Pliant now available in Italy and Ireland

Since the start of the Pliant journey in 2020, everyone at the company has been focused on making the most forward-thinking card payment platform that helps businesses grow. For over two years, we’ve been demonstrating that credit cards are a reliable and scalable payment method that benefits all kinds of businesses, especially those with high spending needs.

We’re excited to announce today that our full product offering in now available in Italy and Ireland, bringing the same high level of functionality and customer support that over 1,000 customers in Germany, Austria, Finland, the Netherlands, Portugal, and Luxembourg have already enjoyed.

If you run a business in Italy and Ireland, you can look forward to getting real credit cards with high limits in both physical and virtual card form without having to visit a bank location or opening a separate bank account.

Applying, onboarding, and issuing cards used to take weeks, but it’s now possible in minutes.

You can say goodbye to long waiting times, tedious paperwork, and all the cumulative annoyances of managing your company’s payments the old-fashioned way.

Our team will be with you at every step to ensure a smooth, safe, and highly productive experience.

As a Pliant customer, you’ll also benefit from generous cashback for high card spending, which is particularly useful if you spend thousands every month on recurring payments like online marketing and advertising.

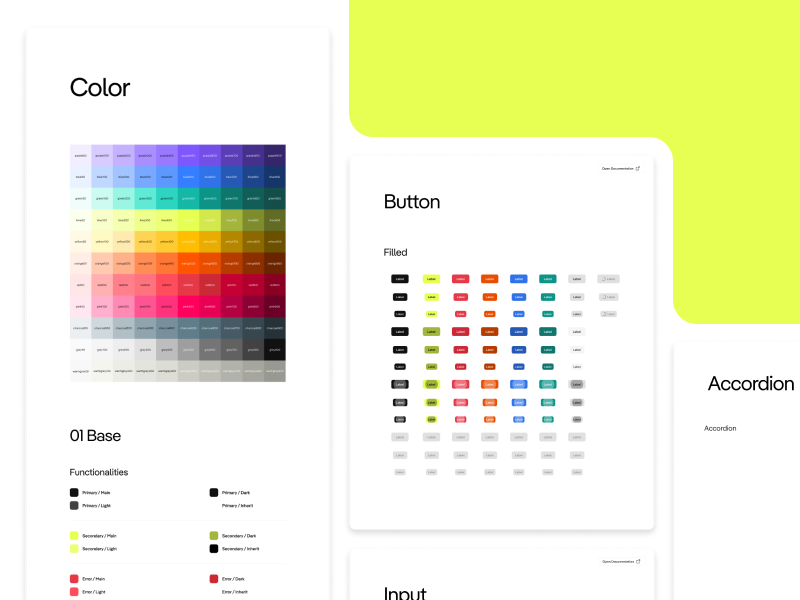

Pliant covers the entire payment process from managing individual cards to uploading receipts and simplifying accounting.

Company founders, team managers, finance managers, and business travelers have all found value in Pliant’s digital processes, which move much faster than traditional processes while maintaining the accuracy and safety everyone needs from their financial management tools.

Pliant operates at the intersection of business and emerging technology, which is why we offer API solutions that allow businesses to seamlessly integrate with their existing tools for accounting, invoicing, liquidity management, and more.

In fact, we already work with a long list of integration partners to cover all your needs without having to migrate to some other all-in-one platform.

If you’re interested in trying any of Pliant’s solutions or you just want to find out exactly how Pliant can benefit your business, schedule a meeting with us here.

We’re looking forward to speaking with you.