Our previous virtual credit card system had several shortcomings. After getting familiar with Pliant, we found that practically all of them were covered and solved.

Why companies choose Pliant over Revolut

Pliant and Revolut offer modern business cards, but Pliant ensures you can scale your business. Create real credit cards on your own and be able to manage dozens of virtual and physical cards for each situation without losing control and flexibility.

A credit card solution that grows with you

Unlimited amount of real credit cards

Unlimited cashback up to 1% on every payment

Global acceptance and high limits to facilitate any purchase

Use with your existing corporate bank account

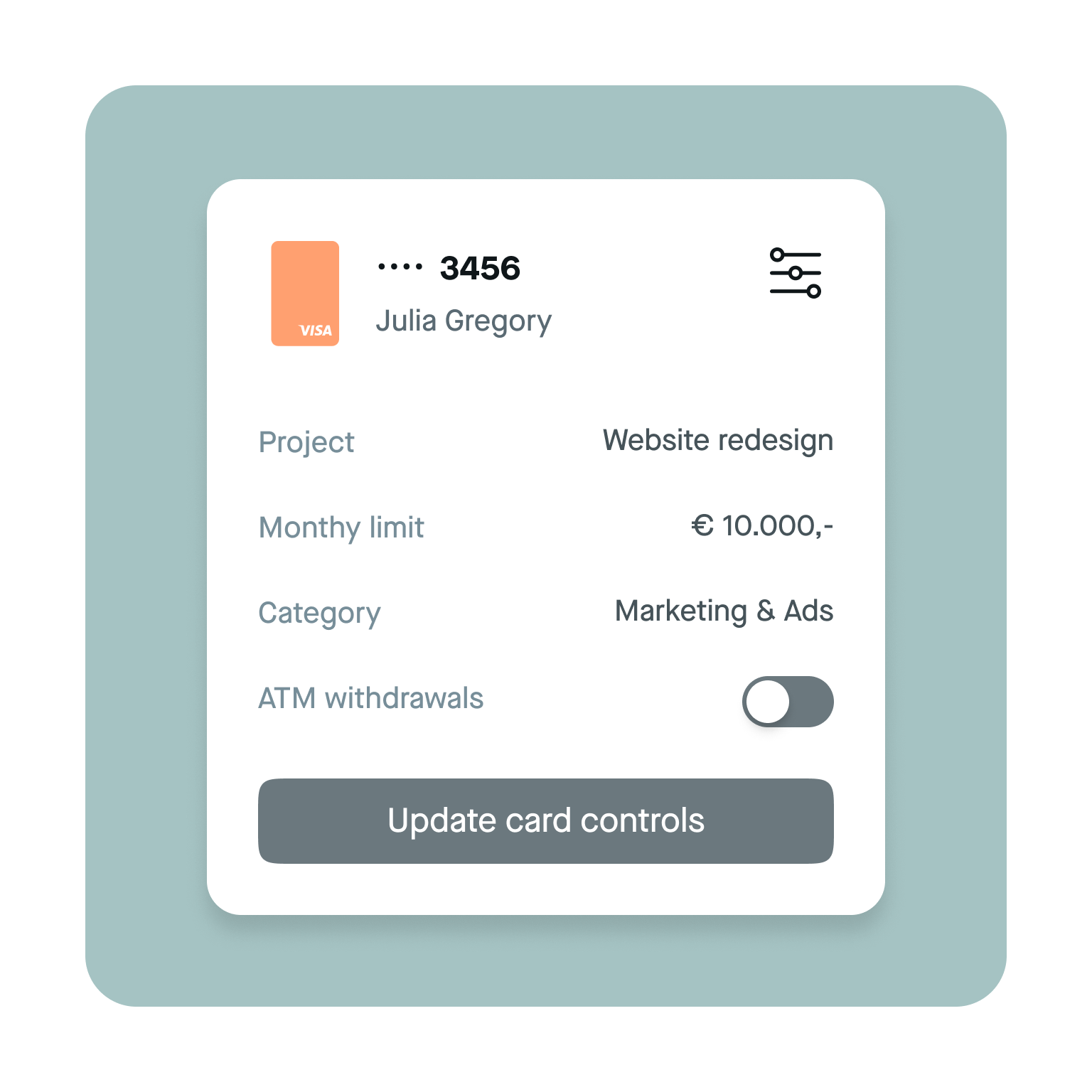

Card-level controls that go even further

Control even more card capabilities like permitted payment categories and choose whether cards can be used at ATMs, for foreign transactions, subscriptions and more.

API integrations that do the work for you

Push accounting records to your accounting system via trustworthy API integrations that ensure data accuracy and keep you updated.

Here’s why companies trust Pliant

With Pliant, we have been utilizing credit cards for all foreign currency transactions, whenever possible, in order to mitigate currency-related risks. Pliant is a flexible and user-friendly solution that enables me to issue new cards to our employees, significantly streamlining our operations.

When it comes to buying media, we benefit from cashback. We also use the cards for purchasing. We no longer have to go to a central person to order what we need. Instead, a virtual card is issued to each employee who regularly places orders. This makes us more agile and we are able to avoid cumbersome processes.

There has been an incredible amount of time savings since our implementation of Pliant. It used to take weeks to request new cards for my employees. Now it takes less than a minute to request and process.

What makes Pliant attractive is the cashback system. In addition, it is very easy to create cards and to block them again when it is necessary to do so. One of the recurring problems I have is unauthorized charges and not being able to track down where they are coming from. This is now a thing of the past as I now have the ability to cancel the card and the problem is solved!

With Pliant, you become your own digital bank and avoid processes that would take several weeks.

FAQs

The Revolut card is a prepaid debit card, Pliant offers a real credit card from Visa. Besides that, our platform smoothly integrates with your existing corporate account, so you won't need to open a new one, transfer funds, etc.

Yes. Unlike Revolut, Pliant offers full integration with Datev, Lexoffice and a number of other bookkeeping software.

Registered corporations, private companies, associations, and partnerships with good credit ratings and high credit card spending can become Pliant clients. Revolut supports Freelancers; Pliant does not.

Pliant offers Visa credit cards, both virtual and physical. Regarding physical cards, customers can choose between Blue (Visa Platinum Business) and Black (Visa Infinite Business credit cards). Pliant is neither a prepaid nor a debit card and, therefore, is bank account independent, offers maximum card acceptance, and does not need to be charged in advance.

Virtual cards work the same way as physical cards, only that no plastic version of the card is provided, with card data being only accessible via your Pliant app. Advantages of virtual cards include their instant availability. They also cannot be lost and are offered with a range of flexible usability options. Since they are offered at no extra cost, separate virtual cards can be issued for specific merchants or purchases with individual settings tailored to the specific use case. That way, if something is wrong with one card, there is no need to update card data across multiple merchants.

We’re here for you.

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.