How can TMCs benefit from virtual credit cards?

Travel Management Companies (TMCs) are used by more and more companies today. In addition, there has been an increase in the adoption of digital payments across a wide range of industries.

With online transactions becoming a ubiquitous trend, many Travel Management Companies (TMCs) are looking into virtual credit cards to improve their operations.

For instance, they can streamline the payment experience between customers, airlines, and hotels. But that is just the tip of the iceberg.

Below, we examine how TMCs can benefit from using virtual credit cards in their business operations.

What is a Travel Management Company (TMC)?

TMCs are B2B companies that specialize in business travel management.

They're also known as corporate travel providers or business travel agencies.

Unlike regular travel agencies, TMCs provide ongoing services to clients. This means they can oversee travel arrangements for other companies over a period of time.

Instead of booking travel individually for employees, a brand can use a TMC to handle travel arrangements for a monthly fee. This can save brands time and money.

Here are some of the services TMCs provide:

Hotel and flight reservations

Car rental and parking

Transfers and shuttles

Currency exchange

Visa procurement

Travel insurance

Some TMCs also offer account and risk management services and management information system (MIS) reporting. It's also possible to integrate them with your expense management practices.

What is a Virtual Credit Card (a.k.a. VCCs or VCNs)?

It's only natural for travelers to optimize their business travel management needs. That's why they turn to TMCs.

And to provide simple, effective and secure payment, TMCs rely on virtual credit cards.

Also known as Virtual Card Numbers (VCNs), they are almost identical to physical cards.

The main difference is that virtual credit cards exist only in the digital space. Otherwise, users can enjoy the same benefits of a virtual credit card:

A 16-digit Primary Account Number (PAN)

A Card Verification Value (CVV) number

Billing address and cardholder name

They can be issued as debit, credit or prepaid cards.

The method of creation is another important advantage. Users can create VCCs manually or have them distributed through APIs to suit their needs.

As a result, the issuance process is much simpler, which can have a positive impact on your budget management.

How TMCs work with virtual credit cards

Let’s take a quick look at how TMC’s use virtual credit cards to solve their customers’ needs:

Control over transactions

Maximum security

Save time reconciling all expense transactions

As we mentioned above, each VCN has fixed funds, a valid PAN, and CVC.

Once the hotel charges the card, it confirms the transaction almost in real-time.

