Pliant and Bezala announce partnership that combines effortless credit card payments with equally effortless expense management

Pliant and Bezala bring end-to-end business payment management capabilities to companies in Finland to greatly simplify their ability to make payments and reconcile their expenses.

Pliant has become the first choice in business payments for over 2,000 companies across Europe as the best-in-class credit card solution, and Bezala is an innovative expense solution that’s well known in the Nordics and is also expanding across Europe. The partnership between the two allows companies to view all their Pliant card transactions in the Bezala app in real time and automate the reconciliation of receipts to those transactions.

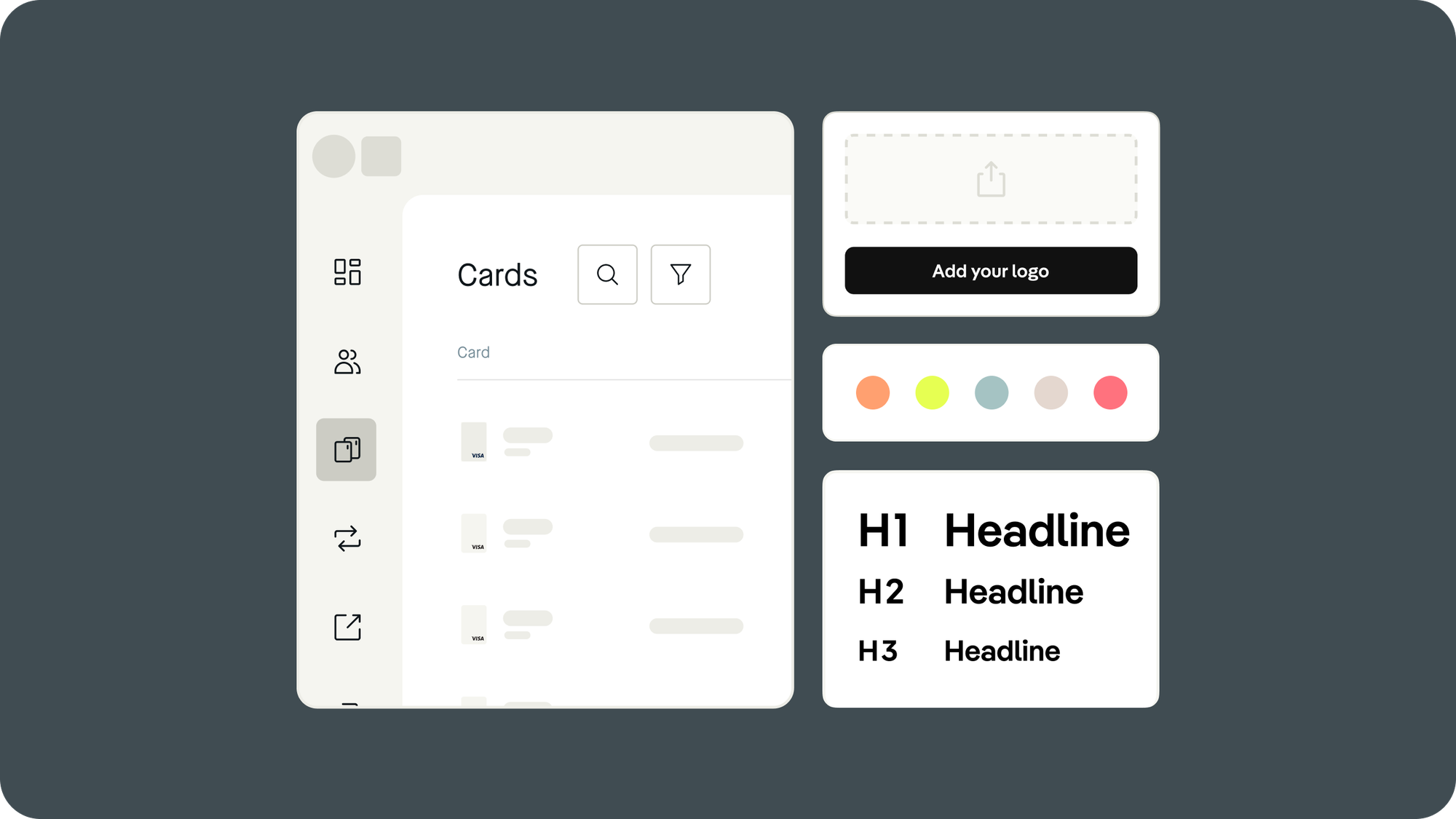

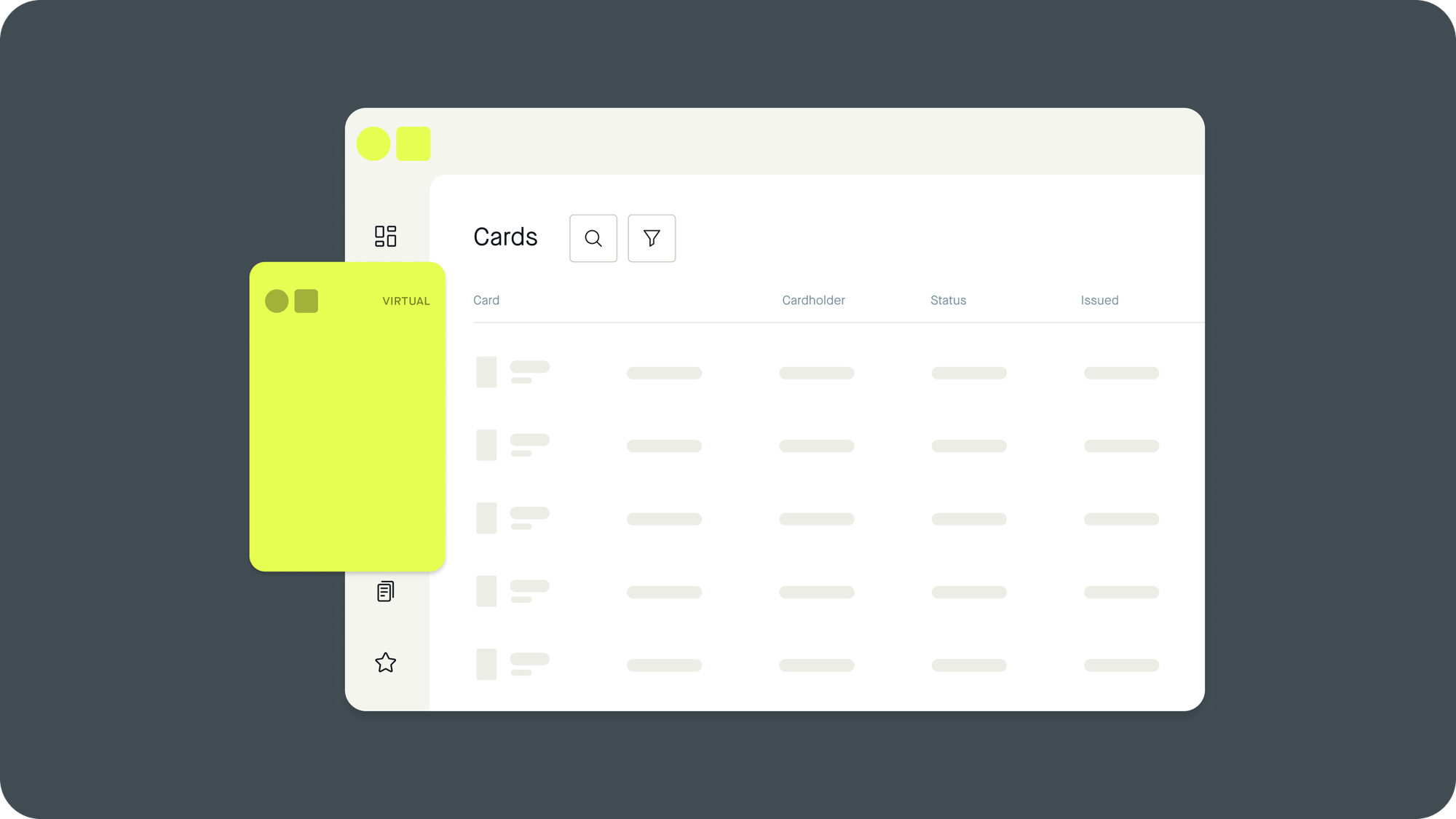

This addresses a common pain point in b2b payments across a variety of use cases. For business travel, employees can make purchases with their individually assigned Pliant card with trip-specific budget settings and view those transactions instantly on Bezala for seamless receipt reconciliation. Your finance team or card administrators can automate reminders for missing receipts to reduce the likelihood for receipts to get lost or to miss reconciliation deadlines. For digital marketing spending, employees can assign Pliant virtual cards to individual campaigns and automate the assignment of those campaign invoices in Bezala so you maintain complete oversight over spending and accounting at the same time.

"We are very excited about our new partnership with Bezala. Our digital credit card combined with their expense management offers businesses in Finland and beyond a fully integrated payment solution allowing for improved efficiency and scalability, allowing them to grow."

"The collaboration between Bezala and Pliant is strong evidence that the future of fintech lies in best-of-breed systems working together to deliver sophisticated solutions to customers. We’re confident that the combination of our tech platforms will empower businesses in Finland and beyond. "

"The credit card market is going through a period of change, and we are proud to be able to announce a partnership with an operator that has already gained great popularity in Central Europe. Pliant knows credit cards and payment, we know receipts, travel invoices and accounting, and together we can now automate the whole process."