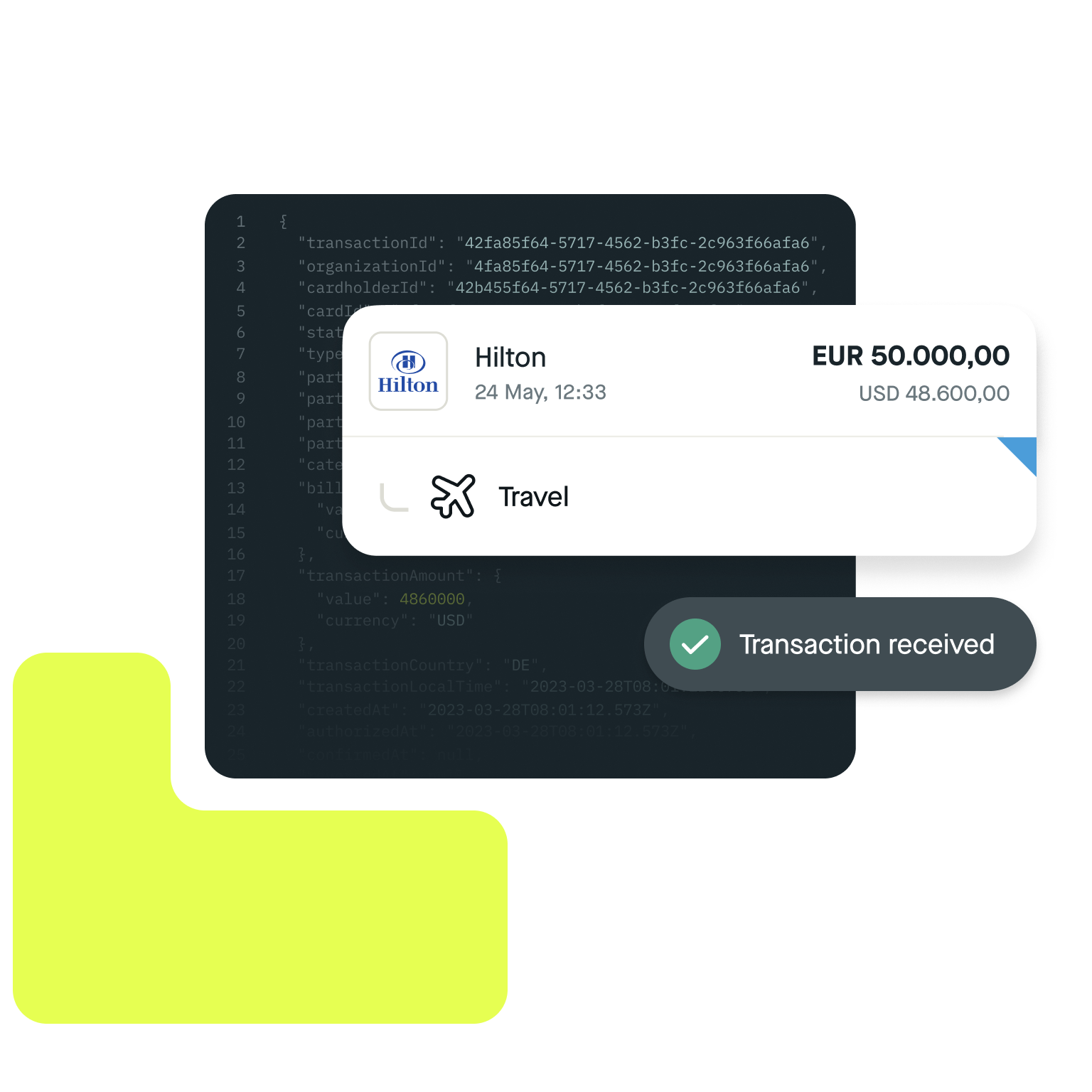

Use a virtual card designed specifically for the travel industry that can be used in fully automated processes.

Issue cards with custom references for fast and easy reconciliation. Automatically match transactions to travel bookings with our state-of-the-art API.

Start quickly with fast KYC and credit checks, and dedicated support from our tech team.

Get generous cashback for high card spending to maximize your margins.

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

“Several thousand euros in cashback are a significant advantage for BLINKED.”

Jean-Gabriel Baron, CFO of the Jaws Group

"Pliant delivers a more efficient solution than building our own."

John Lindström, COO of Bezala

“With Pliant Pro API, we automate 1000s of daily transactions.”

Fiorino Cellucci, CFO at Easy Market

“Only with CaaS was a complete integration quickly achievable.”

Alexander Kintzi, CRO Scopevisio AG

“Pliant Pro API is a key asset to our travel booking platforms.”

Diego Furlani, Founding Partner at Salabam SolutionsOur previous virtual credit card system had several shortcomings. After getting familiar with Pliant, we found that practically all of them were covered and solved.

With Pliant, we have been utilizing credit cards for all foreign currency transactions, whenever possible, in order to mitigate currency-related risks. Pliant is a flexible and user-friendly solution that enables me to issue new cards to our employees, significantly streamlining our operations.

When it comes to buying media, we benefit from cashback. We also use the cards for purchasing. We no longer have to go to a central person to order what we need. Instead, a virtual card is issued to each employee who regularly places orders. This makes us more agile and we are able to avoid cumbersome processes.

There has been an incredible amount of time savings since our implementation of Pliant. It used to take weeks to request new cards for my employees. Now it takes less than a minute to request and process.

What makes Pliant attractive is the cashback system. In addition, it is very easy to create cards and to block them again when it is necessary to do so. One of the recurring problems I have is unauthorized charges and not being able to track down where they are coming from. This is now a thing of the past as I now have the ability to cancel the card and the problem is solved!

With Pliant, you become your own digital bank and avoid processes that would take several weeks.

Pliant offers modern corporate credit cards. Our convenient and easy-to-use card management platform allows for flexible setting of card limits, real-time reporting and seamlessly integrates with your existing setup of accounting and travel expense management tools and processes. On top of that, Pliant offers competitive terms with attractive cashbacks and partner deals. Our Visa Infinite Business cards are equipped with useful features like tailored insurance packages and worldwide airport lounge access.

Registered corporations and private companies, associations and partnerships with good credit rating and high credit card spend.

Pliant offers Visa credit cards, both virtual and physical. Regarding physical cards, customers can choose between black credit cards (Visa Platinum Business) and metal cards (Visa Infinite Business credit cards). Pliant is neither a prepaid nor a debit card and, therefore, is bank account independent, offers maximum card acceptance, and does not need to be charged in advance.

Virtual cards work the same way as physical cards, only that no plastic version of the card is provided, with card data being only accessible via your Pliant app. Advantages of virtual cards include their instant availability. They also cannot be lost and are offered with a range of flexible usability options. Since they are offered at no extra cost, separate virtual cards can be issued for specific merchants or purchases with individual settings tailored to the specific use case. That way, if something is wrong with one card, there is no need to update card data across multiple merchants.

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.