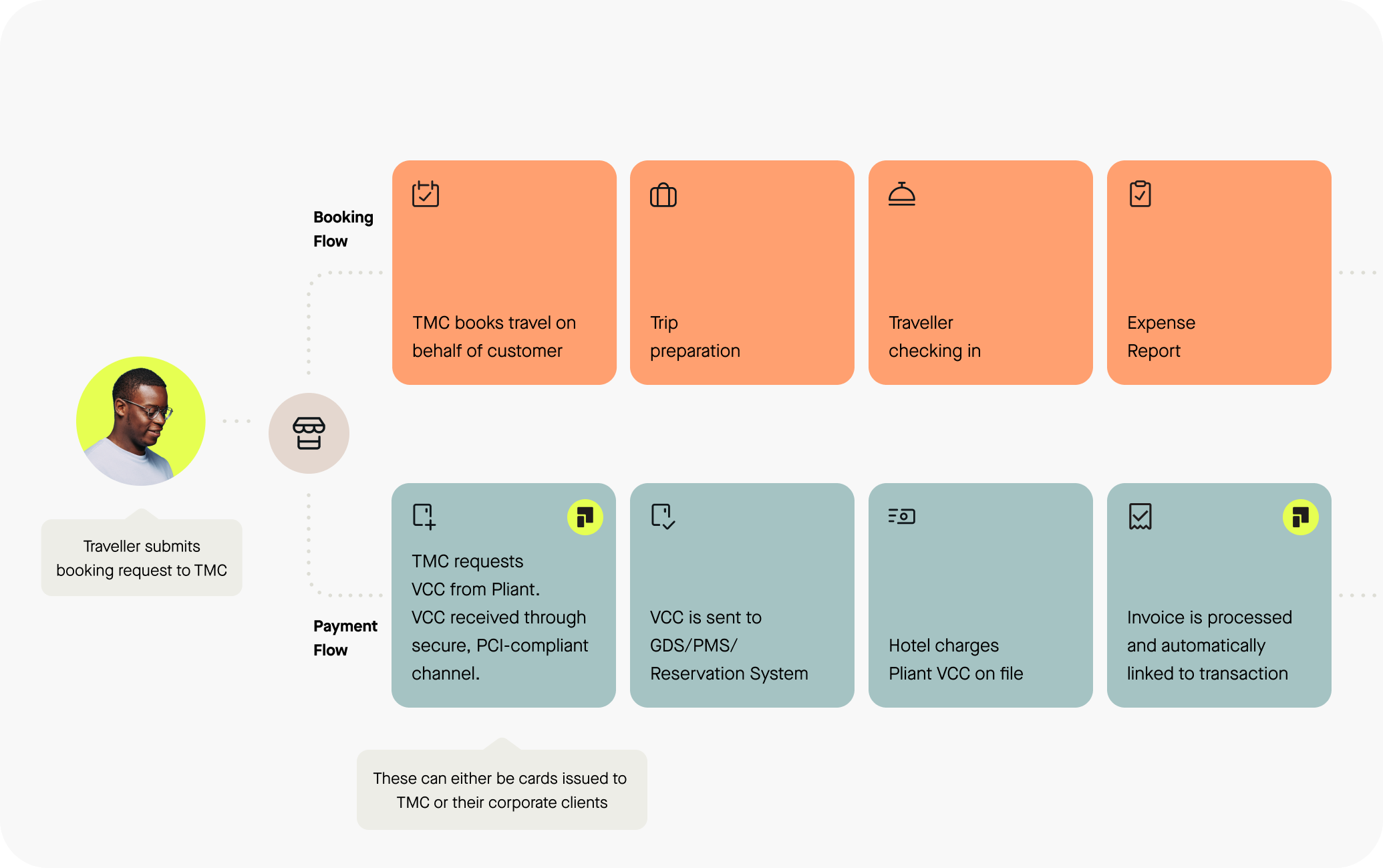

TMC booking process and payment flow: Hotel booking example

Booking flow

Traveler sends a booking request to TMC.

TMC books trip on behalf of customer.

The trip begins to process.

Traveler checks in.

Expense report is processed.

Payment flow

TMC requests VCC from a credit card provider.

VCC is received via a secure, PCI (Payment Card Industry)-compliant channel.

CVV is sent to the GDS (Global Distribution System)/ PMS (Property Management System)/ reservation system.

Hotel bills corporate credit card provider VCC on file.

Invoice is processed and automatically linked to transactions.

TMC booking process and payment flow: Hotel booking example Common challenges faced by customers in the Travel Industry:

Regular plastic credit cards tend to be used for all expenses.

Cumbersome issuing and management of credit cards.

Risk of fraudulent usage and missing spend controls

Time-consuming payment processes without the option for automation due to 3Ds challenges.

Limited acceptance by some merchants

Tedious reconciliation leads to errors and high workload for accounting teams.

Manual review of card statement for changes and refunds.

High fees for international transactions.

Not sufficient credit lines.

Pliant solution for the Travel Industry:

Quick onboarding

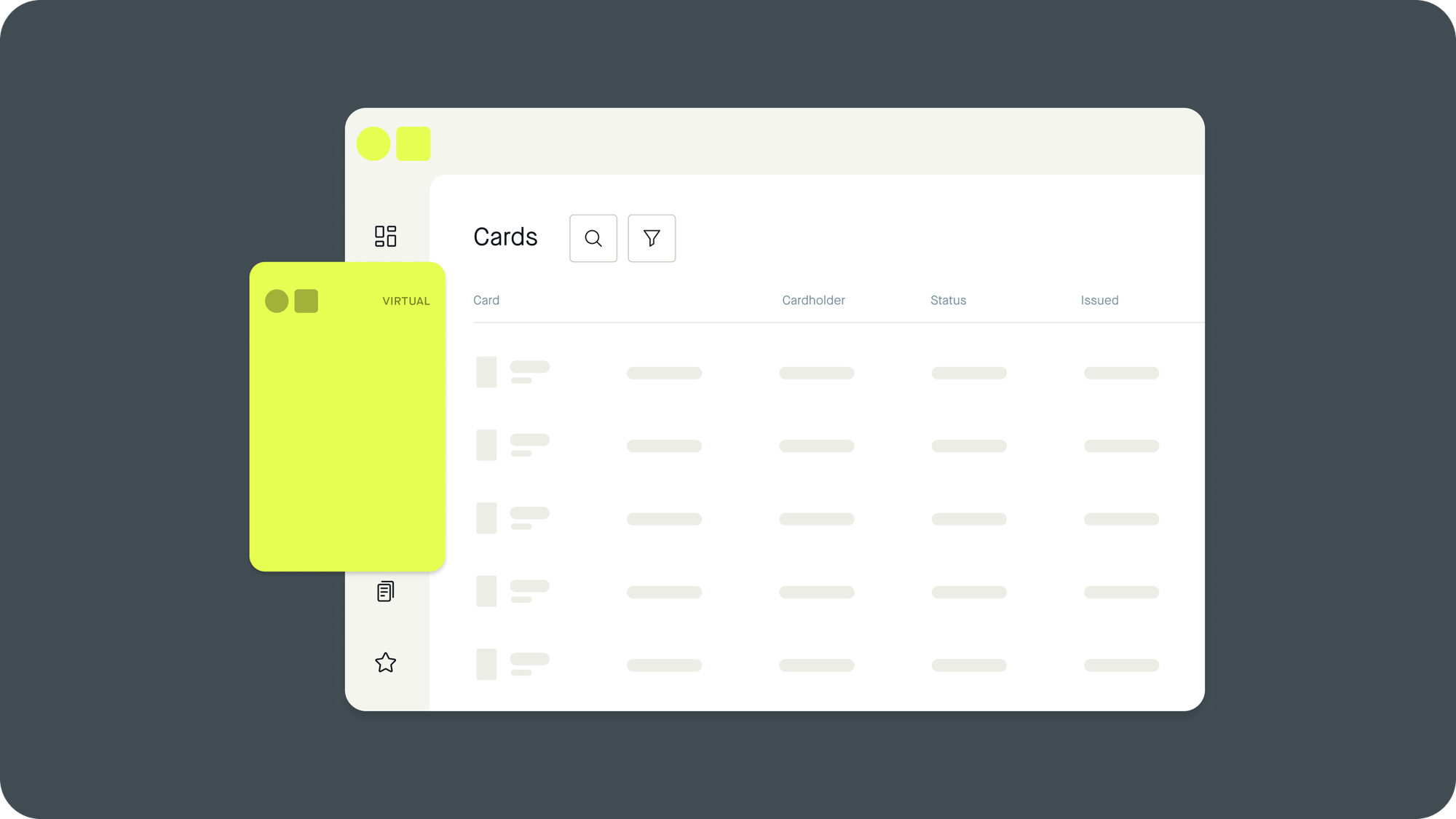

Option to issue one-time cards for each booking or powerful reusable cards with custom transaction limits.

Easy-to-use web application or API for instant card issuance.

Set custom card controls such as exact limits, allowed merchants, or restricted regions.

Integrate with leading travel technology such as GDS systems or settlement platforms.

Globally accepted Visa Platinum business card.

Comprehensive transaction reporting, including custom card labels to automate your accounting processes.

0% fees for foreign currency transactions.

Attractive rebate on total transaction volume.

Generous credit limits.

Streamline ticketing with Pliant's API

Through the use of our API, TMCs can automate the entire ticket purchasing process, which saves time and reduces errors.With a few simple integrations, TMCs can seamlessly connect their back-office systems to Pliant, enabling automated ticket purchases and instant payment reconciliation.

This streamlines operations, increases efficiency, and improves the overall customer experience.

How can VCNs help Travel Management Companies (TMCs) grow

The capabilities of the digital age, along with the use of VCNs, are encouraging many TMCs to become Merchants of Record (MoR) for their clients. As an MoR, travel managers can collect payments for their clients and pay each travel supplier as needed.

Travel management companies are now using VCN providers to help their clients book their travel.

And the benefits to these companies are clear:

According to Amadeus, over 98% of airlines accept virtual card payments. In addition, TMCs earn a 0.5%-2% commission on VCN exchanges.

Payment automation helps companies better manage their budgets because transactions are recorded in real time.

Companies can set spending limits for each card they issue. This helps optimize budget management.

VCNs can be automatically frozen after a certain number of uses. They can also be deleted after processing to prevent overspending and fraud

As a result, both TMCs and their clients enjoy streamlined and secure travel expense payments. But that's just the beginning.

💳 Here’s how TMCs use virtual credit cards to benefit customers:

Payment efficiency

VCNs eliminate manual payments and associated paperwork. This helps improve cash flow and costs.

With this approach, TMCs don't need to invest in large support teams. All they need to do is automate the creation of virtual cards for instant transactions.

Invoices are automatically registered in the company's system once payment is made. This helps minimize errors for TMCs and customers.

Payment optimization

Employees often need to book their travel needs quickly. TMCs can do this with the help of VCNs.

One way to do this is to distribute payments using different VCNs. For example, what if a traveler needs to bundle a flight with a hotel stay, car rental, and travel insurance?

The TMC can issue 4 VCNs to disburse individual payments for each of these needs.

When this is done, the user will have all their travel needs paid for. It's also easier for the TMC to manage individual refunds if any of these services are canceled.

So, TMCs can streamline the customer payment experience. The faster the process, the happier the customer.

Support new business features

TMCs can use VCN payments to offer new services to customers. For example, they can offer off-site event packages for a company. In doing so, they’ll help clients keep their employees happy by managing their travel expenses.

Another great idea is to open the use of TMCs to individual employees. For example, when executives need to travel, they can contact the TMC to arrange all the details and payments. The customer can then issue virtual cards directly, to handle their travel needs.

Direct card issuing

Some TMCs enhance their customer experience with branded corporate cards. This allows TMCs to help customers manage their travel needs, both on and off the Web.

These cards also offer many customer benefits, such as cash back rewards. On top of that, TMCs also earn a commission each and every time the card is used by a customer. Now that's a win-win!

Fast access to working capital and cashback on thin margins

Competition in the travel industry is fierce, which can lead to thin margins. Pliant credit cards offer a generous cash back program that rewards high levels of card spending. In addition, Pliant's credit card solution provides quick access to working capital. Which allows you to provide timely funds when customer needs arise, This keeps your business running smoothly and allows you to take advantage of business opportunities without delay.

Looking for a smart virtual credit card solution for your TMC? Get in touch with our Team of Experts here.